- The Technology industry has surged in 2023, led by the dominant tech giants known as the “Magnificent Seven,” increasing concentration risks for cap weighted indexes.

- Regulated Investment Companies (RICs) are subject to security concentration limits, making capped indexes a potential solution to ensure diversification.

- FTSE Russell has launched capped indexes to address concentration risks, offering alternative solutions for RICs and trimming the weights of the tech giants in industry indexes.

After an abysmal 2022, the Technology industry has staged a remarkable comeback in 2023. The tech giants that have become known as “the Magnificent Seven” have led the rally, considerably outpaced other US large cap companies and propelled their already mega market caps to new heights.

However, for cap weighted indexes, outsized market cap growth can lead to higher security concentration. And for Regulated Investment Companies (RICs), the Magnificent Seven rally puts some cap weighted indexes at risk of exceeding concentration limits—underscoring the need for capped indexes.

2023 has been a year of tailwinds for tech giants

A hawkish Fed interest rate policy took its toll on large US tech companies in 2022, sending the Russell 1000 Technology industry plummeting -34.6%. But a perceived less aggressive Fed stance in 2023—combined with the prospect of growth in AI—has been a reversal of fortune for US tech giants, and the industry has surged 53.5% year-to-date as of July 17, 2023.

While these trends have been a boon to many US companies, the biggest gains have been concentrated among the largest mega caps: Apple, Tesla, Nvidia, Microsoft, Alphabet, Meta, and Amazon. Known as the Magnificent Seven, in 2023 these companies have expanded their dominance in cap weighted US equity indexes, which can be problematic for investment companies with concentration limits.

The rally has pushed some limits

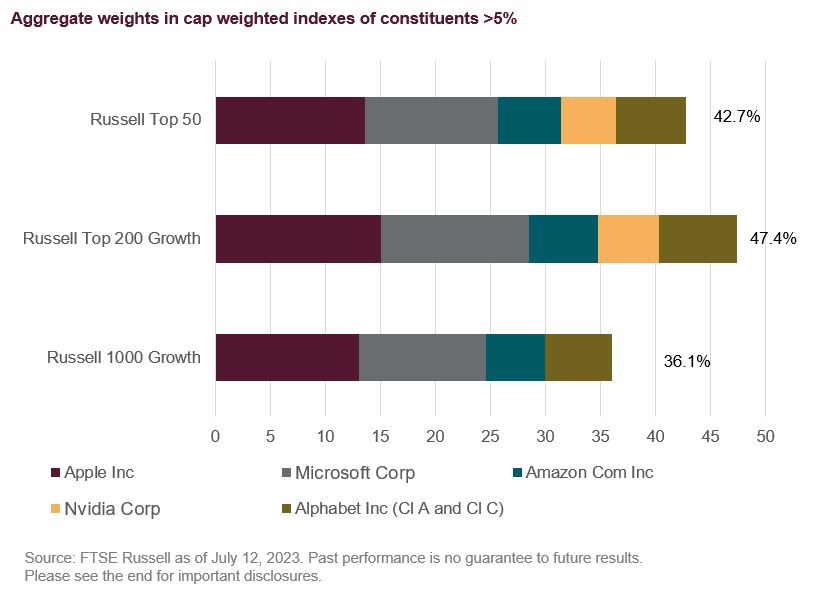

Several types of common investment companies and funds are subject to security concentration limits, designed to ensure diversification. For example, Regulated Investment Company (RIC) capping rules require that all companies that have a weight greater than 5% in aggregate are no more than 50% of the index, and that no individual company in the index has a weight greater than 25% of the index.[1]

If we examine some of our cap weighted Russell US Indexes, we can observe how the recent Magnificent Seven gains have impacted their index weights—and how as a result, some are approaching the RIC concentration limits. As shown, the aggregate weights of constituents with a weight greater than 5% in the Russell Top 50 index, Russell Top 200 Growth Index, and Russell 1000 Growth Index are all nearing the 50% RIC concentration limit.

Capped indexes for addressing concentration risk

In accordance with the FTSE Russell Policy for Benchmark Methodology Changes, we’ve consulted with clients and external committees on the treatment of larger constituent weights in the index, and general feedback has been that market cap weighted indexes such as our Russell US Indexes should reflect the market, so should remain uncapped. However, market trends such as the 2023 Magnificent Seven rally shed light on the needs of clients who require capping methodologies applied to the indexes. To address these needs, we’ve launched various capped indexes based on the standard market cap weighted indexes.

For example, as the Russell 1000 Growth and Russell Top 200 Growth indexes approach concentration limits, the Russell 1000 Growth 40 Act Daily Capped Index and Russell Top 200 Growth 40 Act Daily Capped Index can be alternative index solutions for RICs. We created these indexes in consideration of the definition of a “diversified company” per the Investment Company Act of 1940, applying a methodology that ensures all companies that have a weight greater than 4.5% in aggregate are no more than 22.5% of the index.

