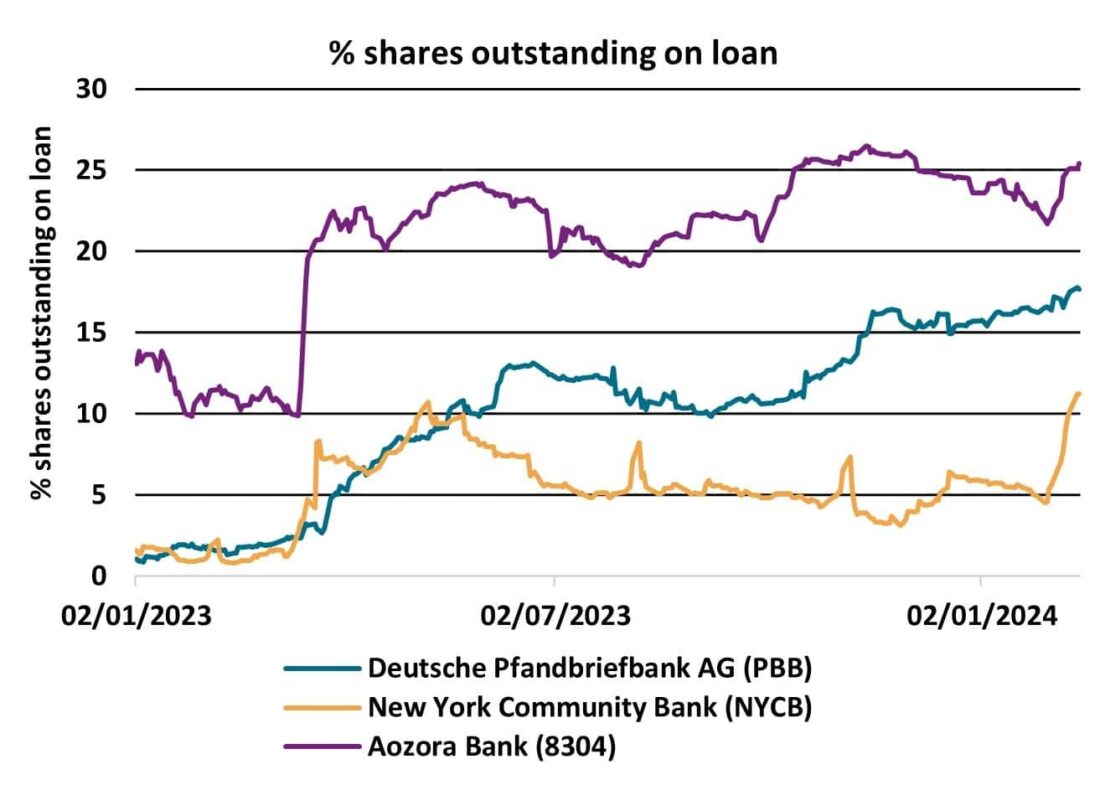

Over the last few months short interest has continued to climb in banks exposed to the commercial real estate sector (CRE).

Since the beginning of 2023, short interest has been rising across global banks with strong links to the commercial real estate (CRE) sector. Over the past weeks, a number of these banks have come under increasing pressure as they look to strengthen their balance sheets following weakness seen across their property loan books.

New York Community Bank (NYCB) has recently considered raising additional funds whilst contemplating asset sales after its stock price plunged. The bank pointed to its property loan book as the reason behind its desire to sure up its balance sheet. The institution reportedly has assets surpassing $100B, 60% of which are tied to commercial properties in Manhattan.

Across Europe and Asia, a similar picture is unfolding as Deutsche Pfandbriefbank AG (PBB), a Bavarian landesbank, has seen its share price fall after making substantial risk provisions as a result of the “persistent weakness of the real estate markets”. Likewise, in Japan, Aozora bank (8304) recently recorded its first loss in 15 years due to bad loans in US commercial property investments.

Short interest has been growing significantly across all three banks since the beginning of 2023, with the percentage of shares outstanding on loan in Aozora Bank recently surpassing twenty five percent.

At a time when interest rates stand at multi-year highs, real estate will have to be refinanced at higher prices when existing debt matures. Coupled with falling asset prices, those banks exposed to commercial real estate will continue to come under pressure. Investors may wish to keep one eye on the short interest metrics across this sector as negative sentiment has been building and providing signals of stress for some time. Without any imminent reduction in interest rates, pressure is likely to continue to grow on these institutions as servicing their loan books becomes increasingly challenging.

For more information on how to access this data set, please contact the sales team at:

h-ihsm-global-equitysalesspecialists@spglobal.com

—

Originally Posted February 14, 2024 – CRE concerns drive shorts higher.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from S&P Global Market Intelligence and is being posted with its permission. The views expressed in this material are solely those of the author and/or S&P Global Market Intelligence and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.