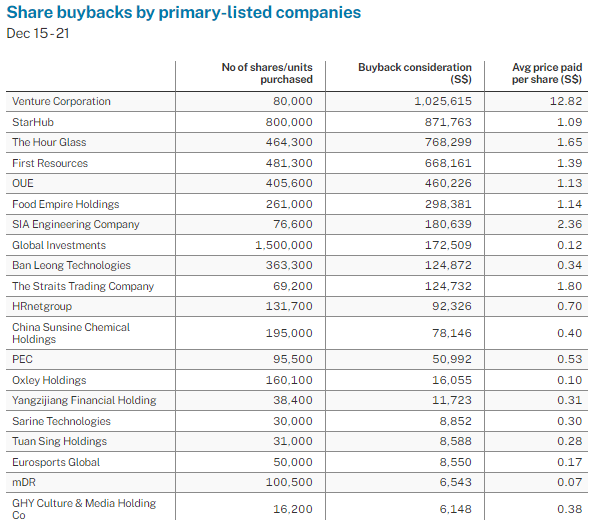

INSTITUTIONS were net sellers of Singapore stocks over the five trading sessions through to Dec 21, with S$217 million of net institutional outflow, as 20 primary-listed companies conducted buybacks with a total consideration of S$5 million.

Venture Corporation bought back 80,000 shares at an average price of S$12.82 per share on Dec 15.

On Nov 29, the company announced a plan to purchase up to 10 million shares in accordance with the share buyback plan that had been approved by shareholders on Apr 27.

Venture directors maintained that purchases in accordance with the plan would only be made in circumstances considered to be in the best interests of the company.

StarHub bought back 800,000 shares at an average price of S$1.09 per share over three sessions. This brings the total number of shares bought back on its current mandate to 16.7 million shares, or 0.96 per cent of its issued shares excluding treasury shares as at the date of the share buyback resolution.

Leading the net institutional outflow over the five sessions were Singtel, Mapletree Pan Asia Commercial Trust, CapitaLand Integrated Commercial Trust, Keppel Corporation, CapitaLand Ascott Trust, Venture Corporation, Isec Healthcare, UOL Group, Sats, and City Developments Ltd.

Meanwhile, Wilmar International, OCBC, DBS, CapitaLand Investment, UOB, Yangzijiang Shipbuilding (Holdings), Keppel DC Reit, CapitaLand Ascendas Reit, Jardine Cycle & Carriage and ST Engineering led the net institutional inflows.

The five trading sessions saw close to 50 changes to director interests and substantial shareholdings filed for close to 30 primary-listed stocks.

Directors or chief executive officers filed seven acquisitions and one disposal while substantial shareholders filed seven acquisitions and nine disposals.

Wilmar International

On Dec 15 Wilmar International chairman and CEO, Kuok Khoon Hong, increased his deemed interest in the global agri business from 13.63 per cent to 13.64 per cent.

This saw Longhlin Asia acquire 200,000 shares and Hong Lee Holdings buy 200,000 shares while Jaygar Holdings purchased 100,000 shares. The 500,000 shares were all bought at an average price of S$3.41 per share.

Kuok has been gradually increasing his total interest in Wilmar from 12.94 per cent in October 2022.

NetLink NBN Management

On Dec 15, NetLink NBN Management executive director and CEO, Tong Yew Heng, acquired 100,000 units of NetLink NBN Trust at S$0.835 per unit. This increased his direct interest in the business trust from 650,000 units to 750,000 units.

His preceding acquisition was back in October 2020 at S$0.97 per unit. The price-to-book ratio of NetLink was around 1.3 at the time of both the acquisitions.

Tong has been the CEO of the trustee-manager since January 2016 and is responsible for the overall leadership and performance of the trust.

He has more than 20 years of experience in senior management positions in various industries.

Prior to joining NetLink, he was executive vice-president, corporate and market development, of Singapore Technologies Electronics; and before that, he was CEO of CitySpring Infrastructure Trust.

With a market capitalisation of S$3.3 billion, NetLink has ranked just outside the 40 most traded Singapore stocks this year and just outside the 20 Singapore stocks that booked the highest net retail inflow this year.

