There is no doubt that a Triple Witching Day brings notable price swings. Curious about how to capitalize on this?

Today I will try to unravel the enigma behind this event, its impact on the stock market, and the seasonal nuances accompanying it.

Mark your calendars for the third Friday of every last month in a quarter – March, June, September, and December. This is when Triple Witching unfolds. The term signifies the concurrent expiration of three specific securities: stock index futures, stock index options, and stock options. Interestingly, this phenomenon was previously referred to as the “Triple Witching Hour” — pointing towards the final hour of trading on these Fridays.

Upcoming Triple Witching Days in 2023 & 2024:

Three’s Company: The Dance of Stock Options, Futures, and Index Options

One of the primary implications of a Triple Witching Day is the surge in trading volume and market volatility. Traders and institutional investors scramble to offset, close, or roll over their positions. This leads to frenzied activity and abrupt price movements.

The simultaneous expiration of multiple derivatives can create temporary price inefficiencies. Savvy traders often seek out arbitrage opportunities that arise from price disparities between the underlying assets and their derivatives.

However, derivatives’ expiry isn’t the only thing that happens on the third Friday of every third month of the quarter. Indexes like the S&P, FTSE also adjust their values on this day (with the exception of Nasdaq 100, which does its annual rebalance only on the third Friday in December).

Historically some studies have suggested that Triple Witching Days tend to have a bullish bias, particularly in December. But this could simply be a reflection of the broader “Santa Claus Rally” phenomenon: where stock markets, especially in the US, have historically shown a tendency to rise during the last week of December.

While many investors are focused on Triple Witching Day itself, I decided to analyze a period of several trading days before and after the expiration date.

My primary focus was on understanding the impact on individual stock investments.

When is the right time to bite an Apple?

