What’s in a number? College football fans know that the both the Big 10 and Big 12 Conferences each has 14 teams[i], so do we really need to be sticklers about whether the “Magnificent Seven” actually has seven components? I’ll argue “no”, since the Mag 7 is at best an artificial construct anyway.

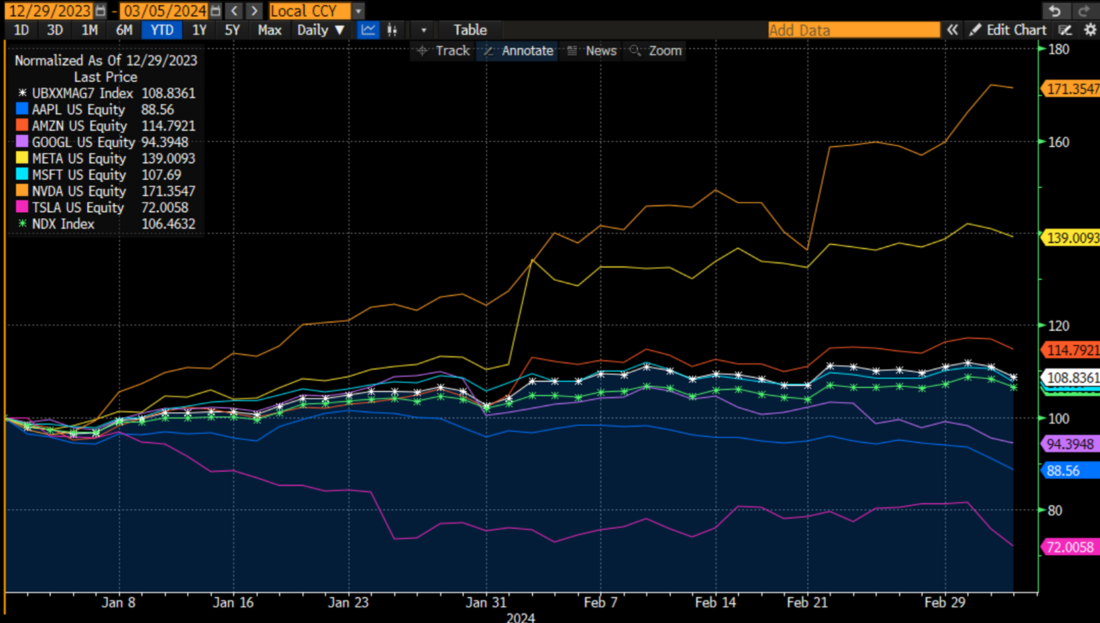

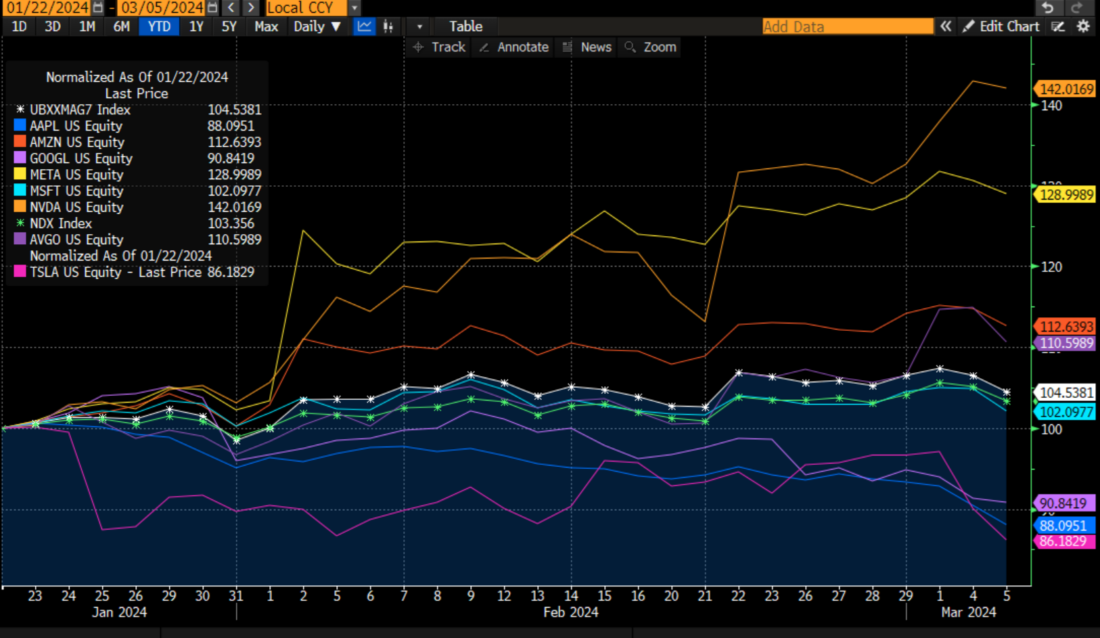

A normalized chart of the relative performance of the seven stocks versus both the Nasdaq 100 (NDX) and the UBS Magnificent 7 Index (a cap-weighted, seven stock index created in October 2023) shows quite disparate performances by the constituent members on a year-to-date and longer-term basis:

Year-to-date Normalized Chart, UBS Mag 7 Index (white), NDX (green), AAPL (blue), AMZN (red), GOOGL (lilac), META (yellow), MSFT (blue), NVDA (orange), TSLA (magenta)

