Dear Investor,

Currently, implied volatility, as calculated from option prices on the US stock market, is relatively low. The Bank of America recently found that there has not been a cheaper time to hedge over a twelve-month period since 2008.

This raises these questions for you as an investor: has a phase of permanently low volatility now been reached? Or is the current low volatility merely the calm before the storm?

With such questions about the future development of the stock market, it is usually worth taking a look at stock market history.

For this analysis, I use one of the longest available time series, that of the Dow Jones Industrial Average starting in 1915. That’s over 100 years of stock market history. For better comparability, I remove the Saturdays on which trading took place in previous years.

I then smooth out the data by calculating the historical volatility, rolling and overlapping over the past 21 trading days (about a calendar month).

The volatility over the year

But is an increase in volatility to be expected now? Let’s take a look at the seasonal cycle.

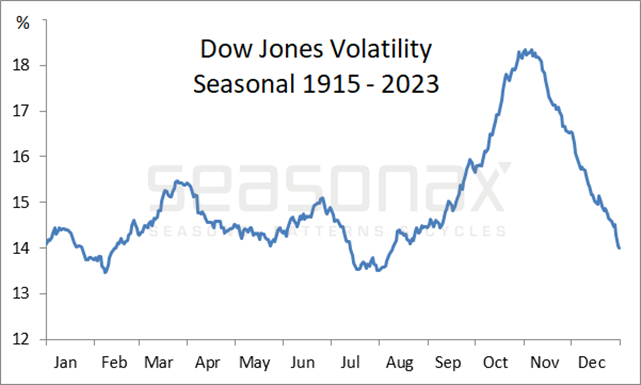

The next chart shows you the seasonal course of the 21-day volatility of the Dow Jones over the entire investigation period from 1915. I’m showing the volatility in the middle of the 21-day period so that the smoothing does not lead to a time shift. The horizontal axis represents the point in time of the year, the vertical axis shows the mean volatility level.

This allows you to see at a glance how volatility is typically seasonal.

Dow Jones Volatility, Seasonal Pattern, 1915 to 2023

The fluctuations increase until November. Source: Seasonax

As you can see, despite the very long survey period with a large number of measurement points, there is a pronounced seasonality in volatility.

At the end of July to the beginning of August, there was a veritable summer lull with average values of less than 14%.

Then there is an increase that ends in early November at 18.3%.

Fluctuations increase seasonally!

Currently, many investors pay little attention to volatility. They seem to feel safe.

However, this might not be such a good idea given the typical seasonal pattern, with spikes in volatility well into November.

The seasonal course is still hardly used by traders in the volatility and options markets. On the other hand, you can be ahead of your competitors and take advantage of seasonality across all your instruments.

Go to www.seasonax.com! There you will find precise seasonal charts, event studies and much more.

—

Originally Posted August 29, 2023 – Is Volatility About to Breakout?

Disclosure: Seasonax

Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. Seasonax GmbH neither recommends nor approves of any particular financial instrument, group of securities, segment of industry, analysis interval or any particular idea, approach, strategy or attitude nor provides consulting nor brokerage nor asset management services. Seasonax GmbH hereby excludes any explicit or implied trading recommendation, in particular, any promise, implication or guarantee that profits are earned and losses excluded, provided, however, that in case of doubt, these terms shall be interpreted in abroad sense. Any information provided by Seasonax GmbH or on this website or any other kind of data media shall not be construed as any kind of guarantee, warranty or representation, in particular as set forth in a prospectus. Any user is solely responsible for the results or the trading strategy that is created, developed or applied. Indicators, trading strategies and functions provided by seasonax GmbH or on this website or any other kind of data media may contain logical or other errors leading to unexpected results, faulty trading signals and/or substantial losses. Seasonax GmbH neither warrants nor guarantees the accuracy, completeness, quality, adequacy or content of the information provided by it or on this website or any other kind of data media. Any user is obligated to comply with any applicable capital market rules of the applicable jurisdiction. All published content and images on this website or any other kind of data media are protected by copyright. Any duplication, processing, distribution or any form of utilisation beyond the scope of copyright law shall require the prior written consent of the author or authors in question. Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Seasonax and is being posted with its permission. The views expressed in this material are solely those of the author and/or Seasonax and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.