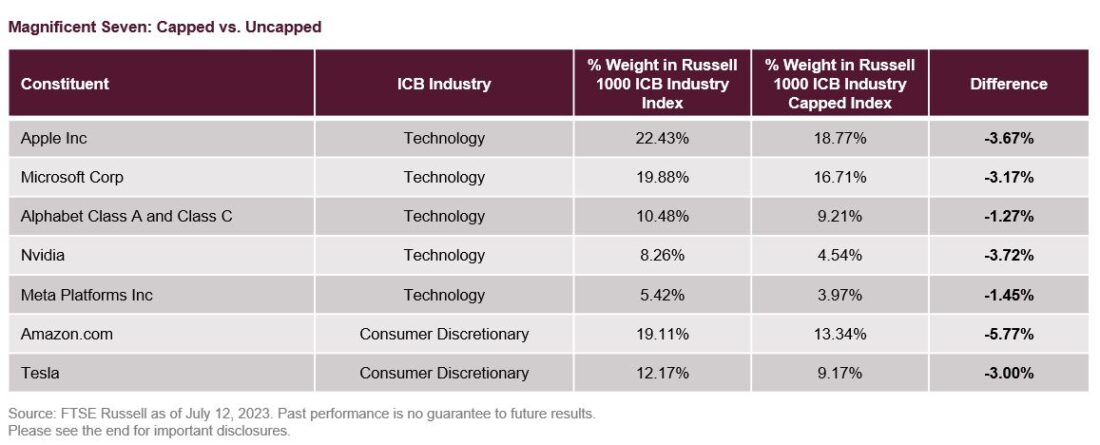

Capping can be a humbling experience for the Magnificent Seven

A closer look at our Russell 1000 ICB Industry Capped Indexes offers a magnified view of the impact of capping the Magnificent Seven. As shown, our capping methodology trimmed the weights of each of the tech giants considerably in their respective industry indexes.

In essence, while our cap weighted indexes are an accurate reflection of the current market, markets can move in uneven ways, spurring demand for capped indexes. Please see our capped index methodology for more information.

—

Originally Posted July 27, 2023 – “Magnificent Seven” rally sheds light on the need for capped indexes

[1]FTSE Global RIC Capped Indexes spotlight | FTSE Russell

Disclosure: FTSE Russell

Interactive Advisors, a division of Interactive Brokers Group, offers FTSE Russell Index Tracker portfolios on its online investing marketplace. Learn more about the Diversified Portfolios.

This material is not intended as investment advice. Interactive Advisors or portfolio managers on its marketplace may hold long or short positions in the companies mentioned through stocks, options or other securities.

© 2023 London Stock Exchange Group plc and its applicable group undertakings (the “LSE Group”). The LSE Group includes (1) FTSE International Limited (“FTSE”), (2) Frank Russell Company (“Russell”), (3) FTSE Global Debt Capital Markets Inc. and FTSE Global Debt Capital Markets Limited (together, “FTSE Canada”), (4) MTSNext Limited (“MTSNext”), (5) Mergent, Inc. (“Mergent”), (6) FTSE Fixed Income LLC (“FTSE FI”), (7) The Yield Book Inc (“YB”) and (8) Beyond Ratings S.A.S. (“BR”). All rights reserved.

FTSE Russell® is a trading name of FTSE, Russell, FTSE Canada, MTSNext, Mergent, FTSE FI, YB and BR. “FTSE®”, “Russell®”, “FTSE Russell®”, “MTS®”, “FTSE4Good®”, “ICB®”, “Mergent®”, “The Yield Book®”, “Beyond Ratings®“ and all other trademarks and service marks used herein (whether registered or unregistered) are trademarks and/or service marks owned or licensed by the applicable member of the LSE Group or their respective licensors and are owned, or used under licence, by FTSE, Russell, MTSNext, FTSE Canada, Mergent, FTSE FI, YB or BR. FTSE International Limited is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

All information is provided for information purposes only. All information and data contained in this publication is obtained by the LSE Group, from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data is provided “as is” without warranty of any kind. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of the FTSE Russell products, including but not limited to indexes, data and analytics or the fitness or suitability of the FTSE Russell products for any particular purpose to which they might be put. Any representation of historical data accessible through FTSE Russell products is provided for information purposes only and is not a reliable indicator of future performance.

No responsibility or liability can be accepted by any member of the LSE Group nor their respective directors, officers, employees, partners or licensors for (a) any loss or damage in whole or in part caused by, resulting from, or relating to any error (negligent or otherwise) or other circumstance involved in procuring, collecting, compiling, interpreting, analysing, editing, transcribing, transmitting, communicating or delivering any such information or data or from use of this document or links to this document or (b) any direct, indirect, special, consequential or incidental damages whatsoever, even if any member of the LSE Group is advised in advance of the possibility of such damages, resulting from the use of, or inability to use, such information.

No member of the LSE Group nor their respective directors, officers, employees, partners or licensors provide investment advice and nothing contained herein or accessible through FTSE Russell products, including statistical data and industry reports, should be taken as constituting financial or investment advice or a financial promotion.

Past performance is no guarantee of future results. Charts and graphs are provided for illustrative purposes only. Index returns shown may not represent the results of the actual trading of investable assets. Certain returns shown may reflect back-tested performance. All performance presented prior to the index inception date is back-tested performance. Back-tested performance is not actual performance, but is hypothetical. The back-test calculations are based on the same methodology that was in effect when the index was officially launched. However, back- tested data may reflect the application of the index methodology with the benefit of hindsight, and the historic calculations of an index may change from month to month based on revisions to the underlying economic data used in the calculation of the index.

This document may contain forward-looking assessments. These are based upon a number of assumptions concerning future conditions that ultimately may prove to be inaccurate. Such forward-looking assessments are subject to risks and uncertainties and may be affected by various factors that may cause actual results to differ materially. No member of the LSE Group nor their licensors assume any duty to and do not undertake to update forward-looking assessments.

No part of this information may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of the applicable member of the LSE Group. Use and distribution of the LSE Group data requires a licence from FTSE, Russell, FTSE Canada, MTSNext, Mergent, FTSE FI, YB, BR and/or their respective licensors.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from FTSE Russell and is being posted with its permission. The views expressed in this material are solely those of the author and/or FTSE Russell and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.