Source: Bloomberg

There are some interesting takeaways from the chart above:

- For starters, it is interesting to note that the Mag 7 has roughly identical performance with NDX on a year-to-date basis. Thus, it is not improper to use the Mag 7 as a proxy for the larger, actively traded index.

- As with any index or average, some components outperform while others underperform. In this case it’s an even split: three outperformers (NVDA, META, AMZN), three underperformers (GOOGL, AAPL, TSLA) and one average performer (MSFT).

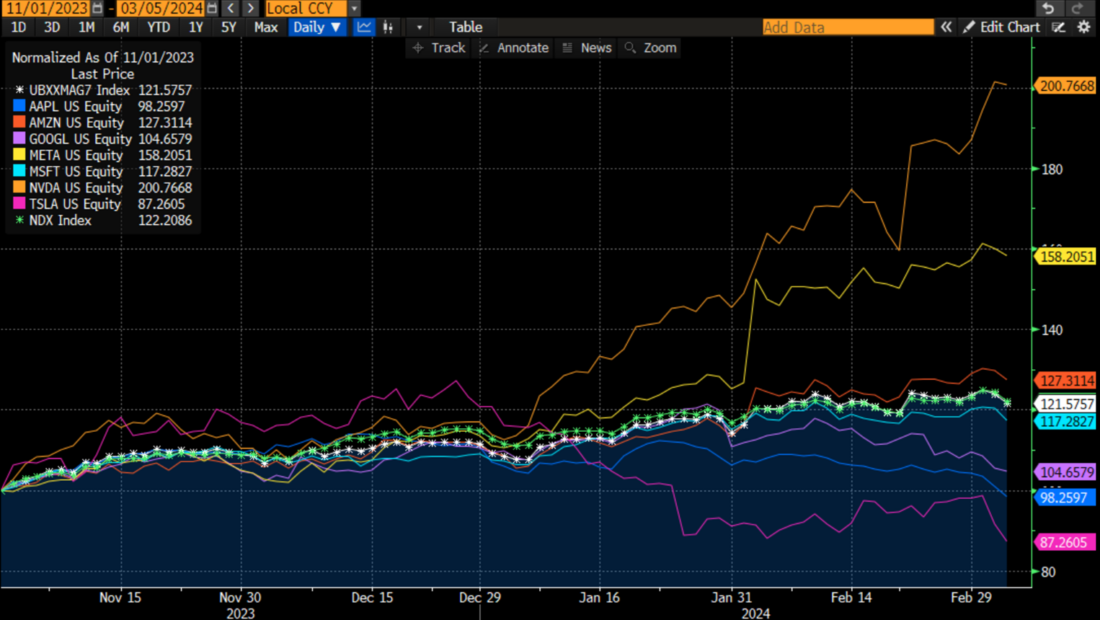

- The relative performances are similar when we graph them on a longer-term basis. Here is the same chart dated back to November 1, 2023, when the current upsurge began:

