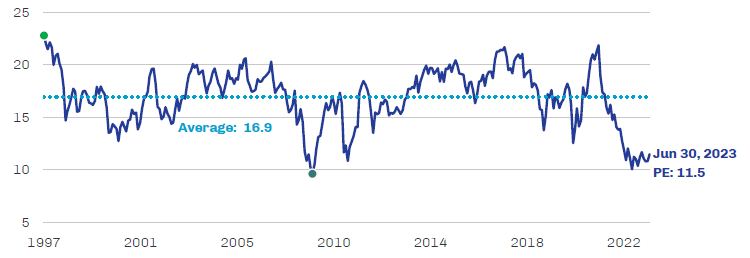

Over the past few weeks, I’ve seen a number of charts highlighting the opportunity in small-cap stocks given their absolute and relative valuations. When I see these charts, my ears definitely perk up because many of the models we run are heavily positioned in small (and mid) caps, and specifically the cheaper value stocks in this segment of the market. The chart below, from First Eagle Investments, “It (May Be) a Small World After All”, shows the valuation of the Russell 2000 going back to 1997. Small caps haven’t been this cheap on an absolute basis since the Financial Crisis. They have been hovering around a Price-Earnings multiple of 11.5, compared to the average of 16.9 over the last quarter-century.

Source: First Eagle Investments

Honing in on Small Cap Value Universe

Things are even more compelling in the small-cap value universe. Using Validea’s Market Valuation tool, I’ve looked at the absolute valuation of small and mid-cap value stocks through various valuation ratios. As you can see, small/mid-cap value has rarely been so cheap (our data goes back to 2006). The other periods of this level of cheapness came mostly during the Great Financial Crisis (2008/2009) and during the COVID crash (2020).

| Small Cap Value Ratio | As of 9/1/2023 | Small-Cap Value Stocks Have Been Cheaper (since 2006) |

| TTM PE Ratio | 8.64 | Only 12.4% of time |

| Current Year PE Ratio | 8.77 | Only 11.7% of time |

| Price/Sales | 0.70 | Only 33.4% of time |

| Price/Book | 1.04 | Only 12.4% of time |

| Price/Cash Flow | 5.80 | Only 15.1% of time |

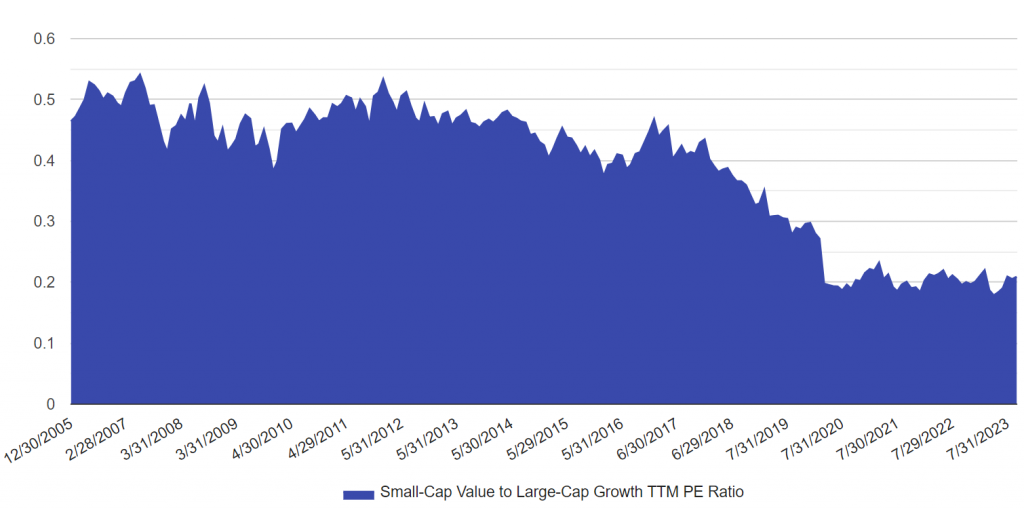

Another common way to look at valuations for small-cap value stocks is to look at them on a relative basis (how expensive are they relative to growth stocks). The chart below, also from our market valuation tool, compares small cap value to large cap growth stocks. Small value has only been cheaper, relative to large cap growth stocks, in 10% of the time and the vast majority of this time in the last three years, setting up an interesting and potentially powerful long-term opportunity (more on that below).

Source: Validea

Why the Discount?

The S&P 500, which has a P/E in the mid-20s, is up over 16% so far in 2023 and is far from cheap. So why the big discount in the small-cap and value space? I think there are a few reasons why this discount exists, and whether it’s completely warranted or not, and when and where the opportunity for investors might emerge. There are a number of risk-based drivers that explain some of the valuation spreads that currently exist. Here are some of the reasons for the discount:

- Small Caps are riskier and more tied to the business cycle: Smaller companies often lack the financial stability and resources of their larger counterparts, making them more susceptible to economic downturns and market volatility. When there is uncertainty around the economic backdrop and growth, as we’re witnessing in 2023, small caps can be impacted.

- They are more sensitive to higher rates & inflation: Small caps rely on borrowing for growth and expansion, making them particularly sensitive to changes in interest rates. When rates rise, borrowing costs increase, potentially squeezing profit margins and hindering growth prospects. On the inflation side, small companies may not absorb price increases as well as larger firms, who have more pricing power in their businesses and negotiating clout with suppliers. Experts are concerned about inflation, but the Federal Reserve has maintained its inflation-fighting stance as recently as last week at Jackson Hole.

- Increase in Passive investing favors larger stocks, market-cap weighted indices: The rise of passive investing and market-cap-weighted indices has resulted in a preference for larger, more established companies. As capital flows into these indices, smaller companies can experience less demand in their share prices. Long-term, this may benefit investors looking to buy underappreciated small-cap stocks, but fund flows play an important role in the price support for equities.

- Sector makeup: Earlier in the year, the failure of Silicon Valley Bank and pressure on other regionals hurt financials, and in the small-cap space, there are lots of financials. When such a large sector is negatively impacted, it can have an outsized effect on the aggregate valuation of segments of stocks (i.e., small caps and value).

In Need of a Jumpstart

While it hasn’t always been this way over the very, very long-term (i.e., going back to the 1920s), the strong performance out of small-cap value has been very episodic over the last 25 years. The great returns have come in bursts and usually after periods of very poor performance. For instance, in the late ’90s, value (and small-cap value) underperformed for years only to roar back in 2000-2003 and in the bull market that ensued. It was the same in 2009 after the 2008 bear market and in March 2020 after the rapid historic decline in stocks. In each of these periods, although very different in nature, value names exploded higher coming out of the depths of recessions and bear markets. At least historically, valuation alone wasn’t the catalyst that shifted investors into value stocks. That is not to say the market needs a repeat of what happened in the past for small-cap value to deliver, but in the last quarter of the century, long-term value investors have had to endure the bust-and-boom pattern to benefit from the performance value can deliver.

So where does that leave us?

Valuation spreads are at levels that present long-term investors with a good opportunity to buy into a segment of the market (i.e., small-cap value) that is very cheap and presents an opportunity for attractive relative returns. But we may need some type of jumpstart, or catalyst, to get things going. That might be a recession, a pivot in the Fed’s stance on rates, surprising growth to the upside, or something else we can’t see. The important thing for investors, even if you’re just idling now, is to be invested so that you benefit when the spark ignites.

—

Originally Posted September 6, 2023 – Small Cap Value: Waiting for the Jumpstart

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Validea Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Validea Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.