- Sembcorp Industries will rejoin the MSCI Singapore Index with effect from the close of trading on Thurs 31 Aug 2023. The leading energy and urban development player was omitted from the Index back on 29 May 2020 amid the broader market volatility brought on by the onset on Covid.

- From its MSCI Singapore Index deletion on 29 May 2020 through to the 11 August 2023 close, Sembcorp Industries market capitalisation has more than quadrupled from S$2.4 billion to S$10.6 billion. Sembcorp Industries completed its landmark demerger with Sembcorp Marine (now Seatrium) in 2020, and has pressed on with its 2025 target for 70% of its net profit to be generated by sustainable solutions.

- Venture Corp will also be removed from the Index on the close of 31 Aug. Unlike the STI, the MSCI Singapore Index does not maintain a limit on the number of constituents which currently includes 22 stocks, including NYSE-listed SEA and Nasdaq-listed Grab Holdings. Jardine Matheson & Hongkong Land are currently a part of the MSCI Hong Kong Index.

- Dividends boosted the MSCI Singapore Index total return in the 2023 year to 11 August to 6.3%. The trio of DBS, OCBC & UOB comprise 46% of the MSCI Singapore Index weights. DBS is also the largest weight of the MSCI AC ASEAN High Dividend Yield Index, with OCBC and UOB ranking as the third and fourth largest weight, as of 31 July.

The MSCI Singapore Index (‘SIMSCI’) comprises 22 stocks, which includes 20 stocks that are also a part of the STI, in addition to the NYSE-listed Sea and Nasdaq-listed Grab Holdings. SEA reported two-thirds of its 2022 revenue to South East Asia, and Grab Holdings reported all of its 2022 revenue to South East Asia, with 36% of Grab Holding’s revenue reported to Malaysia and 21% reported to Singapore. Together Sea and Grab Holdings maintain 13% of the SIMSCI weights, retreating 3 percentage points year-on-year. STI constituents Jardine Matheson Holdings and Hongkong Land Holdings are currently a part of the MSCI Hong Kong.

Sembcorp Industries Re-joins SIMSCI

Sembcorp Industries (‘Sembcorp’) will join the SIMSCI on the close of 31 August 2023 and Venture Corporation will be omitted from the Index. Sembcorp has outpaced all of the current 22 SIMSCI constituents (tabled below) in the 2023 year to 11 August, with a 77% total return. Sembcorp has also averaged S$23 million in average daily trading turnover in the 2023 year to 11 August, compared to S$14 million in 2022. Sembcorp has also booked the most net institutional inflow in the local market this year, with S$162 million of net inflow as of 11 August.

From its deletion from the SIMSCI on 29 May 2020, through to the 11 August 2023 close, Sembcorp Industries market capitalisation has more than quadrupled from S$2.4 billion to S$10.6 billion. Sembcorp Industries completed its landmark demerger with Sembcorp Marine in 2020, and has pressed on with its 2025 target for 70% of its net profit to be generated by sustainable solutions. On Aug 4, Sembcorp attributed its strong performance in 1H23 to the conventional energy segment which saw higher power prices in the Singapore electricity market and increased operational capacity in the Renewables segment. Its gross renewables capacity (installed and under development) totalled 11.9 GW as of June 2023.

| Current MSCI Singapore Index Constituents | Exchange Code | Mkt Cap S$M (in SGD) | YTD Total Return % (in SGD) | 11 Aug Close Price | 5-year Beta |

