Key takeaways

- Year-to-date, technology has outperformed the broader market largely given the prevalence of low leverage, high profitability and consistent earnings across many names in the mega-cap tech space.

- Technology serving as a haven in periods of market volatility is a distinct change to the late 1990’s where the sector was the source of the volatility.

- This change is driven by large-cap companies being more mature, less volatile, with an ability to generate consistent profitability. These quality characteristics may continue to be in demand by investors in an environment of decelerating economic growth.

Equities have officially entered a correction. Both global and domestic stocks have fallen by at least 10% below their summer peak. Volatile portions of the market, notably small cap and early growth companies are down far more. And while large-cap technology companies have not been immune to the weakness, for the most part they have held up better than the broader market. I think this can continue as investors put a premium on higher quality, companies with the ability to generate cash-flow.

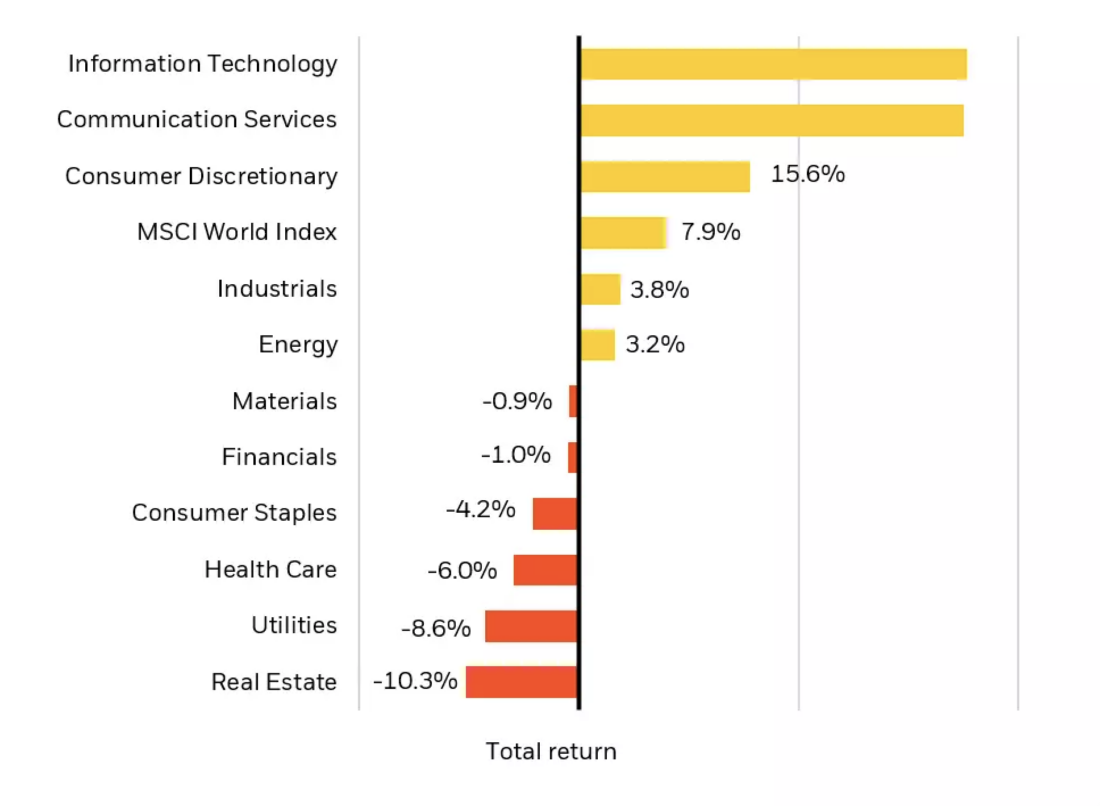

Since the summer peak, the global technology sector has outperformed and remains the top performer year-to-date (see Chart 1). Tech’s resilience owes much to the fact that the mega-cap tech names tend to have low leverage, high profitability, and consistent earnings. In other words, they are high quality companies.

Global sector performance – year to date

Source: LSEG Datastream, MSCI and BlackRock Investment Institute. Oct 31, 2023. The bars show performance in U.S.-dollar terms year to date. Past performance is not indicative of current or future results. Indexes are unmanaged. It is not possible to invest directly in an index.

What investors Want

For investors old enough to remember the late 1990’s, the idea of tech as a haven during periods of market volatility seems odd. These were the stocks that led the market bubble on the way up and were punished the most when the bubble finally burst in 2000. What has changed? The simple answer is the companies in this sector are more mature, less volatile, and more profitable.

One important reason that large-cap technology stocks have held up, despite the surge higher in interest rates: these companies generate strong cash flow. Contrast this with their younger, early-growth cousins. Early growth companies are down roughly 30% from the July peak. The backup in interest rates has been particularly punishing for these companies because their cash-flow is in the distant future. Put differently, a higher discount rate has a more negative impact on early growth companies than those with significant near-term cash flow.

