Michael Kramer and the clients of Mott capital own SHOP

It was a fairly uneventful day, with the S&P 500 falling roughly 20 bps. Meanwhile, the 2-year auction at 11:30 AM was fairly ugly, with the new issue tailing one bps, while indirect acceptance fell to 57.4% from 62% last month. The 5-year auction saved the day, coming in line with the when-issued trading rate and an indirect acceptance rate of 65.5%, which was better than last month’s 61.5%. Tomorrow, the 7-year auction will come at 1 PM.

NASDAQ 100 (NDX)

It isn’t entirely unclear at this point, but it appears we are consolidating and pretty much topping out at these levels based on the NASDAQ futures. The future contracts have traded sideways since November 15, and that isn’t saying much for a market that is supposed to be going higher.

S&P 500 (SPX)

Meanwhile, for the S&P 500, as I have noted a few times now, I think the rally off the October low is a 3-wave structure and is a retracement of the declines from the July peak. At this point, this still seems valid, as the index remains below the July highs and, like the NASDAQ, appears to be churning.

If that is the case, I have no evidence to change my opinion, the lows of October, around 4,100, should be undercut. That may be a hard thought process for many to swallow, given what we have witnessed and all the other chatter from many other sources. However, given my data and my understanding of market mechanics, fundamentals, and technicals, this is my belief. Additionally, I work in isolation and do not rely on what others think, and I like to form my own opinions.

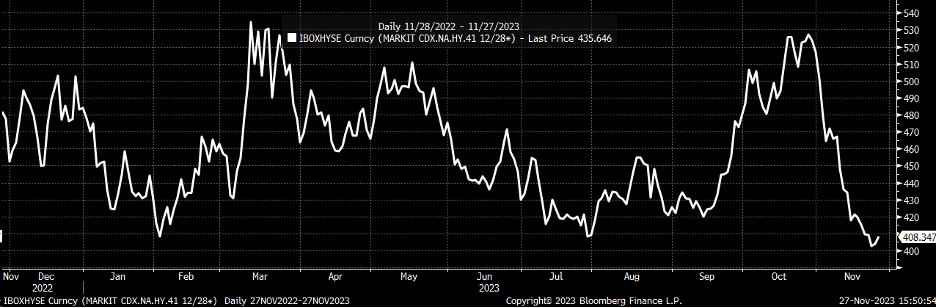

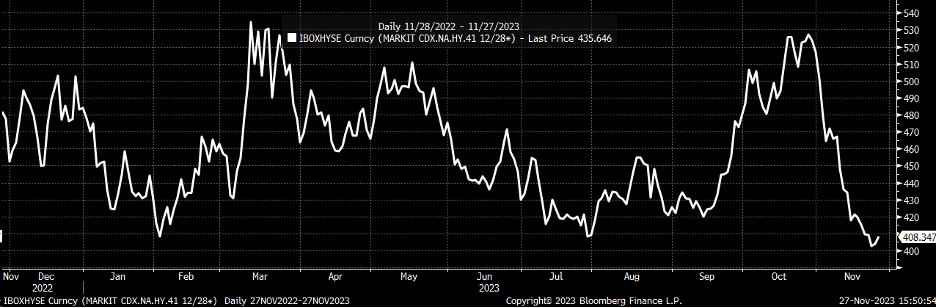

CDX

At least for today, the CDX High Yield Index increased, and it will need to continue to rise for my opinions on the S&P 500 to prove correct. Stocks, after all, are merely a derivative of the credit market, and where credit conditions go, stocks are likely to follow, especially when considering the earnings yield of the S&P 500.

This week could see things pick up, especially with more economic data, a PCE report, and Jay Powell. Depending on how all of this goes, we could see these spreads widen further, and if that happens, stocks will reverse lower as spreads widen, pushing implied volatility higher.

Shopify (SHOP)

Meanwhile, Shopify had a good showing today after reporting strong black Friday sales metrics for its merchants. The stock has performed very well, and while its RSI is over 70, the Bollinger Band shows it could still rise some more, as it doesn’t appear to be overbought yet. If it can clear $75, it has a chance to fill the technical gap at $89 from February 2022. Members of my services know I have owned this stock since June 2022, when it was trading around 5x sales.

—

Originally Posted November 27, 2023 – Stocks Drop On November 27, 2023, As The Rally Stalls Out

Charts used with the permission of Bloomberg Finance L.P. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Disclosure: Mott Capital Management

Mott Capital Management is the portfolio manager for one portfolio offered by Interactive Advisors. Interactive Advisors clients do not invest directly with the Portfolio Managers like Mott Capital Management, and the Managers do not have discretionary trading authority over Interactive Advisors client accounts. The Portfolio Managers on the Interactive Advisors platform simply license their trade data to Interactive Advisors, which then allows its clients to have the same strategy and trading decisions mirrored in their accounts if the Portfolio is in line with their risk score. Portfolio Managers like Mott Capital Management implement their trading philosophy and strategy without knowing the identity of Interactive Advisors’ clients or taking into account these clients’ individualized circumstances.

Mott Capital Management has entered into a Portfolio Manager License Agreement with Interactive Advisors pursuant to which it provides trading data IA uses to offer a portfolio to its investment advisory clients. Mott Capital Management is not affiliated with any entities in the Interactive Brokers Group.

Interactive Advisors is an affiliate of Interactive Brokers LLC.

Pursuant to the Investment Management Agreement between Interactive Advisors and its clients, all brokerage transactions occur through Interactive Brokers LLC, an affiliate of Interactive Advisors. The use of an affiliate for brokerage services represents a potential conflict of interest as Interactive Brokers LLC is paid a commission on trades executed on behalf of Interactive Advisors. Interactive Brokers LLC does not consider this conflict material as it does not sell, solicit, recommend, trade against or otherwise attempt to induce Interactive Advisors to place any orders in any products. Interactive Advisors does not offer services through any other broker-dealer. All trading by Interactive Advisors is self-directed. Interactive Advisors clients acknowledge this potential conflict of interest and authorize Interactive Advisors to execute transactions through Interactive Brokers LLC when they open an Interactive Advisors account. Clients should consider the commissions and other expenses, execution, clearance, and settlement capabilities of Interactive Brokers LLC as a factor in their decision to invest in an Interactive Advisors Portfolio. Interactive Advisors believes it satisfies its best execution obligation by trading its clients’ trades through Interactive Brokers LLC. While there can be no assurance that it will in fact achieve best execution, Interactive Advisors does periodically monitor the execution quality of transactions to ensure that clients receive the best overall trade execution pursuant to regulatory requirements.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Mott Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Mott Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.