- Arm Holdings and Instacart contributed to the weak 2023 IPO market with generally disappointing debuts in September

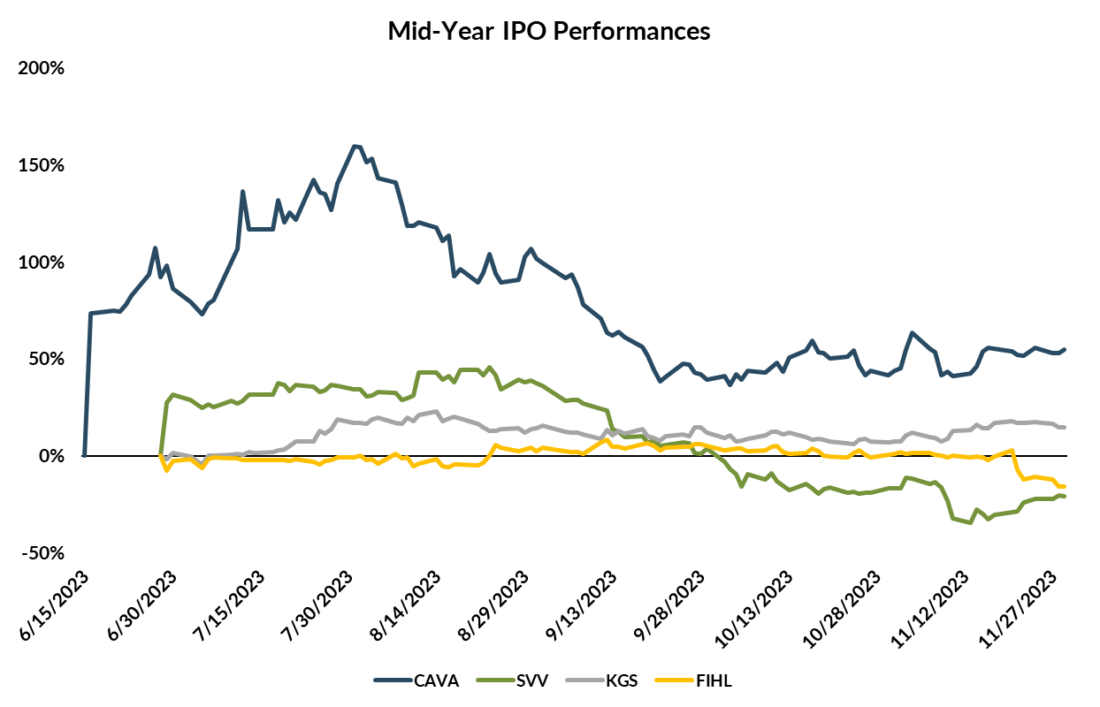

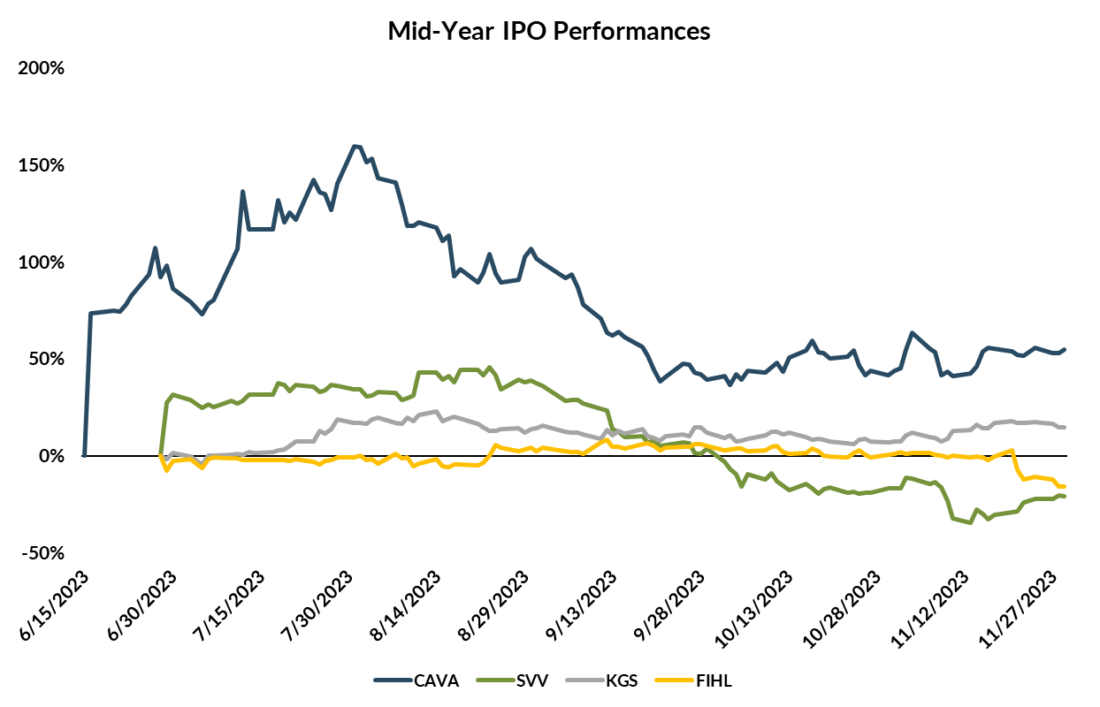

- We revisit four mid-year IPOs with important lock-up expiration dates in late December

