For the trading sessions that spanned Jun 16 to Jun 22, the Straits Times Index (STI) declined 0.6 per cent while the Hang Seng Index fell 2.8 per cent and the FTSE Bursa Malaysia KLCI added 0.9 per cent.

Institutions were net sellers of Singapore stocks over the five sessions with S$234 million of net outflow. UOB, OCBC, Keppel Corporation, ST Engineering and Singtel led the net institutional outflow for the five sessions.

Meanwhile, Great Eastern Holdings, Yangzijiang Shipbuilding (Holdings), Seatrium, Sats and ComfortDelGro Corporation led the institutional inflow over the five sessions.

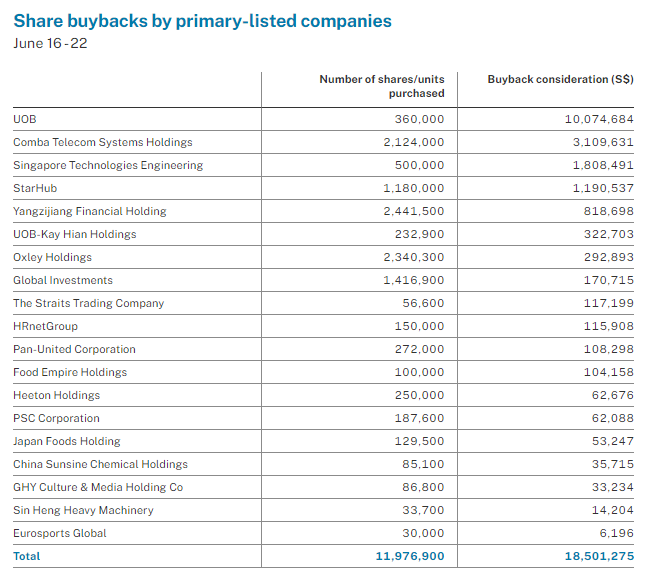

Share buybacks

There were 19 companies conducting share buybacks over the five trading sessions through to Jun 22 with a total consideration of S$18.5 million.

Two Reit managers also conducted share buybacks over the week. Keppel Reit Management bought back 3.45 million units of Keppel Reit for a consideration of S$3.1 million at an average price of S$0.904 per unit.

Digital Core Reit Management bought back 1.22 million units of Digital Core Reit for a consideration of US$0.58 million at an average price of US$0.474 per unit.

Director and substantial shareholder transactions

The five trading sessions saw more than 60 changes to director interests and substantial shareholdings filed for close to 30 primary-listed stocks.

This included 17 company director acquisitions with two disposals filed, while substantial shareholders filed 11 acquisitions and three disposals.

Nio

On Jun 20, Nio announced that it had entered into a share subscription agreement with CYVN Holdings, an investment vehicle majority owned by the Abu Dhabi Government strategically focused on advanced and smart mobility.

The agreement saw CYVN Holdings investing an aggregate of US$738.5 million in cash to subscribe 84,695,543 newly issued Class A ordinary shares of the company at a purchase price of US$8.72 per share.

The share price represents the volume weighted average price of Class A ordinary shares (as adjusted for the American depository share-to-Class A ordinary share ratio) on the New York Stock Exchange over the seven consecutive trading days immediately preceding Jun 19.

The investment transaction is subject to customary closing conditions and the closing is expected to take place in early July 2023.

CYVN Holdings aims to create a smart mobility platform by investing in and partnering industry leaders around the world.

The founder, chairman and CEO of Nio, William Li noted that the investment transaction will further strengthen NIO’s balance sheet to power its continual efforts in accelerating business growth, driving technological innovations and building long-term competitiveness.

Nio is partnering CYVN Holdings to expand its international business, and with the vision of Blue Sky Coming, Nio will continue to strive for technological breakthroughs and user experiences beyond expectations, contributing to a more sustainable future for the world, said Li.

On Jun 9, Nio reported that for its Q1FY23 (ended Mar 31) vehicle deliveries reached 31,041, consisting of 10,430 premium smart electric SUVs and 20,611 premium smart electric sedans. This represented an increase of 20.5 per cent from Q1FY22, and a 22.5 per cent decrease from Q42022.

Nio also updated that it delivered 6,658 vehicles in April 2023 and 6,155 vehicles in May 2023. As at May 31, NIO’s cumulative vehicle deliveries since inception had reached 333,410 vehicles.

In addition, Li noted that on May 24, Nio launched the All-New ES6, an all-round smart electric SUV and started its deliveries the next day which has received overwhelmingly positive feedback from its users.

Nio’s total revenue in Q12023 increased 7.7 per cent year on year and fell 33.5 per cent from the previous quarter. During the analyst results call, Nio stated that it expects to break even within the next one year.

