S-Reits’ benchmark iEdge S-Reit index returned 1.8 per cent in the month of July, extending from the 0.3 per cent total returns in June, and in line with the FTSE EPRA Nareit Developed Index.

In terms of net fund flows over the month, retail investors net bought S$8.2 million of S-Reits while institutional investors net sold S$86.4 million in the sector.

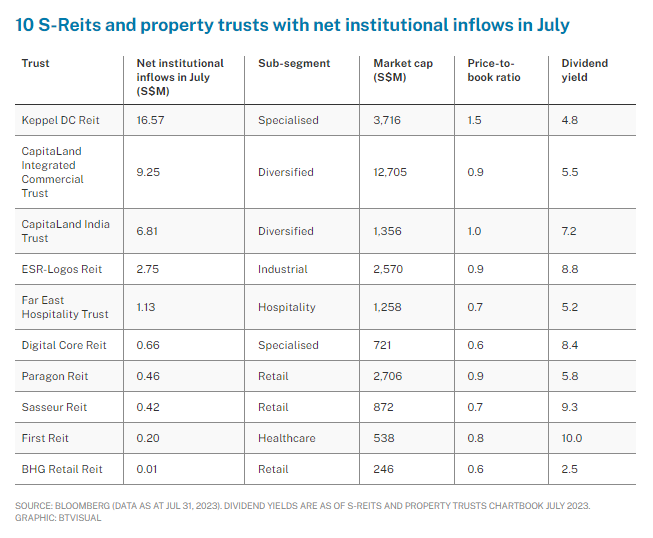

However, there were 10 S-Reits and property trusts which recorded net institutional inflows in the month of July. They were Keppel DC Reit, CapitaLand Integrated Commercial Trust (CICT), CapitaLand India Trust (Clint), ESR-Logos Reit, Far East Hospitality Trust, Digital Core Reit, Paragon Reit, Sasseur Reit, First Reit, and BHG Retail Reit.

The 10 S-Reits and property trusts recorded combined net institutional inflows of over S$38.2 million.

Keppel DC Reit in its H1 2023 results announced distributable income (DI) of S$91.3 million, which was 0.2 per cent higher year on year. The growth in DI was due mainly to contributions from the accretive acquisitions of Guangdong Data Centre 2 and the building shell of Guangdong Data Centre 3; reversions from contract renewals and escalations; and tax savings. Keppel DC Reit declared a distribution per unit (DPU) of 5.051 Singapore cents for H1 2023, and its portfolio occupancy remains at 98.5 per cent. In H1 2023, the manager also secured new, renewal and expansion data centre contracts in Singapore, Ireland, and the Netherlands with overall positive reversions. Keppel DC Reit was the fourth-best performing S-Reit in the month of July, with 3.7 per cent total returns.

CICT was the best-performing S-Reit in July, generating 6.8 per cent in total returns. CICT reported a distributable income of S$353.2 million for H1 2023, an increase of 1.7 per cent year on year, and driven by acquisitions of CapitaSky and its Australia portfolio as well as its completed asset enhancement of Raffles City Singapore. CICT’s H1 2023 DPU was 5.3 Singapore cents, up 1.5 per cent year on year. CICT’s committed portfolio occupancy improved to 96.7 per cent, up 0.5 percentage points from Mar 31, 2023.

Clint reported that its H1 FY2023 total property income and net property income grew 7 per cent and 3 per cent, respectively, year-on-year, mainly due to higher portfolio occupancy which improved from 92 per cent from the start of the year to 94 per cent, as at Jun 30, 2023. Clint’s DPU for H1 FY2023 was 3.36 Singapore cents, lower year-on-year due to an enlarged unit base after its preferential offering in July 2023. Its portfolio leasable area has grown by 24 per cent since the start of the year, with the addition of Block A in International Tech Park Hyderabad and the acquisition of International Tech Park Pune, Hinjawadi.

Visit the monthly S-Reits & Property Trusts Chartbook for more research and information on Singapore’s Reit sector.

REIT Watch is a weekly column on The Business Times, read the original version.

—

Originally Posted August 7, 2023 – REIT Watch – Institutional investors net buyers of these 10 S-Reits in July

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.