Summary:

- We outline six reasons why U.S. economy can continue to perform, and equities can remain supported. How growth and rate cut expectations evolve will be key to monitor.

- An abundance of fear over recession and reflation continues. Given our outlook, these risks are best played allocating equities over fixed income and cash, with a tilt to US equities.

- We see tactical opportunities in long duration, dividend-payers such as banks, and small caps, and like gold and USD as hedges.

The U.S. economy and S&P 500 surprised positively in 2023, and we begin this year with encouraging signs that tailwinds can continue in the year ahead. We outline six reasons to stay bullish in 2024 despite well-known risks to the economic and market outlook. Indeed, two wars and several major elections are fueling geopolitical uncertainty, inflation rates are still elevated, and interest rates have sharply risen, yet the U.S. economy has proved resilient, and global growth is showing early signs of recovery. Even Canada has performed better than feared lately as the labour market remains supported.

1. U.S. recession fear is still too high.

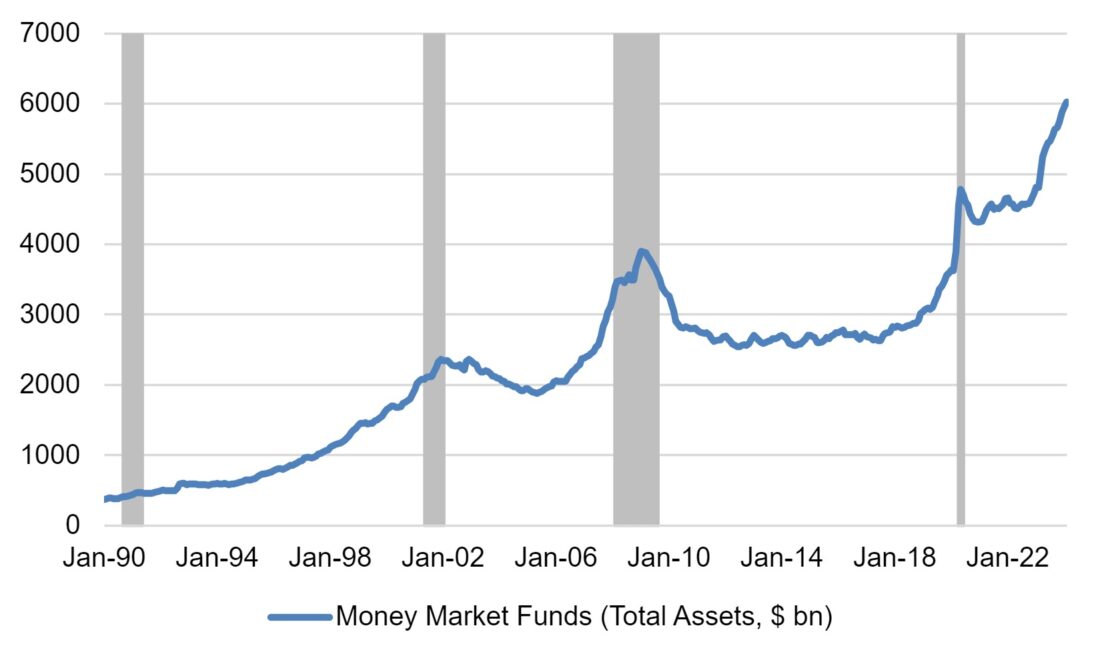

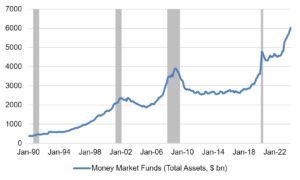

One important reason risk assets rallied in 2023 is because expectations were too bearish. While expectations have improved relative to a year ago, consensus continues to expect weak economic growth. US real GDP growth expected in 24Q1 and 24Q2 remains below 2%, despite a stronger than expected Q4 (3.3%) and current Q1 tracking 2-3%. Consensus recession odds have fallen since a year ago but remain elevated near 40% odds (source: Bloombergopens in new window, WSJopens in new window). Overall, for the past six quarters U.S. growth expectations have been too weak, and modest expectations for 2024 mean there is room for further growth upgrades in coming quarters. Recession fear among investors can explain why cash remains on the sidelines and has yet to be invested (see Figure 1).

