ZINGER KEY POINTS

- BlackRock believes opportunities in AI space in 2024 lie beyond the 2023 high tiders – semiconductor and cloud.

- In 2024, investors may want to focus on stocks of AI data infrastructure and application providers.

BlackRock‘s Investment Institute’s 2024 Global Outlook highlights that AI opportunities in 2024 are expected to expand beyond 2023’s leading sectors, namely semiconductors and cloud computing.

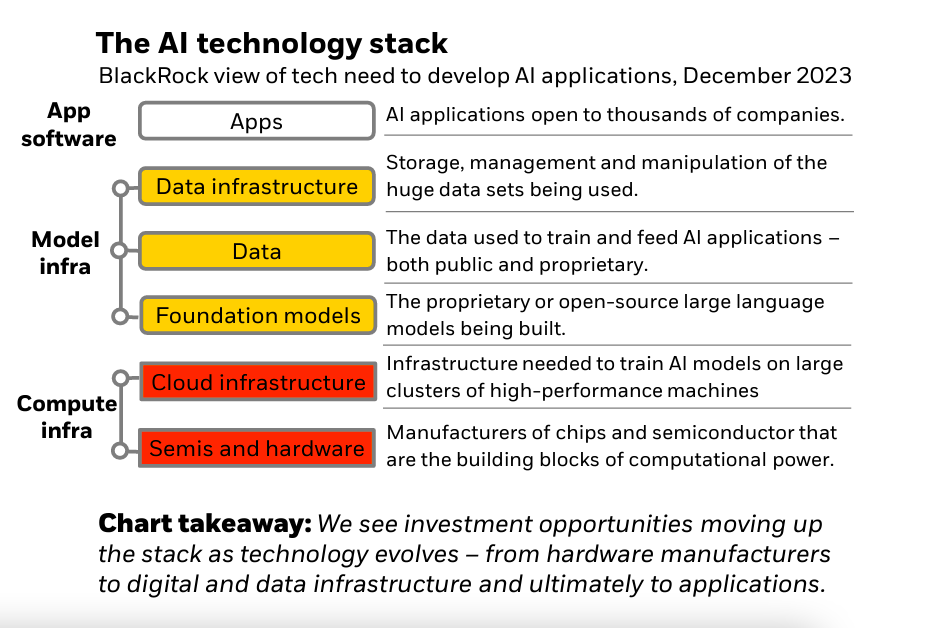

The AI Technology Stack

2023 has emerged as a pivotal year for AI, particularly within the semiconductor and cloud segments of the technology sector. This technological advancement has propelled stocks like NVIDIA Corp, Advanced Micro Devices Inc., Alphabet Inc, Microsoft Corp and Broadcom Inc

While BlackRock believes the advances in AI from here are likely to be “exponential,” the technology stack may offer a roadmap to assess investment opportunities.

Source: BlackRock Investment Institute 2024 Global Outlook

According to BlackRock, there’s a shift occurring up the technology stack. While AI Compute infrastructure stocks have shown significant outperformance in 2023, the focus is now shifting to AI Model infrastructure. Following this trend, AI Application software stocks are poised to be the next growth drivers in the sector.

“We are somewhere between the first and second layers, with the last one likely coming next,” said the report.

AI Stocks Beyond Semiconductor & Cloud

Let’s explore some second-layer stocks, specifically those involved in offering data infrastructure and models [Based on Author’s research]:

- International Business Machines Corp: IBM Watson Orchestrate specializes in automating tasks and workflows, so teams can redirect resources toward more pressing matters and boost their production. IBM recently acquired StreamSets and webMethods for $2.3 billion, boosting AI and hybrid cloud capabilities. The buyout is projected to add data ingestion capabilities to watsonx (IBM’s AI and data platform).

- Salesforce Inc: Salesforce is one of the most well-known CRMs. The powerful tool lets companies log, manage and analyze customer data, information and activity. According to Salesforce Chief Data Officer Wendy Batchelder, “The AI revolution is actually a data revolution, and a company’s AI strategy is only as strong as its data strategy, with trust at its core.”

- Accenture PLC: Accenture recently agreed to acquire Ammagamma, an Italy-based firm that helps companies enhance their uses of AI and generative AI technologies. The transaction is part of Accenture’s investment of $3 billion to accelerate clients’ transformation through large-scale application of AI.

- Kyndryl Holdings, Inc.: An IBM spin-off, Kyndryl is a provider of IT infrastructure services. Kyndryl has over three decades of experience in delivering secure data services and enterprise-grade AI. The company has forged strategic alliances with some of the biggest technology companies, including Microsoft and Amazon’s AWS for AI solutions. Kyndryl stock is garnering “increased” interest from 13F filers this year.

- From the AI App software realm, some key names that come to light include C3.ai Inc, Databricks, Alteryx, Dataminr, Scale AI, SparkCognition, LeewayHertz, DataRobot, Urbint and ThirdEye Data.

Overall, BlackRock is overweight the AI theme in developed market stocks on a six-to-12-month horizon. The institute identifies the tech sector’s earnings resilience to be a major driver of overall U.S. corporate profit growth in 2024.

—

Originally Posted December 19, 2023 – Emerging AI Trends In 2024: BlackRock Sees Shift Beyond Semiconductors, Cloud To Model Infrastructure

Disclosure: Benzinga

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Benzinga and is being posted with its permission. The views expressed in this material are solely those of the author and/or Benzinga and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.