Stocks – AMZN, AAPL, MU

Macro – SPY, DXY

MICHAEL KRAMER AND THE CLIENTS OF MOTT CAPITAL OWN AAPLMICHAEL KRAMER OWNS SPY PUTS

Stocks finished the day higher after another strange day, which was baffling from several metrics. The GDP print showed just 2% growth for the third quarter versus expectations of 2.7%. Meanwhile, the ECB left monetary policy unchanged and pushed back against the market’s view of the ECB hiking rates in 2022.

All of that news hitting at the same time made it even harder to figure out what the market was doing. But watching the FX market closely today, it became clear that the dollar was weakening against every currency, not just the euro, which ruled out the idea that the weaker dollar was due to the ECB. Meanwhile, yields fell most of the morning and finally started to rebound by day’s end.

The price action left me thinking that the market now believes the weak GDP print will hold off the Fed taper. I believe that is highly unlikely. Powell himself, on October 22, said that he now thinks it is the time to taper, but not the time to raise rates. He said that on October 22, you could watch the video and go to the 17:40 mark to watch him say. When he said that just last week, I’m sure he was fully aware of how much the US economy slowed.

Besides, the Fed has a dual mandate for price stability and full employment, not GDP growth. So does the economy warrant low rates, sure. Does it require QE at this point? Probably not, certainly not at the current pace. So if the market thinks that the Fed is not going to taper, I think it will be upset next Wednesday.

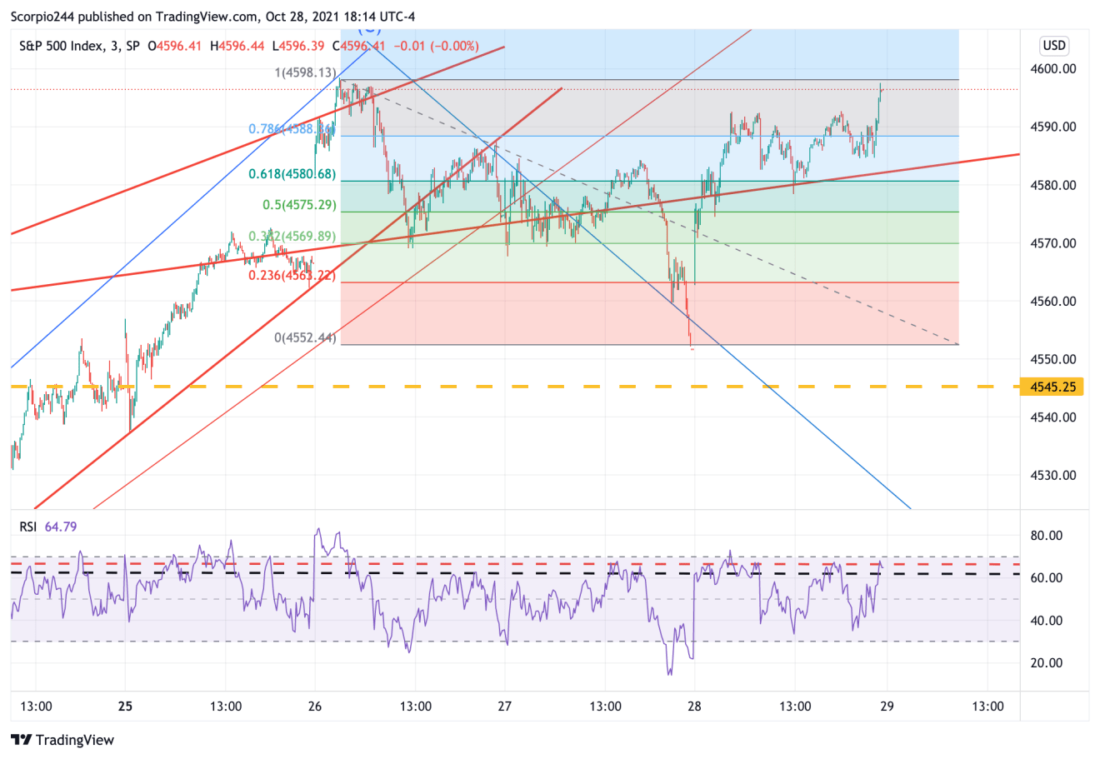

S&P 500 (SPY)

The S&P 500 managed to rise back to yesterday’s highs. Today’s move looked like an awful lot like a Wave 2, with a 100% retracement of wave 1. If so, tomorrow is likely to be a lower day and the start of Wave 3 down.