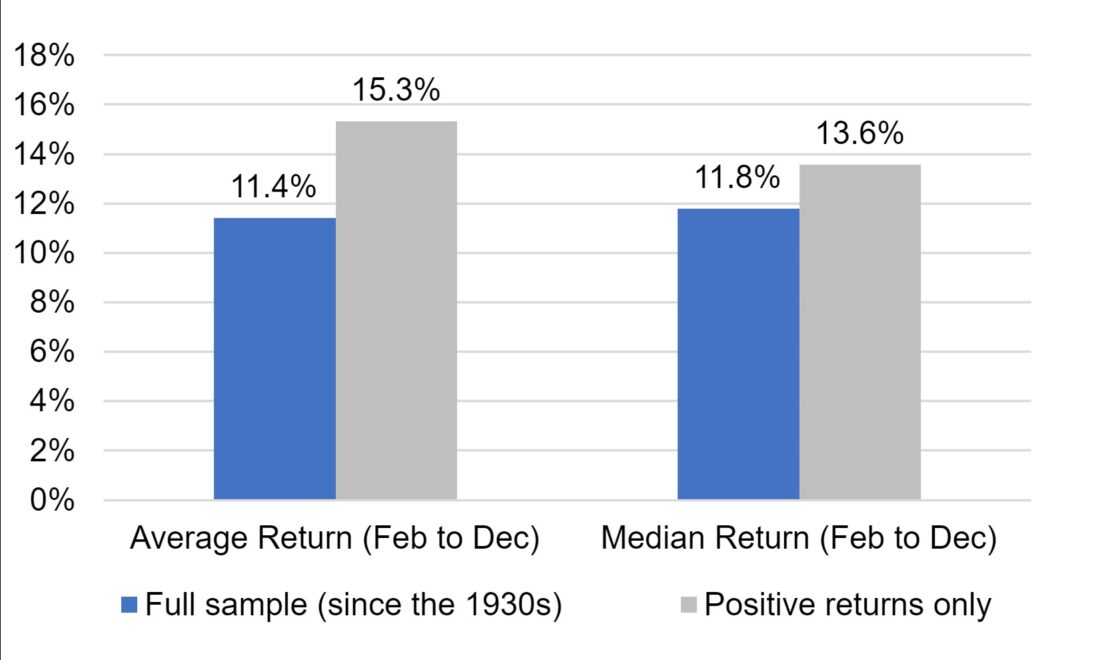

Figure 1: Recession and inflation fears keeping cash on the sidelines

Source: Bloomberg, BMO GAM, February 29, 2024

2. US outperformance is not transitory.

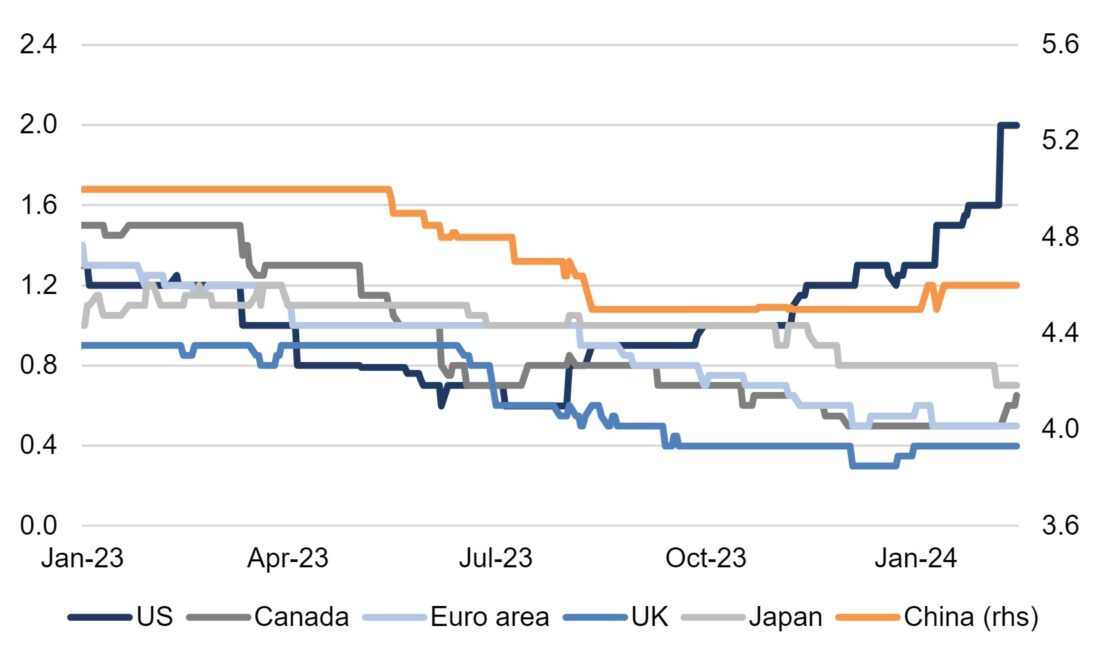

Against still bearish expectations, we expect US outperformance to continue (see Figure 2). Resilience in US growth limits global recession risks by supporting demand, particularly in Canada, Europe, and China, where growth remains weaker but closely tied to US activity.

US consumers still have the healthiest balance sheets and are the least exposed to high interest rates. Layoffs remain low. Fiscal stimulus continues to support business investment. But most importantly, inflation has cooled despite strong growth, and is likely to slow further this year, paving the way for rate cuts. The start of cuts insulates the more vulnerable consumers and businesses while allaying recession fears, supporting capex, and limiting layoffs. Outside the US, there are also signs that growth is bottoming on the back of improving trade flows and business sentiment.

Figure 2: 2024 real GDP growth expectations underpinned by US upgrades

Source: Bloomberg, BMO GAM, February 29, 2024

3. Disinflation trends should continue.

