Recent consumer and leisure activities have picked up domestically with F1 Singapore Grand Prix’s sold-out record crowd of over 302,000 fans, return of major concerts and meetings, incentives, conferences & exhibitions (Mice) activities, and the gradual pickup in tourist arrivals in recent months.

Retail sales in Singapore went up by 13 per cent year on year (yoy) in August, marking its fifth consecutive month of double-digit yoy growth. Growth in retail sales was attributed to increases recorded in most of the retail sales segments including apparel and footwear, department store sales, and food and alcohol sales. On a month-on-month basis, the majority of the industries suffered a drop in sales with petrol service stations seeing the largest dip of 8.2 per cent.

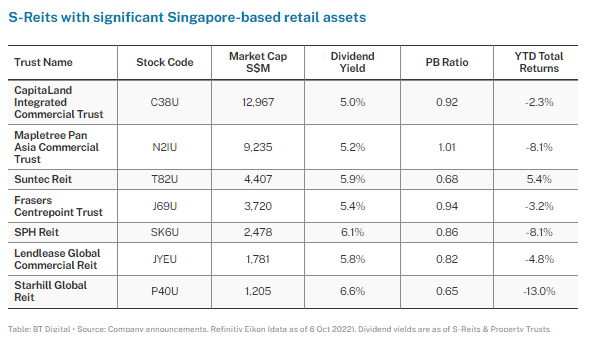

Listed on the SGX are 7 S-Reits which have significant exposure to Singapore-based retail assets.

CapitaLand Integrated Commercial Trust reported 15.9 per cent yoy growth in retail tenant sales and 12.5 per cent yoy growth in shopper traffic for H1 2022. Double-digit growth was led by downtown malls with 26.4 per cent yoy growth in tenant sales and 14.5 per cent yoy growth in shopper traffic.

VivoCity Mall, a key retail mall in Mapletree Pan Asia Commercial Trust’s portfolio, saw shopper traffic grow 50.9 per cent yoy and tenant sales increase 53.3 per cent yoy in Q1 FY2022/2023.

Suntec Reit’s net property income (NPI) for its retail portfolio in H1 2022 improved 41.5 per cent yoy, while NPI for its convention portfolio turned positive in Q2 2022 driven by corporate events, conferences, and long-term licences. The Reit believes that its convention business is on the road to recovery, driven by domestic consumer and corporate events and the return of small-scale international Mice events.

Frasers Centrepoint Trust reported Q3 2022 shopper traffic and tenants’ sales grew 32 per cent and 23 per cent yoy respectively. Tampines 1 and Waterway Point led in tenant sales growth, while all its malls recorded double-digit yoy improvements in shopper traffic.

SPH Reit’s Paragon Mall’s 3Q22 sales saw a marked recovery at 45 per cent yoy growth, driven by the removal of most travel restrictions, to pre-Covid levels. The Clementi Mall continued with resilient sales tracking above pre-pandemic levels supported by strong food and beverage performance.

Lendlease Global Commercial Reit reported stronger recovery in Q4 2022 tenant sales, surpassing pre-Covid average, and faster than shopper visitation. Its retail portfolio maintains healthy leasing at 99.6 per cent occupancy rate.

Starhill Global Reit reported full year FY21/22 strong committed occupancy rates of 98.6 per cent. Its master lease rent review with Toshin, master tenant for Ngee Ann City contributing approximately 23 per cent of the Reit’s portfolio gross rent, was completed at prevailing rent and up to June 2025.

REIT Watch is a weekly column on The Business Times, read the original version

—

Originally Posted October 10, 2022 – REIT Watch – Retail S-Reits see double-digit pickup; downtown malls shine

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.