This September, the stock market acted just as we expected. Usually, September is a tough month for the S&P 500, and this year was no different. Investors may well be wondering therefore: “Is October going to bring some relief?”

There is somewhat of a stigma surrounding October: financial crashes like the Panic of 1907 add to the negative associations; or the haunting Black Monday of 1987, when the Dow plunged 22.6% in a single day. However, looking at an overview of the last century, October does in fact ultimately reflect a net positive outcome.

Time for Take-Off ?

October kicks off the last quarter of the year, a time when companies and individuals are busy refining their financial positions and seeking rewarding investment avenues. This surge in financial activities often boosts the stock values of financial giants like JPMorgan or Goldman Sachs.

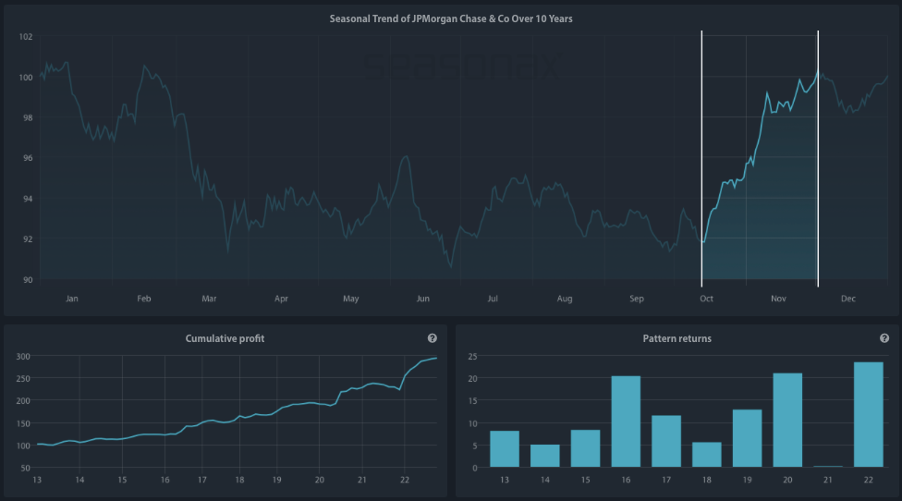

The seasonal chart of JP Morgan Chase over the past decade reveals noticeable peaks during October and November, due to an increase in financial activities. This financial powerhouse has consistently delivered impressive results. For instance, between October 13 and December 03, there has been an astonishing 11.43% rise within a mere 35 trading days!

While it is essential to note that past performance doesn’t guarantee future results, the regularity of these peaks since 2013 hints at a pattern that’s hard to ignore. It seems like JPMorgan has been on a winning spree, making its investors happy.

Seasonal Chart of JP Morgan Chase over the past 10 years

Source: Seasonax – Click the link http://tiny.cc/Seasonax-JPMorgan to access an interactive chart.

Unlike regular charts, a seasonal chart doesn’t display price over a set time, but shows the average trend over several years. The horizontal axis represents the time of the year, and the vertical axis shows the % change in price (indexed to 100). The prices reflect end of day prices and do not include daily price fluctuations.

Pfizer: Capitalizing on Health Consciousness

October also marks the start of a good season for the healthcare sector. Pfizer, for example, often gains momentum with the arrival of the flu season, seeing a spike in vaccine and medication sales. The shift towards preventive healthcare, and a preference for trusted brands, makes Pfizer an attractive option.

Seasonal Chart of Pfizer over the past 10 years

Source: Seasonax – Click the link http://tiny.cc/Seasonax-Pfizerto access an interactive chart.

Over the last ten years Pfizer has displayed a consistent trend, providing a healthy 9.85% return on average between October 14 and December 1.

Another health giant Johnson & Johnson also sees a boost, due to a heightened demand for healthcare products as fall and winter approach.

Current Market Vibes

As we step into the upcoming weeks, there seems to be no red flag signaling a market crash. Nevertheless, keeping a keen eye on the ripples caused by climbing interest rates and the ongoing energy crisis is wise. Also, with many Americans paying their first student loan bills since 2020, a drop in consumer spending is likely, as more funds are channeled towards clearing debts.

However, examining the 4-year election cycle reveals that, since 1999, pre-election years have consistently witnessed positive gains for the S&P 500 during the month of October. Typically, stocks experience an above-average surge in the year leading up to an election. This trend is largely attributed to economic policies implemented before an election, as rising stock prices tend to cast the incumbent political party in a favorable light.

Smarter Investments with Seasonax

Before diving in, leverage Seasonax to pin down the best entry and exit points by studying recurring patterns. With a free sign-up at www.seasonax.com, you get access to insights on a vast array of instruments, including various stocks, commodities, and indices.

Remember, the key is not just to trade, but to trade wisely. So, why not Seasonax it and make the most of October’s market treats!

—

Originally Posted October 4, 2023 – October’s Stock Market Mojo

Disclosure: Seasonax

Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. Seasonax GmbH neither recommends nor approves of any particular financial instrument, group of securities, segment of industry, analysis interval or any particular idea, approach, strategy or attitude nor provides consulting nor brokerage nor asset management services. Seasonax GmbH hereby excludes any explicit or implied trading recommendation, in particular, any promise, implication or guarantee that profits are earned and losses excluded, provided, however, that in case of doubt, these terms shall be interpreted in abroad sense. Any information provided by Seasonax GmbH or on this website or any other kind of data media shall not be construed as any kind of guarantee, warranty or representation, in particular as set forth in a prospectus. Any user is solely responsible for the results or the trading strategy that is created, developed or applied. Indicators, trading strategies and functions provided by seasonax GmbH or on this website or any other kind of data media may contain logical or other errors leading to unexpected results, faulty trading signals and/or substantial losses. Seasonax GmbH neither warrants nor guarantees the accuracy, completeness, quality, adequacy or content of the information provided by it or on this website or any other kind of data media. Any user is obligated to comply with any applicable capital market rules of the applicable jurisdiction. All published content and images on this website or any other kind of data media are protected by copyright. Any duplication, processing, distribution or any form of utilisation beyond the scope of copyright law shall require the prior written consent of the author or authors in question. Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Seasonax and is being posted with its permission. The views expressed in this material are solely those of the author and/or Seasonax and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.