Inflation has failed to reignite despite a tight labor market, strong growth and continued fiscal stimulus in the US. Goods inflation has normalized while services inflation is stickier but also trending lower, likely led by shelter costs this year. Supply chains have played a large role, but rate hikes have also helped cool demand and keep inflation expectations anchored. Fear of a second wave of inflation is overplayed against the current supply-demand backdrop and still tight monetary policy. The 1970s offer a poor comparison but, if anything, tell us that reflation requires a significant commodity shock. That is what we are watching the most. We also note that, unlike commodity-driven inflation, services inflation rhymes with a strong economic backdrop and rising revenues and profits.

4. Don’t fear record highs in the S&P 500 given current fundamentals.

S&P 500 hit a new record on January 19th, 2024, and has risen to more than 10 record highs since. Looking at returns since 1950, after recording a new high S&P 500 returns are positive more than 60% (Source: Bloomberg Terminal, authors calculation, February 29,2024) of the time over 6 and 12 months.

Moreover, equities are a trending, productive asset linked to economic growth, making it difficult to underweight for long-term investors, especially when recessions fail to materialize. In this cycle, fundamentals underpinning recent US equity performance are the end of rate hikes, the potential start of insurance cuts, falling inflation, rising growth expectations, strong breadth, and strong earnings.

