Few areas have been as performance-challenged as biotechnology stocks in the last three years. Sometimes it makes sense to search for opportunity among the areas that recently performed the worst.

Double-Digit Negative Returns for Three Years?

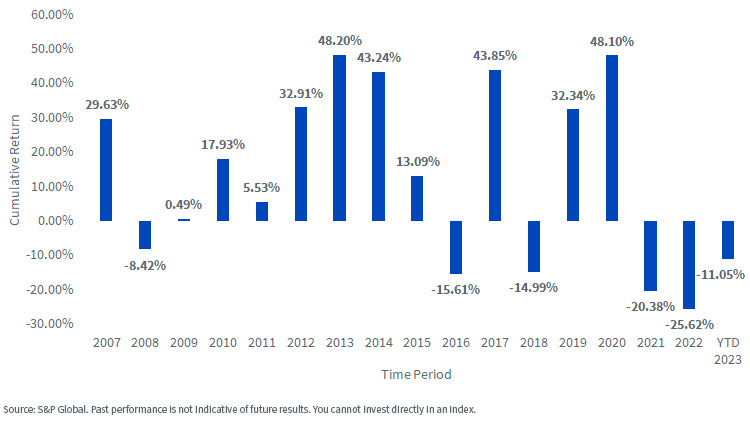

The S&P Biotechnology Select Industry Index had a return worse than -10% in 2021 and 2022, and recognizing that a lot of 2023 is on the books (through November 24, 2023), 2023 may be the third full year in a row when this occurs. Looking back 10 years, this set of stocks has been volatile, but such negative returns three years in a row is unique.

To put this recent drawdown into context, $100 invested at the end of 2020 and simply held through those returns would have left a bit more than $52 at the market’s close on November 24, 2023. Sure, we’ve written at length about the contributing macroeconomic challenges, but we also must recognize that biotech is an important industry that is unlikely to disappear. We may be in a position where simply “less negative” news could lead to a rebound.

Figure 1: Calendar Year Returns for the S&P Biotechnology Select Industry Index (12/31/13–11/24/23)

The Beauty of a Catalyst

Sometimes thematic strategies trade based on macroeconomic developments, like when valuations adjust downwards amid a higher interest rate environment. However, we believe, solely gauging the macro misses the core story underlying thematics—that these companies are plumbing the depths of certain opportunities to find potentially transformative growth. Even if this is a high-risk endeavor, we don’t feel that it is a 0 % endeavor.

We just saw how ChatGPT, launched in November 2022, contributed to artificial intelligence (AI) having a strong 2023, even though the rise in interest rates has been historic. AI stocks bucked the overall macro trend.

What will be the next catalyst for biotech?

CRISPR?

CRISPR stands for ”clustered regularly interspaced short palindromic repeats.” It can be used to precisely cut DNA at certain points that could then focus on targeting very specific characteristics. Jennifer Doudna and Emmanuelle Charpentier received the 2020 Nobel Prize in chemistry for their work on this topic. But, we also have to keep in mind:

- Doudna and Charpentier’s work on precision gene editing occurred in 2012, more than 11 years ago

- The Nobel Prize was now awarded more than three years ago

- Even if the concept of CRISPR is understood, we do not yet have a network of CRISPR-based cures that people around the world are routinely accessing through their healthcare providers

ChatGPT was launched in November 2022 and within a year companies with large productivity platforms (Alphabet, Microsoft) developed an offering that could be widely purchased. It speaks to an important difference in speed to have in mind that CRISPR’s proliferation is taking far longer. Clinical research is highly regulated with much testing and lots of different hurdles to clear.

While we likely all agree it is important that the standard for releasing a health treatment with the capability to influence a person’s genes is much higher than for releasing a software program, the challenge for thematic investors is navigating different business models and product runways. Shifting from analyzing the release and proliferation of generative AI software to looking at CRISPR therapies effectively requires the most advanced of mental gymnastics and managing of expectations.

A Catalyst Arrives?

In November 2023, British regulators approved the first treatment derived from CRISPR. The treatment, called Casgevy, is focused on sickle-cell disease and beta thalassemia. It is expected that about 2,000 patients in Britain could be eligible. The two companies involved are Vertex Pharmaceuticals and CRISPR Therapeutics.1

It is expected that in late December 2023, the FDA will approve another sickle cell gene therapy, this one by Bluebird Bio, which uses a method that inserts new DNA into the genome.2

If we force ourselves to respect the journey of discovery and all the steps required to get to this point, these developments are extremely exciting. However, we are likely still a long way off from CRISPR therapies that can be used at scale. Patients will only be eligible if they have gone through other possible treatments without success. Additionally, the cost of the therapies is extremely high and the expertise required would not, at least initially, be available at just any hospital.

DNA represents the information required to assemble all the different proteins needed by living organisms. Being able to edit this at will to induce certain characteristics or “fix” mistakes would be nothing short of remarkable. We are clearly on the path and much further than we were 10 years ago. At the same time, if people are expecting widespread deployment of these therapies at scale, they may yet be disappointed.

Convergence of Innovations

Still, the promise for the convergence of technology can accelerate the learnings in biotech. AI and the growth of models to help researchers unlock new drug discoveries looks to be increasing future innovation potential.

1 Source: Gina Kolata, “Sickle-Cell Treatment Created with Gene Editing Wins U.K. Approval,” The New York Times, 11/20/23.

2 Source: Kolata, 11/20/23.

—

Originally Posted December 5, 2023 – Is it Time for Biotech?

Important Risks Related to this Article

For current Fund holdings, please click here. Holdings are subject to risk and change.

There are risks associated with investing, including the possible loss of principal. The Fund invests in BioRevolution companies, which are companies significantly transformed by advancements in genetics and biotechnology. BioRevolution companies face intense competition and potentially rapid product obsolescence. These companies may be adversely affected by the loss or impairment of intellectual property rights and other proprietary information or changes in government regulations or policies. Additionally, BioRevolution companies may be subject to risks associated with genetic analysis. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is governed by an Index Committee and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Disclosure: WisdomTree U.S.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473) or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

Interactive Advisors offers two portfolios powered by WisdomTree: the WisdomTree Aggressive and WisdomTree Moderately Aggressive with Alts portfolios.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree U.S. and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree U.S. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.