CEO Optimism Abounds

After a volatile 2023, CEO confidence seems to be rebounding in 2024. A number of readings on CEO sentiment, including our own Late Earnings Report Index (LERI), seem to be indicating that executives are feeling more certain about corporate growth prospects. Investor sentiment has also been improving as of late.

LERI Hits Its Lowest Level in a Year

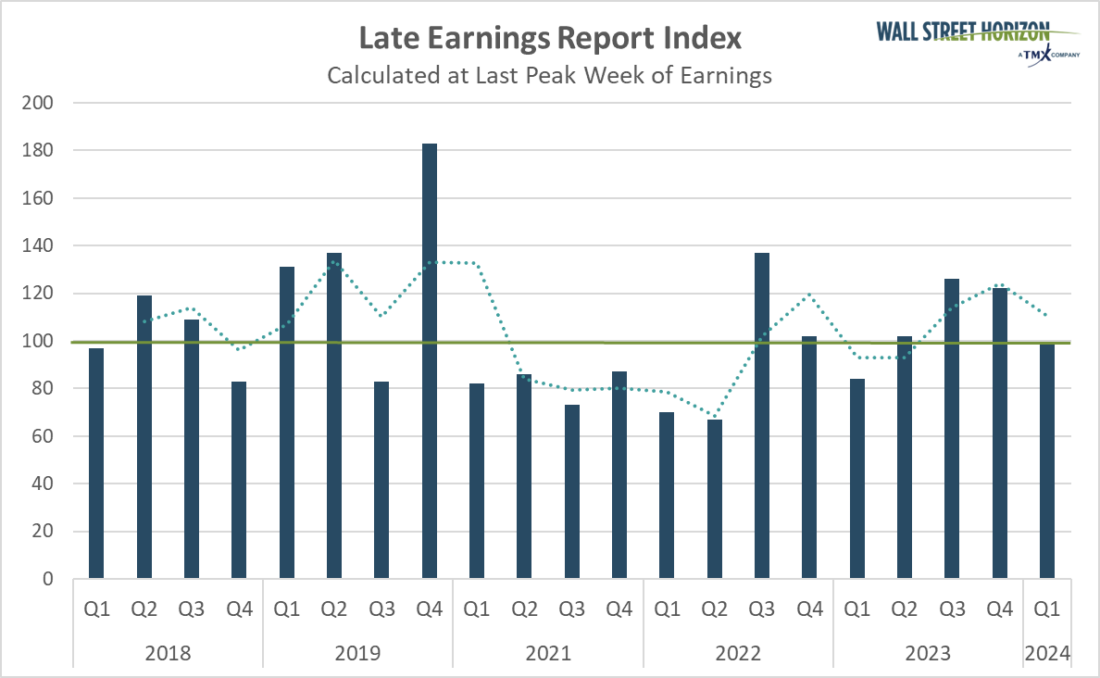

The Late Earnings Report Index (LERI) tracks outlier earnings date changes among publicly traded companies with market capitalizations of $250M and higher. The LERI has a baseline reading of 100, anything above that indicates companies are feeling uncertain about their current and short-term prospects. A LERI reading under 100 suggests companies feel they have a pretty good crystal ball for the near-term.

The LERI ended the Q4 2023 earnings season (data collected in Q1 2024) with a post-peak reading of 99, the lowest in a year, showing that the unwarranted skepticism that built up throughout 2023 was starting to dissipate. The prior low of 84 was reached during the Q4 2022 earnings season (data collected in Q1 2023).

Source: Wall Street Horizon, note: 2020 is excluded due to abnormal delays.

This is in line with other metrics of CEO sentiment such as the CEO Economic Index published by Business Roundtable which also showed business leaders were more confident in the economy with expectations for stronger sales and capital investments.1 Similarly, the Conference Board’s quarterly Measure of CEO Confidence™ also showed an improvement in Q1.2

Survey Says: Investors are Feeling More Bullish Too

It’s not just top management whose sentiment is improving, but investors’ attitudes are positive as well. A recent Bank of America survey showed that Wall Street’s optimism is at its highest level since January 2022. In its survey of 226 fund managers they found the group was also the most bullish they’ve been on stocks since February 2022.3 The main reason for the sunny outlook? Over 90% of participants believe the Fed is done raising interest rates. This could very well be one reason that corporate America is also feeling optimistic.

Looking Ahead

As we head into the Q1 2024 earnings season in a couple of weeks we’ll be monitoring this trend to see if it continues. The next reading of the pre-peak LERI will be published on April 14.

—

Originally Posted March 25, 2024 – CEO Sentiment is Slowly Improving in 2024

1 Business Roundtable Q1 CEO Economic Index Signals a Resilient, Accelerating U.S. Economy

https://www.businessroundtable.org

2 CEO Confidence Improved in Q1 2024, February 8, 2024, https://www.conference-board.org

3 Optimism Abounds on Wall Street This New Year, Wall Street Journal, January 1, 2024, https://www.wsj.com

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.