OCBC, CapitaLand Investment, UOBKH lead buyback tally

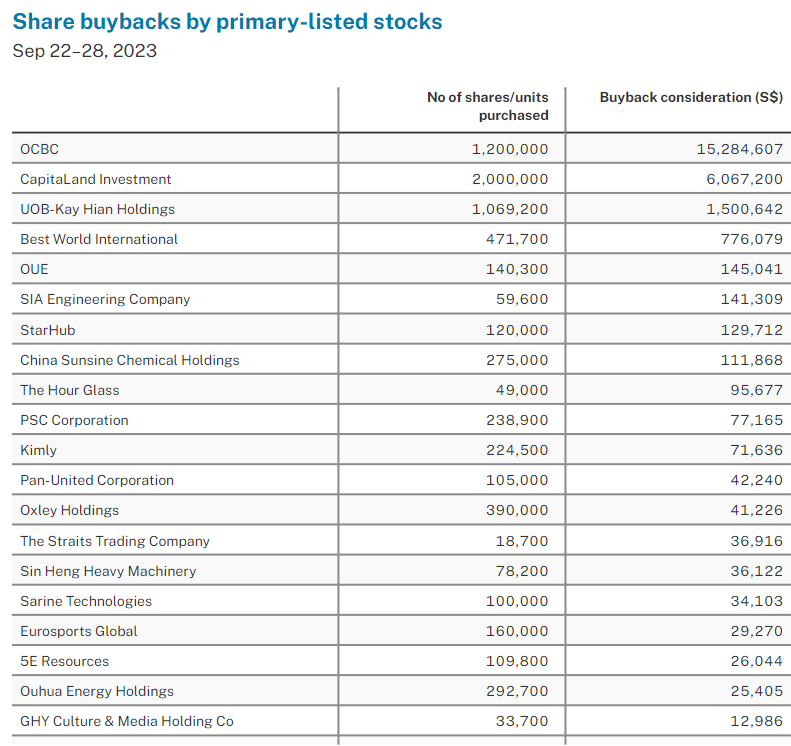

INSTITUTIONS were net buyers of Singapore stocks over the five trading sessions through to Sep 28, with S$179 million of net institutional inflow, while 21 primary-listed companies conducted buybacks with a total consideration of S$24.7 million.

OCBC led the share buyback consideration tally, buying back 1.2 million shares at an average price of S$12.74 per share, followed by CapitaLand Investment, which bought back two million shares at an average price of S$3.03 per share. This was CapitaLand Investment’s first share buyback since August 2022. CapitaLand Investment maintains its share purchase mandate allows the company greater flexibility over its share capital structure, with shares that are purchased held as treasury shares which it may transfer pursuant to its employee share-based incentive schemes.

UOB Kay Hian also bought back 1,069,200 shares at an average price of S$1.40 per share.

Leading the net institutional inflow over the five sessions were OCBC, DBS, Keppel Corp, United Overseas Bank, ComfortDelGro, Sembcorp Industries, Singapore Telecommunications, Singapore Technologies Engineering, Mapletree Logistics Trust, and Jardine Cycle & Carriage.

Meanwhile, Singapore Airlines, Venture Corp, CapitaLand Integrated Commercial Trust, CapitaLand Investment, Suntec Reit, City Developments, Keppel Infrastructure Trust, Genting Singapore, Frasers Logistics & Commercial Trust and Keppel Reit led the net institutional outflow over the five sessions.

For Singapore Depository Receipts, on the back of stronger oil prices, PTTEP SDR saw S$0.7 million of shares change hands on Sep 28, with its unit price reaching fresh highs at $6.48. PTTEP SDR has also been the top-performing SDR, returning over 14 per cent since its launch on May 30, when it saw S$0.14 million in net inflows from individual investors.

CP All, the exclusive operator of 7-Eleven convenience stores in Thailand, and Airports of Thailand continued to see net inflows from individual investors despite prices dipping to new lows, due to weak market sentiments as high oil prices weighed down the Thai baht and SET50.

The five trading sessions saw close to 80 changes to director interests and substantial shareholdings filed for more than 30 primary-listed stocks. This included 15 company director acquisitions with three disposals filed, while substantial shareholders filed 11 acquisitions and two disposals.

Wilmar International

Between Sep 22 and 27, Wilmar International chairman and CEO Kuok Khoon Hong increased his deemed interest in the global agri-business from 13.44 per cent to 13.46 per cent. This saw Longhlin Asia Ltd acquire 594,800 shares and Hong Lee Holdings (Pte) Ltd acquire 594,800 shares. The 1,189,600 shares were all acquired at an average price of S$3.70 per share.

Envictus International

On Sep 28, Envictus International executive chairman Jaya J B Tan acquired five million shares from non-executive director Mah Weng Choong. With a consideration of S$1.15 million, the married deal was transacted at S$0.23 per share. This increased his total interest from 22.58 per cent to 24.23 per cent. Mah reduced his direct interest in Envictus from 4.97 per cent to 3.33 per cent.