If not, then there is a potential inverse head and shoulder pattern forming too, which would mean much higher prices. But until proven otherwise I will stick with the wave 2 view.

Dollar

The dollar fell sharply today, but managed to hold the trend line. I thought it was clear as day that GDP would be a colossal disappointment, but it appears to have not been “priced in.” For now, the trends are holding. After the market digests this, I feel that the dollar will reverse and start moving higher again. My view of a higher dollar is unchanged.

Amazon (AMZN)

Amazon had pretty bad results and gave disappointing guidance. From the little bit I have read so far, it sounds like slower revenue growth and higher cost. That is a bad combination. After hours, the stock is trading down 4%, and I’m surprised that it is not down more. The stock has support at $3,300, but I would be surprised if that holds, and I think the first real test will come at $3,200.

Apple (AAPL)

Apple is also down around 4% after hours, with revenue missing estimates and the company, noting that supply chain constraints will worsen next quarter. I have been looking for this stock to fall to the low $130s for some time. After these results, it should be on its way there now.

Micron (MU)

Micron is falling 2% tonight after Western Digital’s results sent the shares plunging by 10%. On top of that, Digitimes is reporting that DRAM prices are still falling. It looks like a bear flag on the chart, and if so, it would be a perfect setup for that drop to $58 I have been eyeing for some time.

Anyway, we will see what happens tomorrow.

Originally Posted on October 28, 2021 – Does The Market Really Think The Fed Will Delay Tapering?

Disclosure: Mott Capital Management

Mott Capital Management is the portfolio manager for one portfolio offered by Interactive Advisors. Interactive Advisors clients do not invest directly with the Portfolio Managers like Mott Capital Management, and the Managers do not have discretionary trading authority over Interactive Advisors client accounts. The Portfolio Managers on the Interactive Advisors platform simply license their trade data to Interactive Advisors, which then allows its clients to have the same strategy and trading decisions mirrored in their accounts if the Portfolio is in line with their risk score. Portfolio Managers like Mott Capital Management implement their trading philosophy and strategy without knowing the identity of Interactive Advisors’ clients or taking into account these clients’ individualized circumstances.

Mott Capital Management has entered into a Portfolio Manager License Agreement with Interactive Advisors pursuant to which it provides trading data IA uses to offer a portfolio to its investment advisory clients. Mott Capital Management is not affiliated with any entities in the Interactive Brokers Group.

Interactive Advisors is an affiliate of Interactive Brokers LLC.

Pursuant to the Investment Management Agreement between Interactive Advisors and its clients, all brokerage transactions occur through Interactive Brokers LLC, an affiliate of Interactive Advisors. The use of an affiliate for brokerage services represents a potential conflict of interest as Interactive Brokers LLC is paid a commission on trades executed on behalf of Interactive Advisors. Interactive Brokers LLC does not consider this conflict material as it does not sell, solicit, recommend, trade against or otherwise attempt to induce Interactive Advisors to place any orders in any products. Interactive Advisors does not offer services through any other broker-dealer. All trading by Interactive Advisors is self-directed. Interactive Advisors clients acknowledge this potential conflict of interest and authorize Interactive Advisors to execute transactions through Interactive Brokers LLC when they open an Interactive Advisors account. Clients should consider the commissions and other expenses, execution, clearance, and settlement capabilities of Interactive Brokers LLC as a factor in their decision to invest in an Interactive Advisors Portfolio. Interactive Advisors believes it satisfies its best execution obligation by trading its clients’ trades through Interactive Brokers LLC. While there can be no assurance that it will in fact achieve best execution, Interactive Advisors does periodically monitor the execution quality of transactions to ensure that clients receive the best overall trade execution pursuant to regulatory requirements.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Mott Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Mott Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.