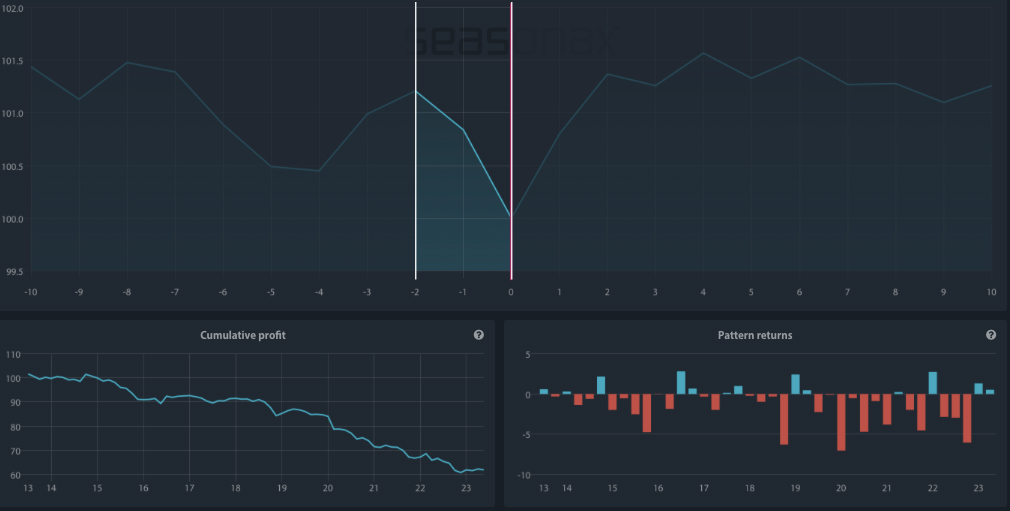

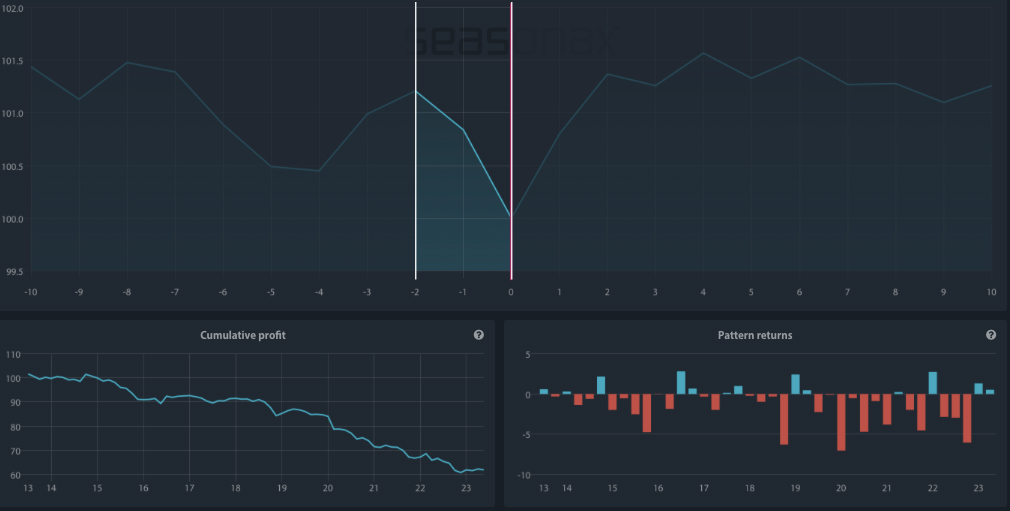

The event chart below shows the average course of Apple in the ten trading days before and after the Triple Witching expiration days.

The chart was calculated over the past ten years, during which there have been 40 Triple Witching Days. The horizontal axis shows the number of trading days before, and after, the event took place. The vertical axis shows the average trend in percent.

The red line marks the day of the event the Triple Witching Day. In this way you can see at a glance what the typical course of Apple share prices look like around the Witching Days.

Average price move of Apple in the 10 days before and after Triple Witching Day

Source: Seasonax – Chart is based on 40 events between 2013 and 2023 . Click here http://tiny.cc/Apple-TripleWitching to access an interactive chart

It’s evident that Apple’s price usually drops two days prior to Triple Witching expiration, with an average decline of 1.20% over these two trading days.

For you as an equity investor, it’s statistically favorable to buy this particular stock close to the end of a Triple Witching Day. You can use this effect as a trader, but also as a long-term investor, to improve your entry timing.

Mind over Market

There’s also a psychological aspect to Triple Witching Day. Some traders tend to be superstitious, believing that these days bring bad luck or are a precursor to unfavorable market shifts. While this might sound irrational, the collective belief can sometimes sway market sentiment and become a self-fulfilling prophecy.

Some of the most turbulent days in the stock market have coincided with Triple Witching, such as in 1992 when sell-offs in IBM, General Motors, and other blue chips led to a significant market decline on a Triple Witching Friday.

While being aware of the price movements around the Triple Witching Day are a great help in improving investment returns, it’s essential to remember that, like all market phenomena, it’s just one of many factors that influence stock prices.

By using the Seasonax Event Feature, you can examine different events reaching from economic data releases, central bank decisions, specific holidays or even the turn of the month effects. Try them out now: www.seasonax.com

—

Originally Posted September 12, 2023 – The Triple Witching Effect: How Witching Days Shape Market Behavior

Disclosure: Seasonax

Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. Seasonax GmbH neither recommends nor approves of any particular financial instrument, group of securities, segment of industry, analysis interval or any particular idea, approach, strategy or attitude nor provides consulting nor brokerage nor asset management services. Seasonax GmbH hereby excludes any explicit or implied trading recommendation, in particular, any promise, implication or guarantee that profits are earned and losses excluded, provided, however, that in case of doubt, these terms shall be interpreted in abroad sense. Any information provided by Seasonax GmbH or on this website or any other kind of data media shall not be construed as any kind of guarantee, warranty or representation, in particular as set forth in a prospectus. Any user is solely responsible for the results or the trading strategy that is created, developed or applied. Indicators, trading strategies and functions provided by seasonax GmbH or on this website or any other kind of data media may contain logical or other errors leading to unexpected results, faulty trading signals and/or substantial losses. Seasonax GmbH neither warrants nor guarantees the accuracy, completeness, quality, adequacy or content of the information provided by it or on this website or any other kind of data media. Any user is obligated to comply with any applicable capital market rules of the applicable jurisdiction. All published content and images on this website or any other kind of data media are protected by copyright. Any duplication, processing, distribution or any form of utilisation beyond the scope of copyright law shall require the prior written consent of the author or authors in question. Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Seasonax and is being posted with its permission. The views expressed in this material are solely those of the author and/or Seasonax and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.