The fact that these companies are more mature and more profitable, also means that, unlike the 1990’s, many of the mega-cap tech companies trade close to a beta of one. In other words, they generally trade with no more volatility than the broader market. This is important because in the current environment investors are demonstrating a clear preference for lower beta companies and an aversion to excess volatility.

The other distinguishing characteristic of these companies: Not only are they highly profitable, but their profits are remarkably consistent. The large, ‘platform’ companies have strong entrenched user bases and consistent demand. And with interest rates high and the economy likely to slow from here, consistency is becoming more important to investors.

Large Cap Tech = High Quality

Tech outperformance looks less strange viewed through a factor perspective. While the market can rally into year-end, investors are likely to prove more risk averse than they were earlier in the year. Higher rates, tighter financial conditions and the prospect for an economic slowdown have left investors with a clear preference for safety and an aversion to volatility. Our view is that mega-cap tech names offer these quality characteristics. They are highly profitable and, perhaps somewhat surprisingly, reliable.

Russ Koesterich, CFA, is a Portfolio Manager for BlackRock’s Global Allocation Fund and the lead portfolio manager on the GA Selects model portfolio strategies.

—

Originally Posted November 9, 2023 – Mega-cap tech a safe haven

To obtain more information on the fund(s) including the Morningstar time period ratings and standardized average annual total returns as of the most recent calendar quarter and current month-end, please click on the fund tile.

The Morningstar Rating for funds, or “star rating,” is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

© 2023 BlackRock, Inc. All rights reserved.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of June 2023 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

The BlackRock Model Portfolios are provided for illustrative and educational purposes only, do not constitute research, investment advice or a fiduciary investment recommendation from BlackRock to any client of a third party financial advisor (each, a “Financial Advisor”), and are intended for use only by such Financial Advisor as a resource to help build a portfolio or as an input in the development of investment advice from such Financial Advisor to its own clients and shall not be the sole or primary basis for such Financial Advisor’s recommendation and/or decision. Such Financial Advisors are responsible for making their own independent fiduciary judgment as to how to use the BlackRock Model Portfolios and/or whether to implement any trades for their clients. BlackRock does not have investment discretion over, or place trade orders for, any portfolios or accounts derived from the BlackRock Model Portfolios. BlackRock is not responsible for determining the appropriateness or suitability of the BlackRock Model Portfolios or any of the securities included therein for any client of a Financial Advisor. Information and other marketing materials provided by BlackRock concerning the BlackRock Model Portfolios –including holdings, performance, and other characteristics –may vary materially from any portfolios or accounts derived from the BlackRock Model Portfolios. Any performance shown for the BlackRock Model Portfolios does not include brokerage fees, commissions, or any overlay fee for portfolio management, which would further reduce returns. There is no guarantee that any investment strategy will be successful or achieve any particular level of results. The BlackRock Model Portfolios themselves are not funds. The BlackRock Model Portfolios, allocations, and data are subject to change.

For financial professionals: BlackRock’s role is limited to providing you or your firm (collectively, the “Advisor”) with non-discretionary investment advice in the form of model portfolios in connection with its management of its clients’ accounts. The implementation of, or reliance on, a Managed Portfolio Strategy is left to the discretion of the Advisor. BlackRock is not responsible for determining the securities to be purchased, held and sold for a client’s account(s), nor is BlackRock responsible for determining the suitability or appropriateness of a Managed Portfolio Strategy or any securities included therein for any of the Advisor’s clients. BlackRock does not place trade orders for any of the Advisor’s clients’ account(s). Information and other marketing materials provided to you by BlackRock concerning a Managed Portfolio Strategy—including holdings, performance and other characteristics–may not be indicative of a client’s actual experience from an account managed in accordance with the strategy.

For investors: BlackRock’s role is limited to providing your Advisor with non-discretionary investment advice in the form of model portfolios in connection with its management of its clients’ accounts. The implementation of, or reliance on, a Managed Portfolio Strategy is left to the discretion of your Advisor. BlackRock is not responsible for determining the securities to be purchased, held and sold for your account(s), nor is BlackRock responsible for determining the suitability or appropriateness of a Managed Portfolio Strategy or any securities included therein. BlackRock does not place trade orders for any Managed Portfolio Strategy account. Information and other marketing materials provided to you by BlackRock concerning a Managed Portfolio Strategy—including holdings, performance and other characteristics—may not be indicative of a client’s actual experience from an account managed in accordance with the strategy. This material is subject to change.

Prepared by BlackRock Investments, Inc. LLC. Member FINRA

©2023 BlackRock, Inc or its affiliates. All rights reserved. BLACKROCK is a trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

USRRMH0623U/S-2964925

Disclosure: BlackRock

©2022 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from BlackRock and is being posted with its permission. The views expressed in this material are solely those of the author and/or BlackRock and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.