Sorry if you haven’t heard from me for a while. A combination of illness and business travel have kept me quiet for most of the past two weeks. But I’m back now and for the foreseeable future. That said, events of the past week made of one of our recent pieces seem somewhat prescient.

On September 15th we published a piece entitled “Thank Eisenhower for “Sell Rosh Hashanah, Buy Yom Kippur.”” The headline referred to an adage that was already widely in use by the time I started in the business in the late ‘80s. The origin of the adage was likely rooted in religious practice — it was probable that a group of investors lightened up their riskier positions before the Jewish holidays to avoid distraction and temptation – but its effectiveness was hammered home in 1955 when markets plunged on Yom Kippur after President Eisenhower had a heart attack.

Even so, it appears that the adage’s effectiveness is the result of seasonality as much as anything else. Although the holidays’ dates tend to move around (they’re based on a lunar calendar), they always fall during the mid-September to early-October period. Anyone with a historical sense of equity markets has a gut feeling about this time period – regardless of religion – so it is inherently sensible to be wary.

We’ve written about seasonality recently, first in early August and again at the end of that month, noting that stocks tend to perform worst in September and the month prior. The S&P 500 Index (SPX) and the NASDAQ 100 (NDX) both ended August lower by over -1.5%. Neither index has closed above its July 31st close since then. That said, in spite of VIX typically rising most in August, it was almost exactly unchanged at 13.57. So far, September finds SPX about -5% lower and NDX down about -6%.

Had one followed the “sell Rosh Hashanah” strategy this year, you’d be doing pretty well. SPX closed at 4,450.32 on September 15th, the day before Rosh Hashanah. As I type this, the index is at 4,331.50, a drop of over 2.5%. Over the same period, the NDX has fallen 4%. The market’s attitude about risk has also changed dramatically, however, with VIX rising from 13.79 to 18.31 over that time.

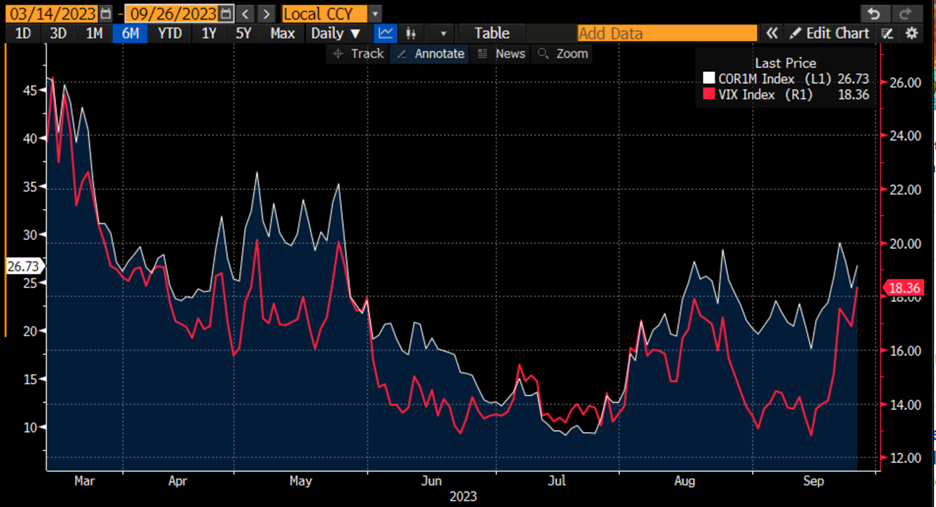

The last point is most evident when one examines the relationship between VIX and correlation. We wrote about how VIX tended to roughly follow the Cboe 1-Month Correlation Index (COR1M) for most of this year, but that VIX failed to rebound earlier this month when COR1M had. Over the past week, VIX caught up in a hurry:

6-Month Chart, COR1M (white) vs. VIX (red)

Source: Bloomberg

So, now that part one of the adage gets to take a victory lap, we need to turn our attention to part two, “buy Yom Kippur.” That is a bit murkier. It is said that “no one ever went broke taking a profit,” so it would be quite OK if a trader took profits and covered shorts that might have been established earlier this month. But it is not clear that this is the ideal time to re-establish long positions. It is difficult to ignore the fact that rates have risen fairly substantially over the past weeks, and while the relationship between the stock and bond markets can diverge for long periods of time, it feels as though equity investors are taking greater note of bond market risks. And while we seem to have reversed a significant amount of the recent complacency, volatility measures are more normal, rather than showing the type of nervousness that presents a buying opportunity.

Besides, if we’re following seasonality, we have more recently seen bottoms occur in mid-October. And by the way, one time the “buy Rosh Hashanah, sell Yom Kippur” strategy failed was 50 years ago. The Yom Kippur War started in 1973, but US markets rose slightly over that period. Unfortunately, the first of the 1970’s oil shocks followed, and stocks plunged rather precipitously in the weeks that followed. So who knows?

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.