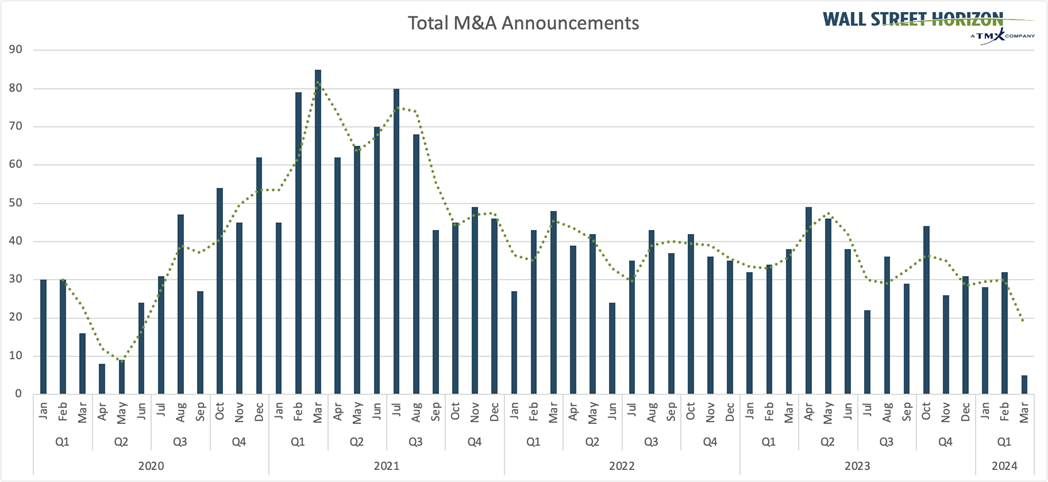

There were high hopes for a pickup in M&A activity heading into the new year, after 2023 hit an all-time low for the decade.1 However, with only three weeks left in the first quarter, it doesn’t look like improvement is on its way just yet.

High Interest Rates Still a Headwind

High interest rates continue to impact dealmaking, making it more expensive for companies and private equity firms to raise financing. Late last year there was hope that the March 20 FOMC meeting would bring the first cut in interest rates in four years. Since then, however, Federal Reserve Chairman Jerome Powell and several Fed presidents have made clear that investors should expect later and fewer cuts in 2024.2 Currently the CME Group’s FedWatch tool only has a 3% probability of a rate cut at the March 20 meeting, with that probability increasing for meetings in the second half of the year.3

Another thing that hampered dealmaking was the economic uncertainty felt last year, exacerbated by pockets of market volatility in certain quarters. Those factors made it difficult for buyers and sellers to agree on terms. However, there is evidence that corporate uncertainty may be dissipating. Our Late Earnings Report Index (LERI) which tracks outlier earnings dates, an indicator of corporate uncertainty, fell to its lowest level in nearly 2 years. A low reading suggests that US companies are markedly more confident than they were in 2022 or 2023. That could bode well for dealmaking as the year continues.

Dealmaking in Jan/Feb 2024 Falls to a 4-Year Low

Despite some recent and exciting M&A announcements, volumes are still low for the year, with only 60 deals announced in January and February. That’s the lowest number of announcements since 2020, which also clocked in at 60. March 2020 marked the beginning of COVID lockdowns, so only 16 deals were announced that month; we’ll likely end higher for March 2024. M&A closes are also underwhelming at 45 vs. the 5-year average of 70 closes for the first two months of the year.

Source: Wall Street Horizon, Note: WSH M&A Announcements only include deals where the target is a publicly traded company.

Some big announcements this year that have gotten investors excited are HPE’s bid for Juniper Network back in January which could result in a $14B deal.4 There was also Walmart’s recent bid for Vizio at $2.3B.5 The largest YTD merger announcement, however, is that of Capital One Financial Corporation and Discover Financial Services in a deal that could be worth $35.3B.6

Things have fallen apart on other highly-anticipated deals. JetBlue announced they were scrapping a plan to takeover Spirit Airlines in a deal worth $3.8B7 weeks after losing a federal antitrust lawsuit that challenged the deal because of how it could possibly disadvantage consumers that rely on Spirit’s discount fares.

M&A Rebound Expected As the Year Rolls On

While there is still hope for an M&A rebound this year, it won’t come in the first quarter. Morgan Stanley did say in a note released Monday that they expect global deal-making volumes to rise 50% YoY however, as headwinds that plagued the dealmaking world in 2023 dissipate. “We think that this ‘winter’ for M&A is thawing and activity is set to return cyclically and secularly,” said the investment bank.8

—

Originally Posted March 11, 2024 – January and February M&A Hits Lowest Level Since 2020, Will March Pick Up?

1 Dealmakers see rebound after global M&A volumes hit decade-low, Reuters, December 21, 2023

https://www.reuters.com

2 Semiannual Monetary Policy Report to the Congress, Chair Jerome Powell, March 6, 2024, https://www.federalreserve.gov

3 CME FedWatch Tool, CME Group, March 8, 2024, https://www.cmegroup.com

4 HPE to acquire Juniper Networks to accelerate AI-driven innovation, January 9, 2024, https://www.hpe.com

5 Walmart Agrees To Acquire VIZIO HOLDING CORP. To Facilitate Accelerated Growth of Walmart Connect through VIZIO’s SmartCast Operating System, February 20, 2024, https://corporate.walmart.com

6 Capital One to Acquire Discover, February 16, 2024 https://investor.capitalone.com

7 JetBlue Announces Termination of Merger Agreement with Spirit, March 4, 2024, https://news.jetblue.com

8 An M&A Comeback Is on the Way, Morgan Stanley Says. Why Deals Can Surge 50%, Barron’s, March 6, 2024. https://www.barrons.com

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.