As at Jun 21, Nio’s shares on SGX has seen 84 per cent higher daily turnover of S$2.0 million so far during the month of June compared to the previous month. Order book quality has improved with best bid-ask spreads at 2.4 ticks and top-of-book depth at S$29,500 for June month to date.

Great Eastern Holdings

On Jun 19, OCBC acquired 2,345,800 shares of Great Eastern Holdings at S$16.99 per share. With a consideration of S$ 39,855,142, the married deal increased OCBC’s total interest in Great Eastern from 87.91 per cent to 88.40 per cent.

As a subsidiary of OCBC Bank, Great Eastern maintains an S$8 billion market capitalisation, however its monthly median of daily trading volume does not qualify for inclusion in the STI. Nonetheless, the stock has averaged more than S$670,000 a day in average trading turnover this year, more than doubling its 2022 average turnover level.

With over S$100 billion in assets and more than 14.5 million policyholders, including 12 million from government schemes, Great Eastern provides insurance solutions to customers through three distribution channels. These include a tied agency force, bancassurance, and financial advisory firm, Great Eastern Financial Advisers.

Great Eastern has set out a three-pronged strategic focus to bolster its product propositions to address customers’ needs across all life stages and segments.

This involves enhancing its digital tools to offer a more seamless and intuitive experience, the strengthening of operational services to bring greater value to customers, in addition to living up to its refreshed brand identity and promise.

JEP Holdings

Between Jun 19 and 20, JEP Holdings executive chairman Andy Luong acquired 500,000 shares at S$0.325 per share.

With a consideration of S$162,500, this increased his direct interest in the company from 0.51 per cent to 0.63 per cent.

Luong also holds 15.89 per cent of the issued share capital of UMS Holdings, which in turn holds 73.85 per cent of the issued share capital of JEP Holdings. This brings his total interest in JEP to 74.48 per cent. His preceding acquisition was on Jun 9, with 600,000 shares acquired at S$0.310 per share.

With over 30 years of operating history, JEP Holdings is a leading solutions provider of precision machining and engineering services, with a primary focus on the aerospace industry.

Luong noted in April that he expects a more noticeable recovery of JEP’s aerospace business in the second half of 2023, supported by volume production of complex and high value-added parts from its strategic customers.

The group’s new factory in Penang, Malaysia is scheduled for completion in the second half of 2023, and full production is expected to begin in the first quarter of 2024. This will enable the company to take on more customer orders and increase production output.

Luong has more than 20 years of experience in manufacturing front-end semiconductor components. He acquired his machining skills through his experience in working in his family machining business in Vietnam.

He emigrated to the United States from Vietnam in 1979 and shortly after college, started a precision business called Long’s Manufacturing. He is also the executive chairman and CEO of UMS Holdings.

YKGI

Between Jun 15 and Jun 20, YKGI executive chairman and executive director Seah Boon Lock acquired 1,033,300 shares at an average price of S$0.136 per share.

With a consideration of S$140,691, this increased his deemed interest in the Catalist-listed food and beverage player from 77.46 per cent 77.70 per cent.

Seah has gradually increased his deemed interest in YKGI from 76.70 per cent on Feb 6. He has more than 30 years of experience in the F&B industry and was a founder the group.

Sing Investments & Finance

On Jun 19, Sing Investments & Finance (SIF) deputy managing director Lee Sze Siong acquired 32,000 shares at S$1.00 apiece. This increased his total interest in the licensed finance company from 30.52 per cent to 30.54 per cent.

His preceding acquisition was on Jun 12, with 8,000 shares also acquired at S$1.00 apiece.

SIF’s principal activities include accepting deposits from the public and providing loans and credit facilities to individuals and corporations, particularly the small and medium-sized enterprises in Singapore.

Lee currently oversees the company’s credit documentation & operations, credit control, finance, IT support, product management, HR, tenancy and building maintenance.

PNE Industries

Between Jun 15 and 16, PNE Industries executive managing director Tan Koon Chwee acquired 24,700 shares.

With a consideration of S$18,128, this increased his direct interest in the manufacturer, dealer and trader of electrical and electronic products and appliances from 11.12 per cent to 11.15 per cent.

Tan serves as the CEO of the group and is the brother of non-executive chairman Tan Kong Heng. He is responsible for formulating and implementing the group’s corporate and business strategies and financial matters. He also oversees the marketing function of the group.

On May 11, PNE Industries reported that its H1FY23 (ended Mar 31) revenue decreased by S$13.6 million or 35.5 per cent compared to the same period the previous year due mainly to lower contract manufacturing sales because of customer requests to defer deliveries as well as component shortages.

Inside Insights is a weekly column on The Business Times, read the original version.

—

Originally Posted June 26, 2023 – Nio enters share subscription agreement with CYVN Holdings; OCBC ups Great Eastern stake

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.