- Chatter persists that several large companies may look to go public during the first half of 2024

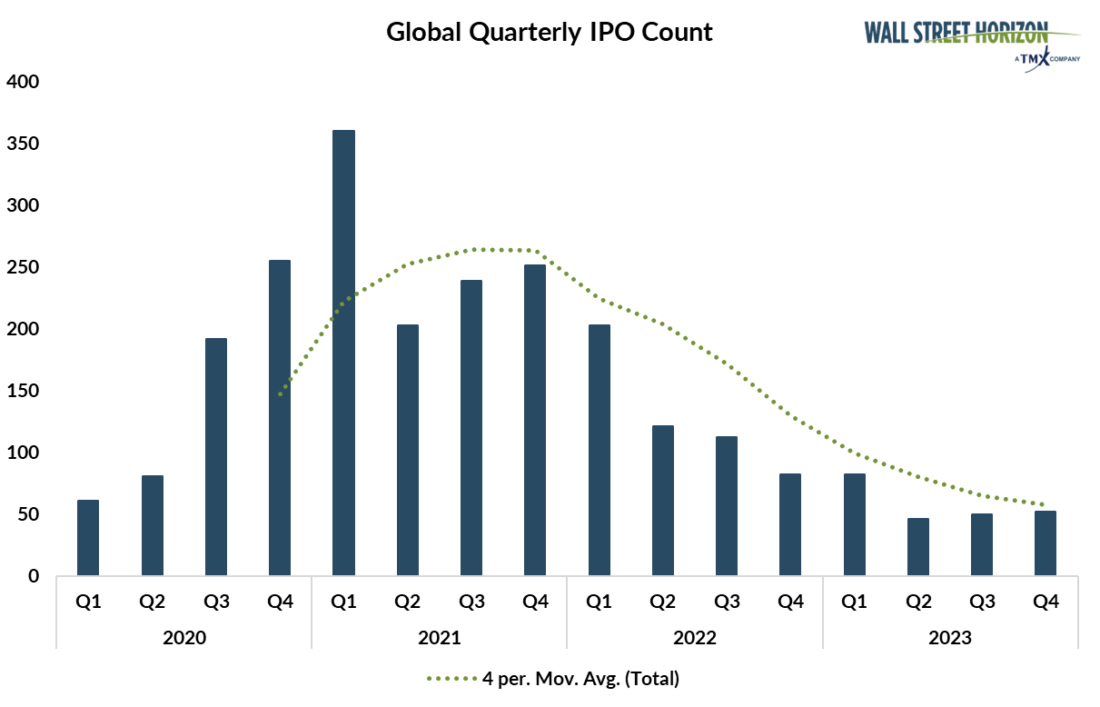

The global IPO market continues to run cold. The final quarter of 2023 paces to be the softest Q4 IPO count since 2019 while the 4-quarter moving average of new offerings keeps on sagging, according to Wall Street Horizon data. Despite a few noteworthy IPOs in the middle of the year, overall performance for these newcomers has been lackluster. Then two Q3 headliners, Arm (ARM) and Instacart (CART), failed to live up to the hype, with both stocks experiencing significant drops from their initial highs. While Arm has managed to rally and retest its year-to-date peak, Instacart’s stock performance remains weak.

Closing the Door on a Disappointing Year for IPOs

Source: Wall Street Horizon

Tough Macro Conditions for IPO Candidates

Closing the chapter on a lackluster year for newly public stocks, weak and volatile price action among significant IPOs in 2023 has likely made other growing private companies hesitant to enter the public arena. Tighter capital market conditions, including higher interest rates compared to the IPO boom of 2020 and 2021, contribute to the challenging environment. Optimists can point to the steep decline in yields since mid-October, but it remains to be seen whether that near-term macro trend will warm the IPO market and Wall Street dealmaking.

Event Risk: IPO Lock-Up Expiration Dates

Back in July, we profiled a handful of companies that went public amid high interest rate volatility and shaky credit markets. The six-month mark is important in the life of an IPO stock since that’s typically when a lock-up expiration date hits. Investors should recognize the risk that insiders could sell shares, increasing the supply on the market, possibly leading to a lower stock price.