| DBS Group Holdings | D05 | 86,709 | 5 | 33.62 | 1.34 |

| Oversea-Chinese Banking Corp | O39 | 58,801 | 11 | 13.08 | 1.13 |

| United Overseas Bank | U11 | 48,504 | 0 | 28.98 | 1.23 |

| Sea ADR | SE | 44,178 | 12 | 57.62* | N/A |

| Singapore Telecommunications | Z74 | 40,286 | -2 | 2.44 | 0.93 |

| Wilmar International | F34 | 23,785 | -6 | 3.81 | 0.72 |

| Singapore Airlines | C6L | 21,950 | 39 | 7.38 | 1.25 |

| Grab Holdings | GRAB | 18,312 | 10 | 3.50* | N/A |

| CapitaLand Investment | 9CI | 16,287 | -10 | 3.18 | 1.11 |

| Jardine Cycle & Carriage | C07 | 13,426 | 23 | 33.97 | 0.98 |

| CapitaLand Integrated Commercial Trust | C38U | 12,838 | 0 | 1.93 | 0.83 |

| Keppel Corp | BN4 | 12,529 | 58 | 7.11 | 1.10 |

| CapitaLand Ascendas REIT | A17U | 12,074 | 6 | 2.75 | 0.46 |

| Singapore Tech Engineering | S63 | 11,782 | 15 | 3.78 | 0.80 |

| Genting Singapore | G13 | 11,529 | 2 | 0.955 | 1.15 |

| Singapore Exchange | S68 | 10,242 | 9 | 9.59 | 0.37 |

| Seatrium | S51 | 9,209 | -2 | 0.135 | 1.90 |

| Mapletree Pan Asia Commercial Trust | N2IU | 8,232 | -2 | 1.57 | 0.75 |

| Mapletree Logistics Trust | M44U | 8,206 | 9 | 1.66 | 0.48 |

| City Developments | C09 | 6,221 | -15 | 6.86 | 1.33 |

| UOL Group | U14 | 5,694 | 3 | 6.74 | 0.96 |

| Venture Corp | V03 | 4,105 | -15 | 14.11 | 0.76 |

*Note 11 Aug prices are in USD and beta is not available in the SGX Stock Screener for Sea ADR and Grab Holdings.

Source: SGX, Refinitiv. Data as of 11 August 2023.

SIMSCI Heavyweights Boosted YTD Index Total Return

The SIMSCI has generated a 2.6% price gain in the 2023 year to 11 August, with dividend distributions extending the total return to 6.3%. With the trio of DBS Group Holdings (‘DBS’), Oversea-Chinese Banking Corporation and United Overseas Bank comprising 46% of the Index, the SIMSCI maintains a comparatively high dividend yield.

As of 31 July, DBS ranked as the seventh largest weight of the MSCI AC Asia Pacific High Dividend Yield Index with a 2.3% weight, a fivefold increase from its 0.4% weight in the parent MSCI AC Asia Pacific Index. DBS is also the largest weight of the MSCI AC ASEAN High Dividend Yield Index, with Oversea-Chinese Banking Corporation and United Overseas Bank ranking as the third and fourth largest weight, as of 31 July.

According to MSCI, the MSCI AC Asia Pacific High Dividend Yield Index construction starts with a dividend screening process and only securities with a track record of consistent dividend payments and with the capacity to sustain dividend payouts into the future are eligible index constituents. Securities are also screened based on certain “quality” factors such as return on equity (‘ROE’), earnings variability, debt to equity, and on recent 12-month price performance.

DBS reported a record quarterly high ROE of 19.2% in 2Q23. At the May Investor Day, DBS’ CFO highlighted that successful digital transformation since 2015 led to a higher ROE that in 2022 ranked in the top decile of the globe’s 100 largest banks.

Recent Comparative Performances

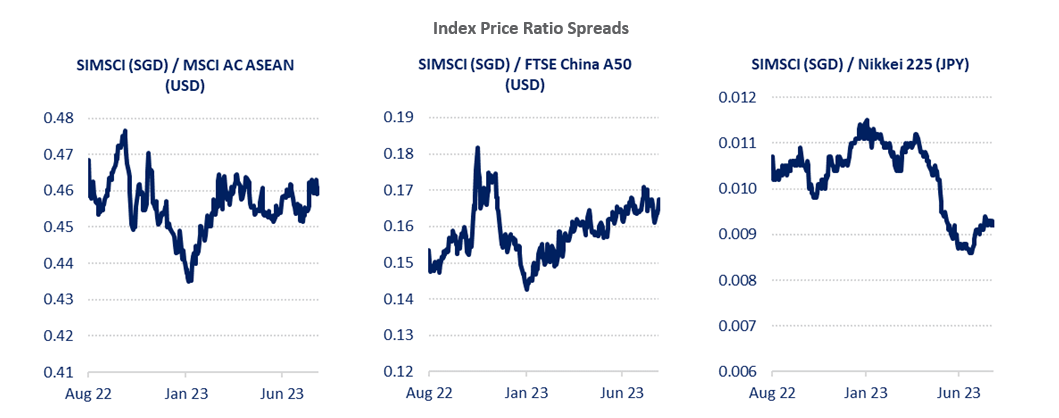

The SIMSCI (in SGD) maintained a 120-day correlation co-efficient of 0.77 to the MSCI AC ASEAN Index (in USD) as of the 11 August close, compared to a 0.81 correlation co-efficient to the STI. Over the past 12 months, the rolling 120 day correlation co-efficient of the SIMSCI to the MSCI AC ASEAN Index ranged from a high of 0.80 to a low of 0.68. Recently, on 28 July, the price ratio spread of the SIMSCI SGD to the MSCI AC ASEAN Index, moved from below the 12-month mean to above the mean.

Over the first 32 weeks of 2023, the SIMSCI outpaced the FTSE China A50 Index, while lagging the Nikkei 225 Index. This sees the price ratio spread of the SIMSCI to the FTSE China A50 Index (in USD) currently more than one standard deviation above the 12-month mean, while the price ratio spread of the SIMSCI to the Nikkei 225 Index (in JPY) is more than one standard deviation below the 12-month mean.

—

Originally Posted August 14, 2023 – Sembcorp Industries Scheduled to Rejoin MSCI Singapore on 1 Sep

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.