Tan has been on the board of Envictus since December 2003. He was re-designated from non-executive chairman to executive chairman on Nov 3, 2020. He is overall in charge of the group’s corporate and operational functions, identifying, charting, and implementing sustainable business strategies in new growth areas of the group’s businesses. The principal activities of the Malaysia-focused group are the operating of fast-food restaurant and specialty coffee chains; wholesale of foodstuff and frozen food; manufacturing of butchery products; and manufacturing and distribution of condensed and evaporated milk.

First Sponsor Group

On Sep 25, First Sponsor Group’s Ho Han Khoon acquired 40,000 shares at S$1.22 per share. With a consideration of S$48,888 this took his total interest in the property development, holding and financing company from 31.46 per cent to 31.47 per cent.

Ho Han Khoon has been the alternate director to non-executive chairman Calvin Ho Han Leong since May 2014. Ho Han Khoon is currently holding the position of executive vice-president of Tai Tak, where he is responsible for overseeing Tai Tak group’s overall business and financial strategy, investments, and operations.

On July 27, the group reported H1FY23 (ended June 30) revenue of S$115.3 million, an increase of 17.9 per cent from H1FY22. This was due mainly to the increase in revenue from hotel operations of S$34.7 million and rental of investment properties of S$2.3 million. The increase was partially offset by the decrease in revenue from sale of properties of S$2.4 million and property financing of S$14 million. The H1FY23 net profit was S$10.6 million, representing an 85.1 per cent decline from H1FY22, due mainly to lower property financing income and the absence of one-off disposal gains. Following from Q1FY23, the group’s European operating hotels continued their recovery with occupancies in Q2FY23 close to their pre-pandemic 2019 levels. Profitability of the hotels was however adversely impacted by high energy and labour costs as well as the temporary closure of two Dutch Bilderberg hotels in H1FY23 due to major renovation works. The group’s property development projects include offices, retail, residential and hotel developments in the Netherlands, Australia, and China. Its property portfolio comprises commercial properties (including hotels) in the Netherlands, Germany, and China. The group provides property financing services mainly in the Netherlands, Germany, Australia, and China.

YKGI

Between Sep 21 and 27 executive chairman and executive director Seah Boon Lock acquired 2,235,100 shares at an average price of S$0.119 per share. With a consideration of S$265,955, this increased his deemed interest in the Catalist-listed F&B player from 77.70 per cent to 78.23 per cent. Seah has gradually increased his deemed interest in YKGI from 76.70 per cent on Feb 6. He has more than 30 years of relevant experience in the F&B industry and was a founder the group.

YKGI was listed on the Catalist on Feb 6, 2023. The principal activity of the company is that of an investment holding. The principal activities of the subsidiary corporations are those of F&B operations, food court management and franchising and sub-franchising. The F&B operations contributed 52 per cent of H1FY23 revenue (ended June 30) and comprise the operations of food outlets and hawker stalls under the flagship brand, Yew Kee Duck Rice. The F&B operations also include a diverse portfolio of other non-halal and halal brands such as XO Minced Meat Noodles, My Kampung Chicken Rice, PastaGo and Kampung Kopi House. The operations of the food outlets and hawker stalls are supported by the central kitchen which procures, processes, and prepares key ingredients and products for supply to the food outlets operating under the group’s brands and certain third-party food outlets.

For its H1FY23, the group reported revenue of S$29.6 million, a 10.7 per cent increase from H1FY22. This was mainly attributed to an increase of S$2.3 million from the F&B operations, due to more stores being in operation in H1FY23, and the charging for takeaway packaging from the end of FY22. It also highlighted an increase of S$0.8 million from its food court business due to the lifting of Covid-19 epidemic safe distance measures in Singapore universities and in the community and the gradual resumption of activities in the community which led to higher demand.

Asian Pay Television Trust

On Sep 26, Brian McKinley, executive director and CEO of the trustee-manager of Asian Pay Television Trust (APTT), increased his deemed interest in APTT from 0.166 per cent to 0.178 per cent. This saw 215,700 units acquired for a consideration of S$20,707 at an average price of S$0.096 per unit. Prior to his appointment as CEO in April 2017, McKinley was the chief financial officer of the trustee-manager, an office he held since the listing of APTT in May 2013, providing financial and strategic leadership to the company.

Back in August, McKinley relayed that broadband, which now constitutes around 25 per cent of APTT’s total revenue, will remain the largest driver of its long-term growth. He added that the manger is looking to extract more value from its aggressive broadband growth strategy and grow cash flows that consistently more than offset the decline in basic cable TV. APTT has an investment mandate to acquire controlling interests in and to own, operate and maintain mature, cash generative pay-tv, and broadband businesses in Taiwan, Hong Kong, Japan, and Singapore.

Bonvests Holdings

On Sep 21, Bonvests Holdings executive chairman Henry Ngo acquired 16,000 shares at S$1.00 per share. The acquisition was made through Allsland Pte Ltd, which is wholly owned by him. His total interest in Bonvests Holdings is 84.60 per cent. Ngo has gradually increased his total interest from 82.93 per cent in August 2018. The three core businesses of the group span property development and investment, hotel ownership and management, and waste management and contract cleaning of buildings.

Inside Insights is a weekly column on The Business Times, read the original version.

—

Originally Posted October 2, 2023 – OCBC, CapitaLand Investment, UOBKH Lead Buyback Tally

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.