The business trust also presently maintains a 6.3 per cent dividend yield at a unit price of S$0.84, while the Refinitiv consensus estimate target price is S$0.978 as at Dec 19. Refinitiv consensus estimates represent the average of individual estimates provided by analysts covering the stock and estimates typically represent an analyst’s opinion of the company’s performance over the next 18 months.

On Nov 27, the trustee-manager announced that the Infocomm Media Development Authority had completed its review of the wholesale prices, terms, and conditions of the NetLink Trust Interconnection Offer for the next five years.

The revised prices will take effect from Apr 1, 2024, commencing the day after NetLink’s current financial year ends on Mar 31, 2024.

As reported by The Business Times, from Apr 1, 2024, the monthly recurring charge of residential end-user connections will go down to S$13.50 from S$13.80.

The price for non-building address point connection service will also be lowered to S$70.50 from S$73.80, and the monthly recurring charge for non-residential connections will be kept unchanged at S$55.

The trustee manager also added that NetLink may propose to conduct a mid-term price adjustment in the third year, in the event of any significant changes to cost or demand forecasts due to unforeseen circumstances.

It also relayed that the stable and consistent regulatory framework provides low risk and long-term returns to investors.

NetLink maintains a vision to be the leading telecommunications infrastructure provider in Singapore. For H1 FY24 (ended Sep 30), its revenue was up 2.9 per cent from H1 FY23.

This was mainly attributed to higher connections, installation-related, co-location and central office revenue; and was partially offset by lower ducts and manhole services, and ancillary project revenue.

The trustee-manger maintains that NetLink is well positioned to chart the next phase of growth for the Nationwide Broadband Network (NBN). It says it will provide its expertise and infrastructure to support the upgrade of the NBN that will deliver Internet speeds of up to 10Gbps, with the commitment to collaborate with all key stakeholders to contribute towards Singapore’s digital transformation into a world-class Smart Nation.

JB Foods

Between Dec 15 and Dec 19, JB Foods executive director Goh Lee Beng acquired 70,600 shares at S$0.50 per share. The acquisition increased her direct interest in the company from 1.85 to 1.87 per cent.

Goh is deemed to be interested in the shares held by JB Cocoa Group, and thus maintains a 45.52 per cent deemed interest in JB Foods. This brings her total interest in the provider of premium cocoa ingredient products to 47.39 per cent.

Goh was appointed to the board of JB Foods in May 2012 and is responsible for procurement of raw materials and managing the cocoa trading positions of the group, which includes sourcing of cocoa beans and cocoa ingredients, managing the group’s cocoa hedging book, monitoring world cocoa trends, and marketing of cocoa butter.

With over 25 years of experience in the cocoa business, Goh joined Guan Chong Cocoa Manufacturer in November 1989 as an executive and was responsible for logistics, operations, and inventory management. She joined JB Cocoa in January 2003 and was appointed executive director in August 2003. She was responsible for sourcing of cocoa beans and supply chain management.

Back in August 2023, JB Foods reported profit after tax growth of 15.5 per cent, from US$7.3 million in H1 FY22 (ended Jun 30) to US$8.4 million in H1 FY23.

Its operations span Asia-Pacific, Europe, North America, and West Africa, and it maintains a cocoa bean processing capacity of 180,000 tonnes per year.

LY Corporation

On Dec 19, LY Corporation founder and executive director Tan Kwee Chai acquired 190,000 shares of the Catalist-listed company. At S$0.04 per share, the consideration of the acquisitions was S$7,600.

This followed his acquisition of 460,000 shares also at S$0.04 per share on Nov 8. His total interest in the manufacturer and exporter of wooden bedroom furniture is 73.37 per cent.

LY Corporation is one of Malaysia’s leading manufacturers and exporters of wooden bedroom furniture.

SunMoon Food Company

On Dec 21, SunMoon Food Company non-independent and non-executive director Song XiaoJun acquired 150,000 shares at S$0.023 per share. This increased his direct interest in the company from 1.43 to 1.44 per cent.

He is also deemed interested in 13.84 per cent of the shares in SunMoon, held by Champion Financial (Hong Kong), bringing his total interest to 15.28 per cent.

Song is experienced in supply chain management and has held management positions in this industry for close to 10 years. He also has relevant experience in the food services business since year 2020 and is currently the director of Champion Financial (Hongkong).

—

Originally Posted December 25, 2023 – NetLink NBN Trust director acquires more units

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.