HEADWINDS for the global office real estate segment has been under focus after office-sharing firm WeWork raised “substantial doubt” in its ability to continue its business.

However, Singapore-listed real estate investment trusts (S-Reits) are showing signs of resiliency in their office portfolios.

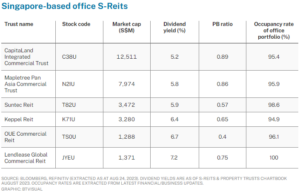

While there are three Reits listed in Singapore that have limited exposure to the New York-headquartered WeWork – CapitaLand Integrated Commercial Trust (CICT), Suntec Reit, and Mapletree Pan Asia Commercial Trust (MPACT) – other Reits with heavy office portfolios such as Keppel Reit and OUE Commercial Reit have also seen consumer sentiment hold up alongside high occupancy rates and growth in rental reversions.

For the first half of FY2023, CICT reported higher gross revenue and net property income of 19.6 per cent and 14.8 per cent year on year, respectively, for its office portfolio.

Year to date, rent reversion for CICT’s office portfolio grew 9.6 per cent, outpacing that of its retail portfolio, which recorded a 6.9 per cent growth.

Its office portfolio’s occupancy rate rose quarter on quarter, marginally improving from 94.8 per cent to 95.4 per cent.

WeWork was one of CICT’s top 10 tenants for the month of June, with 2.4 per cent of total gross rent contributing to CICT’s total gross rental income.

The Singapore central business district (CBD) was CICT’s second-highest revenue stream (27.7 per cent) for the first half of the year.

A recent Knight Frank report that found that businesses in Singapore were “not deterred from continuing to seek quality spaces in the CBD, supporting the strong occupancy levels in the office market”.

CICT echoed that view, seeing healthy demand for its office assets coming from private wealth and asset management companies, law firms, professional services and government agencies – combined with a tighter supply ahead for Singapore’s CBD expected beyond 2023.

Suntec Reit’s Singapore office portfolio recorded year-on-year growth in both gross revenue and net property income for H1 FY2023 by 8.1 per cent and 1.1 per cent respectively, citing higher occupancy and rent at its Suntec City Office and One Raffles Quay.

The Reit’s Singapore office portfolio was near full occupancy as at Jun 30, 2023, with its overall Singapore occupancy at 99.3 per cent and its core CBD occupancy at 94.8 per cent.

Its office assets also marked 20 quarters of positive rent reversion and came in at 10.8 per cent for H1 FY2023.

Co-working spaces remained a minor portion of Suntec Reit’s office portfolio at roughly 3 per cent as at Jun 30.

WeWork consisted of 1.9 per cent of Suntec Reit’s total monthly office gross rental income, according to Suntec Reit’s 2022 annual report.

MPACT’s Mapletree Business City had 95.9 per cent committed occupancy with 7.1 per cent rental reversion. Year on year, MPACT’s gross revenue and net property income for Q1 FY2023/24 were up 75.6 per cent and 68.0 per cent respectively, with its Singapore properties delivering better performance more than offsetting higher utility expenses.

Source: SGX Research S-Reits & Property Trusts Chartbook.

For more research and information on Singapore’s Reit sector, visit here for the monthly S-Reits & Property Trusts Chartbook.

REIT Watch is a weekly column on The Business Times, read the original version.

—

Originally Posted August 28, 2023 – REIT Watch – Singapore-based office S-Reits resilient despite concerns sparked by WeWork

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.