Normalized Chart Since November 1, 2023, UBS Mag 7 Index (white), NDX (green), AAPL (blue), AMZN (red), GOOGL (lilac), META (yellow), MSFT (blue), NVDA (orange), TSLA (magenta)

Source: Bloomberg

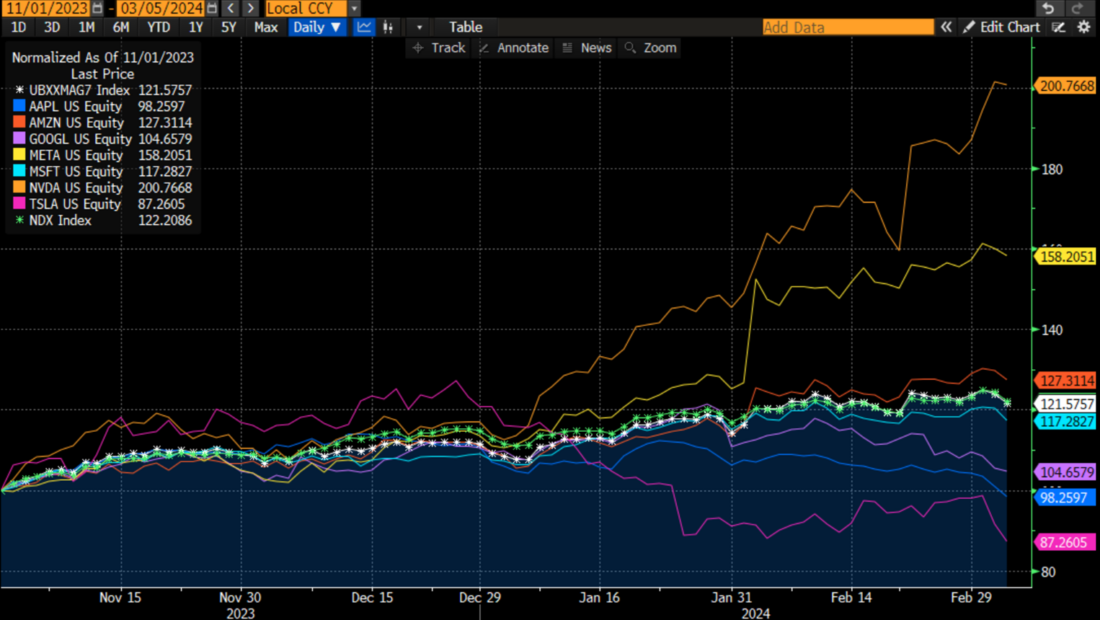

And here it is on a one-year basis:

1-Year Normalized Chart, UBS Mag 7 Index (white), NDX (green), AAPL (blue), AMZN (red), GOOGL (lilac), META (yellow), MSFT (blue), NVDA (orange), TSLA (magenta)

