Key news last week was the US Federal Reserve’s decision to put a pause on interest rates, keeping them unchanged as announced during this month’s Federal Open Market Committee (FOMC) meeting. This is the first pause in rate hikes since early 2022 and the benchmark rate remains at 5 per cent to 5.25 per cent.

While interest rates were kept unchanged, the Federal Reserve signaled that interest rates could see two more increases for the rest of this year.

Perhaps a sigh of relief for many as the STI gained 2.3 per cent over the past week until the end of Friday’s morning session. S-REITs were one of the better performing sectors of the STI, post the FOMC meeting, with the iEdge S-REIT Index gaining over 3.5 per cent during the same period.

Across the 40 actively traded S-REITs & Property Trusts on Thursday’s session after the FOMC meeting, there were 23 gainers and only 6 decliners, while the remaining 11 REITs ended the day flat.

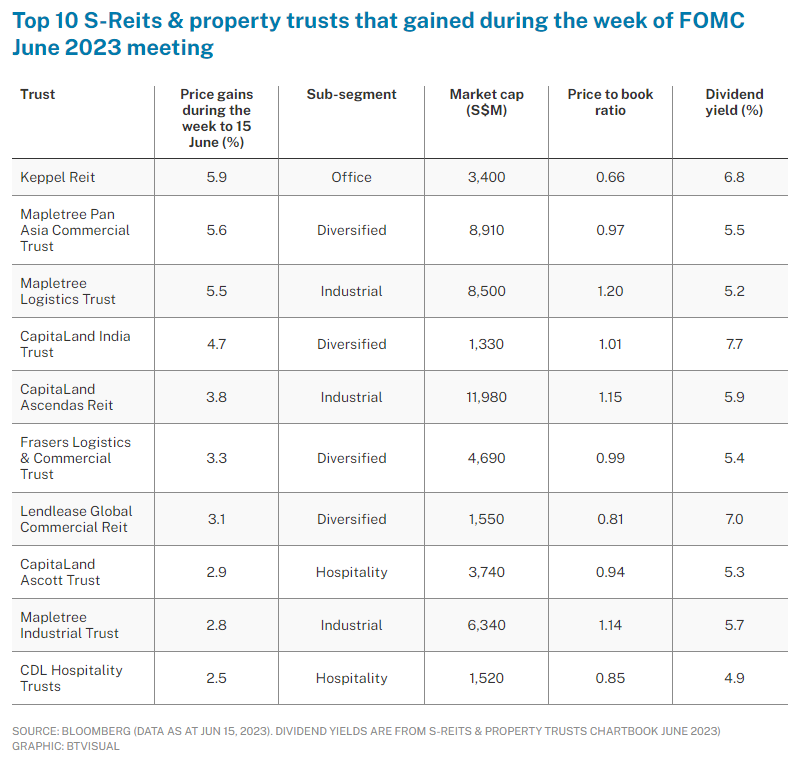

The top 5 gainers among S-REITs & Property Trusts during the week until Thursday’s close were: Keppel REIT (5.9 per cent), Mapletree Pan Asia Commercial Trust (5.6 per cent), Mapletree Logistics Trust (5.5 per cent), CapitaLand India Trust (4.7 per cent), and CapitaLand Ascendas REIT (3.8 per cent). On average, the 5 trusts gained 5.1 per cent, outperforming the S-REITs benchmark. 4 out of the 5 recorded net institutional inflows during the week with Keppel REIT leading net inflows exceeding S$6 million.

Singapore’s 5 REIT ETFs have also trended upwards, gaining an average 2.6 per cent during the week until the end of Friday’s morning session. CSOP iEdge S-REIT Leaders Index ETF gained 3.9 per cent, followed by both NikkoAM-StraitsTrading Asia ex Japan REIT ETF and Lion-Phillip S-REIT ETF at 2.5 per cent each, Phillip SGX APAC Div REIT ETF at 2.3 per cent, and UOB APAC Green REIT ETF at 1.6 per cent.

NikkoAM-StraitsTrading Asia ex Japan REIT ETF was among top traded ETFs over the past week and recorded net inflows. Phillip SGX APAC Div REIT ETF gained close to 10 per cent just on Friday’s early session, followed by CSOP iEdge SREIT Leaders Index ETF which gained 3.6 per cent.

And as shared by advisory platform Beansprout in an insight, while the expectation that interest rates are close to peak might lead to improved sentiments for REITs, market participants will still consider a REIT’s ability to generate higher rental income from its properties to offset higher interest costs.

REIT Watch is a weekly column on The Business Times, read the original version.

—

Originally Posted June 19, 2023 – REIT Watch – S-REITs rally on sigh of relief post June FOMC pause

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

When you talk about S-REITs, it would help if you could give a very short description as to what an S-Reit is and why one would want to invest in this particular vehicle as opposed to other REITS. I am very familiar with most REITs and had never heard of them until today.

Thank you for sharing, Rob. S-REIT is short for Singapore REIT. We have more articles on this type of product. Please visit https://www.interactivebrokers.com/en/search/index.php?query=s-reit to learn more.