CAVA Group (CAVA) faces a lock-up expiration on Monday, December 11. The owner and operator of fast-casual Mediterranean-style restaurants issued a strong EPS beat in its November earnings report, though shares fell 7.7% the following trading day, according to Option Research & Technology Services (ORATS).

Down 20% from its IPO-day closing price, CAVA presents a conundrum for another fast-casual chain that is suspected by some market pundits to be a 2024 IPO candidate: Panera. The once-public Consumer Discretionary stock was taken private in 2017 by a European investment firm in a $7.16 billion transaction.1 CAVA shares could also face volatility this week as its management team is slated to present at the Morgan Stanley Consumer and Retail Conference in New York on Tuesday and Wednesday.

The next important lock-up expiration event is on December 25, so Tuesday, December 26, will be a key date for investors to manage risk among the other three mid-2023 IPO stocks described below.

Small-Company IPOs Struggle

First, Savers Value Village (SVV), a $2.3 billion market cap Broadline Retail industry firm, has been under intense pressure after peaking above $26 in August. Shares fell on high volume after it last reported earnings results. In November, SVV’s CEO commented on a “strong quarter” and the management team announced a new share repurchase authorization, which perhaps helped buoy shares after notching a low under $12 during the middle of last month.2

Next, Kodiak Gas Services (KGS) has held up well since its IPO date in June, though the stock remains well off its August peak. Shares are up more than 10% from the IPO-date closing value with higher oil and gas prices providing a tailwind through Q3. Amidst a downturn in global energy-commodity markets in the last two months, the oil and gas equipment and services stock has outperformed the Energy sector since September. We’ll find out if the lock-up expiration later this month disrupts the decent relative trend.

Finally, Fidelis Insurance Holdings (FIHL), a $1.4 billion market cap property and casualty insurer within the Financials sector had been performing well for stockholders before its November 20 third-quarter 2023 earnings report. Misses on the top and bottom lines were likely the culprits3 – FIHL plunged from above $14 before the report to under $12 by late November. The stock is now 15% below its $14 IPO price.

2023 IPO Stocks Off the Highs

Source: Wall Street Horizon with TMX Money historical pricing

Better Days on the Horizon?

Looking ahead, recent IPO buzz has focused on the Chinese fashion company Shein. Reuters reports that the firm confidentially filed to go public in the U.S. with Goldman Sachs, JPMorgan Chase, and Morgan Stanley as lead underwriters.4 The IPO size could be north of $60 billion, but controversy surrounds Shein given labor rights issues, racketeering, accusations of intellectual property theft, and safety concerns.5 Bigger picture, recent IPOs in the consumer and tech spaces have disappointed investors. Birkenstock (BIRK), Instacart, and Arm Holdings have all fallen below their respective IPO prices in recent weeks.

Elsewhere, Reddit and Kim Kardashian’s Skims are two companies bantered about as 2024 IPO candidates. Also, Rubrik, a startup financed by Microsoft, could go public early next year.6 Finally, any rebound in the Chinese market could result in a slew of companies from the world’s second-largest economy helping to revive global IPO activity.

The Bottom Line

The 2023 IPO window shuttered following weak debuts from a few big-name companies in September and October. There may be trepidation later this month when four mid-year IPO stocks face lock-up expiration dates. Hope abounds for 2024, though, as several multi-billion-dollar enterprises across sectors and geographies could venture into IPO waters.

—

Originally Posted December 4, 2023 – Looking Back on a Chilly Year for IPOs, and Why 2024 Could Warm the Waters

1 Exclusive: Panera Laying Off 17% of Corporate Staff as It Eyes IPO, The Wall Street Journal, Heather Haddon, November 1, 2023, https://www.wsj.com

2 Savers Value Village, Inc. Reports Third Quarter Financial Results, Savers Value Village, Inc., November 9, 2023, https://ir.savers.com

3 As compared to FactSet data.

4 China’s Shein files for US IPO in major test for investor appetite -sources, Reuters, Kane Wu, Anirban Sen, November 28, 2023, https://www.reuters.com

5 America can’t resist fast fashion. Shein, with all its issues, is tailored for it, NPR, Alina Selyukh, October 13, 2023, https://www.npr.org

6 Reddit Leads Class of 2024 IPO Candidates Testing the Water, Bloomberg, Amy Or, Ryan Gould, Katie Roof, Gillian Tan, November 27, 2023, https://www.bloomberg.com

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Initial Public Offering

This communication does not constitute investment advice and is for informational purposes only. It is not a recommendation to buy or sell any security. Any investment decision should be made after careful consideration of all available information. The information contained in this communication may not be complete or accurate and may be subject to change.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.