Source: Bloomberg

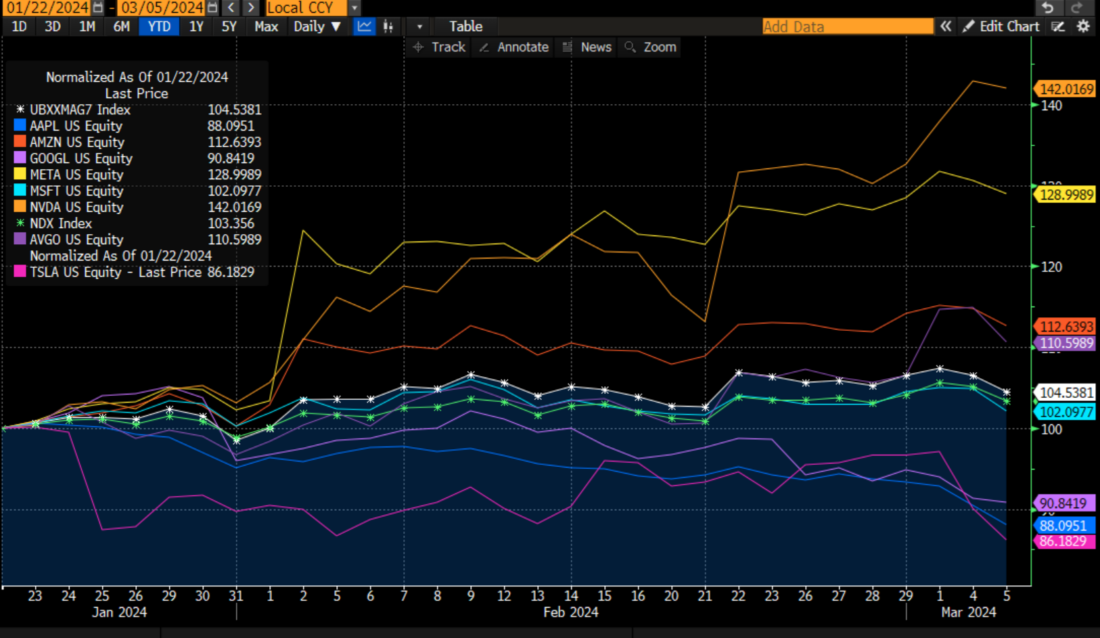

Shortly before Tesla (TSLA) released its last earnings report, we advocated for its removal from the Mag 7, to be replaced by Broadcom (AVGO). Certainly that would have been an improvement, with AVGO rising as TSLA fell in the ensuing period:

Normalized Chart Since January 22nd, 2024, UBS Mag 7 Index (white), NDX (green), AAPL (blue), AMZN (red), GOOGL (lilac), META (yellow), MSFT (blue), NVDA (orange), TSLA (magenta)

Source: Bloomberg

That would have given us an extra outperformer and one less underperformer, but I doubt that would have moved the psychological needle. The Mag 7 is as much about mindshare as it is about market capitalization. Even though AVGO is larger and a recently a better performer than TSLA, only NVDA occupies a bigger mindshare among investors than the latter company.

That’s why I now assert that we should be shrinking the roster of the Mag 7 to either the Big 5[ii] or the Fantastic Four. So what if it narrows the market leadership? No one seems to mind anyway. Starting last spring, we asserted that “It’s Nvidia’s World, We’re Just Living (and Investing) in It”. We can add to the supporting cast with three, six, or however many components we want, but as long as NVDA is leading the parade, the rest of the market is following along.

—

[i] The Big 10 will be adding four more teams later this year, while the Big 12 adds another two.

[ii] A shout-out to Philadelphia-area basketball, even though that unofficial regional group now contains six teams.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

More option strikes were added to NVDA today, going up to $1750 (!!!)

$1600 would give it a valuation of $4 Trillion (!!!!!!!!!!)

At the close of trading today, the Prob.OTM for a Dec24 $1750 call option is 96.10%. I don’t know who makes the odds, I guess it’s someone at Draftkings or Fanduel, or Bet MGM.

My own probability for this to expire worthless is 99.99%.

BUT WHAT DO I KNOW??? The only thing that matters to traders is the direction, and they continue to bet big money at the Wild West AI/Bitcoin casino.

I am confident that the Russell 2000 will be playing catch up and eventually make an all time high in this very incohesive market.