The Straits Times Index (STI) gained 0.6 per cent in total returns for the year to date till Jun 8, slightly underperforming the iEdge S-Reit Index which gained 0.8 per cent.

Following the June 2023 quarterly review, FTSE Russell announced that there would be one change to the constituents of the STI. Seatrium has been added to the STI and Keppel DC Reit has been removed from the index.

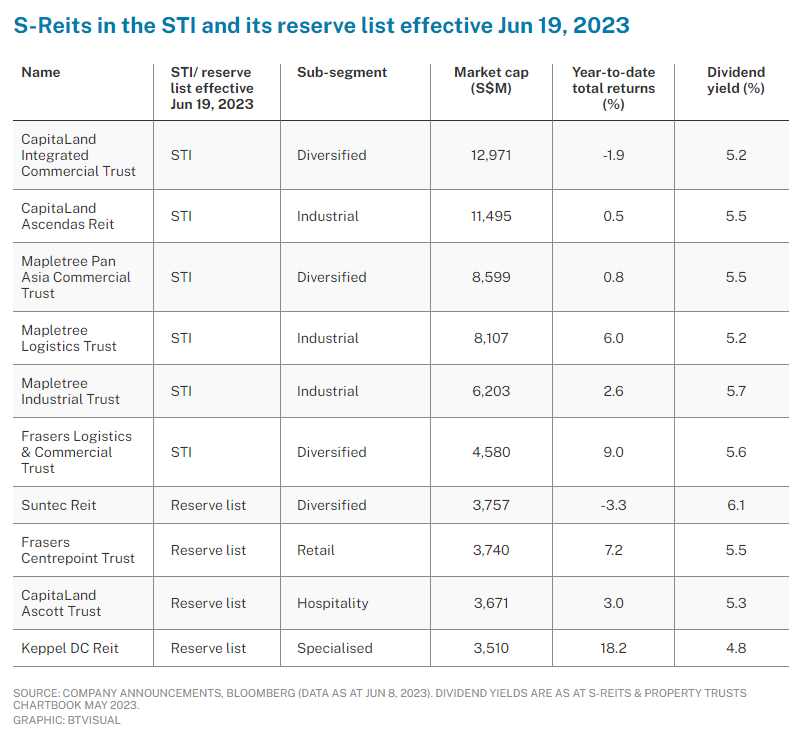

Effective at the start of business on Jun 19, the STI will have six S-Reits while the STI reserve list will have (in alphabetical order) four S-Reits – CapitaLand Ascott Trust, Frasers Centrepoint Trust, Keppel DC Reit and Suntec Reit – as well as Olam Group.

The STI reserve list is used in the event that one or more of the STI constituents are deleted in between quarterly reviews.

In total, the 10 S-Reits that are part of the STI and its reserve list, averaged 4.2 per cent total returns in the year to date till Jun 8, outpacing the STI and the iEdge S-Reit Index. Seven out of the 10 S-Reits outperformed the two indices – Keppel DC Reit (18.2 per cent), Frasers Logistics & Commercial Trust (9 per cent), Frasers Centrepoint Trust (7.2 per cent), Mapletree Logistics Trust (6 per cent), CapitaLand Ascott Trust (3 per cent), Mapletree Industrial Trust (2.6 per cent) and Mapletree Pan Asia Commercial Trust (0.8 per cent).

Keppel DC Reit is the best-performing Reit in the year so far, with 18.2 per cent total returns. While it reported last week that one of its customers – Cyxtera Technologies, a US-listed data centre operator – has filed for bankruptcy protection amid struggles to pay down debt and a severe funding crunch, the Reit said that the asset accounts for less than 2 per cent of its assets under management (AUM) and has no material impact on its distribution per unit.

Last week, Singapore also launched new standards for data centres to optimise energy efficiency in tropical climates, allowing data centres to gradually increase operating temperatures to 26 degrees Celsius and above. The Infocomm Media Development Authority said that with every 1 deg C increase in operating temperature, data centres could save about 2 per cent to 5 per cent in cooling energy.

Keppel DC Reit has six data centres in Singapore, amounting to 54.7 per cent of overall AUM as at Mar 31, 2023. In its 2023 first-quarter business update, Keppel DC Reit noted that its distributable income was partially offset by lower net contributions from some of the Singapore colocation assets arising from higher facilities expenses including electricity costs.

Aside from Keppel DC Reit, STI constituents – Mapletree Industrial Trust and CapitaLand Ascendas Reit also have exposure to Singapore data centres. As at Mar 31, 2023, Mapletree Industrial Trust’s Singapore data centres accounted for 3.4 per cent of its AUM, while CapitaLand Ascendas Reit has three data centres in Singapore.

REIT Watch is a weekly column on The Business Times, read the original version.

—

Originally Posted June 12, 2023 – REIT Watch – S-Reits in STI and its reserve list gain 4% this year

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.