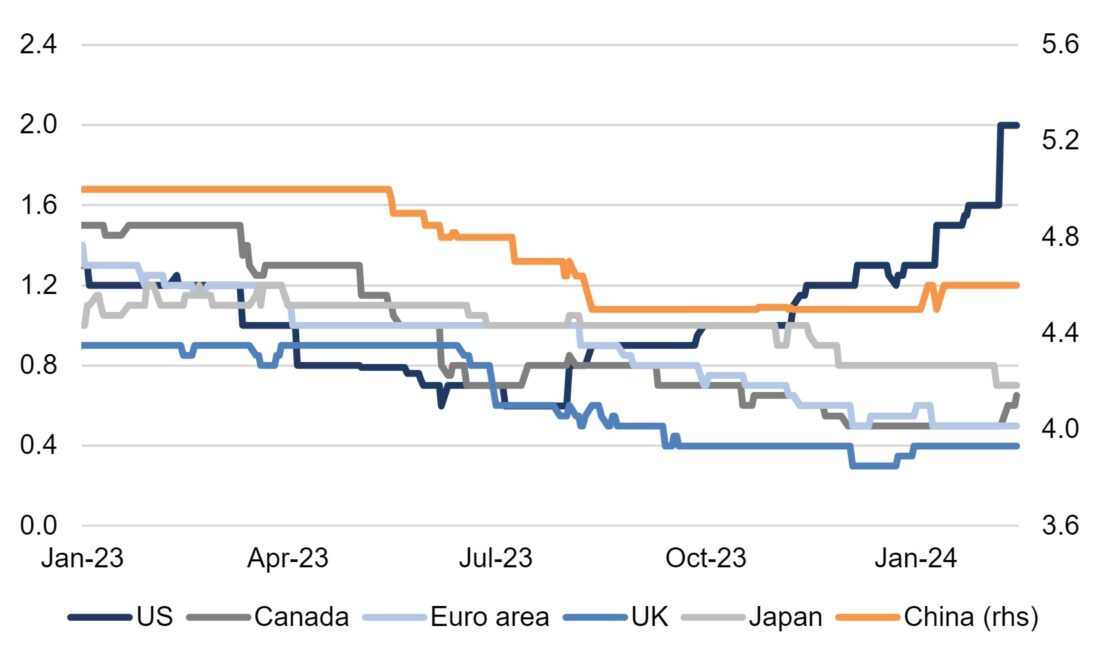

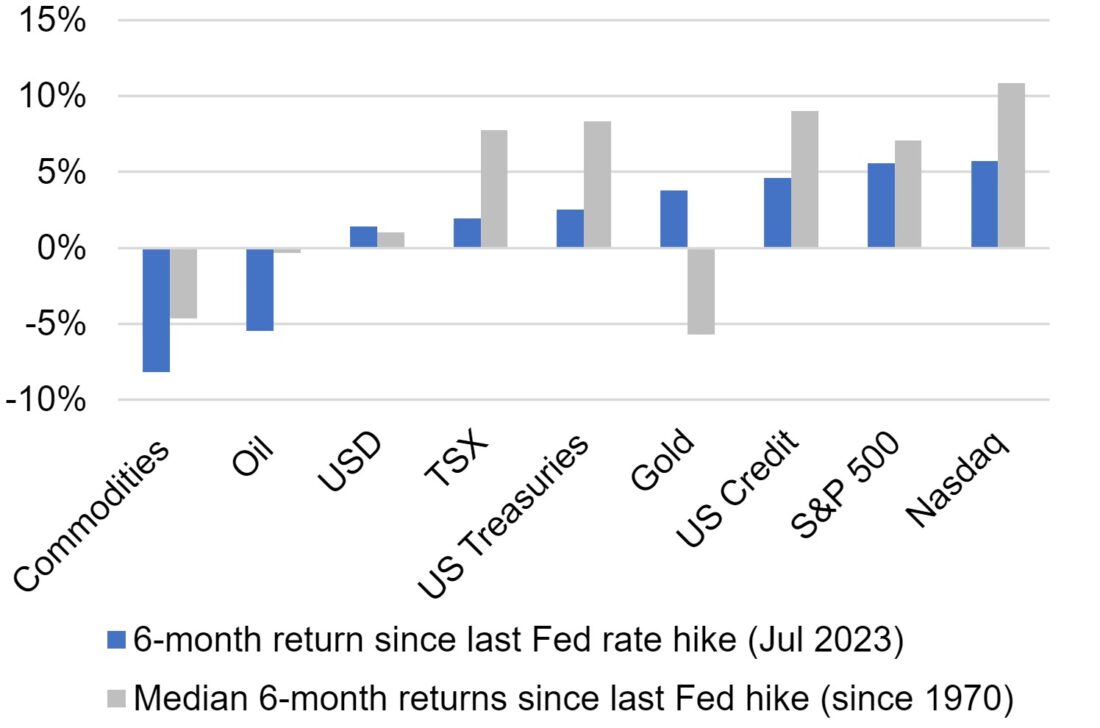

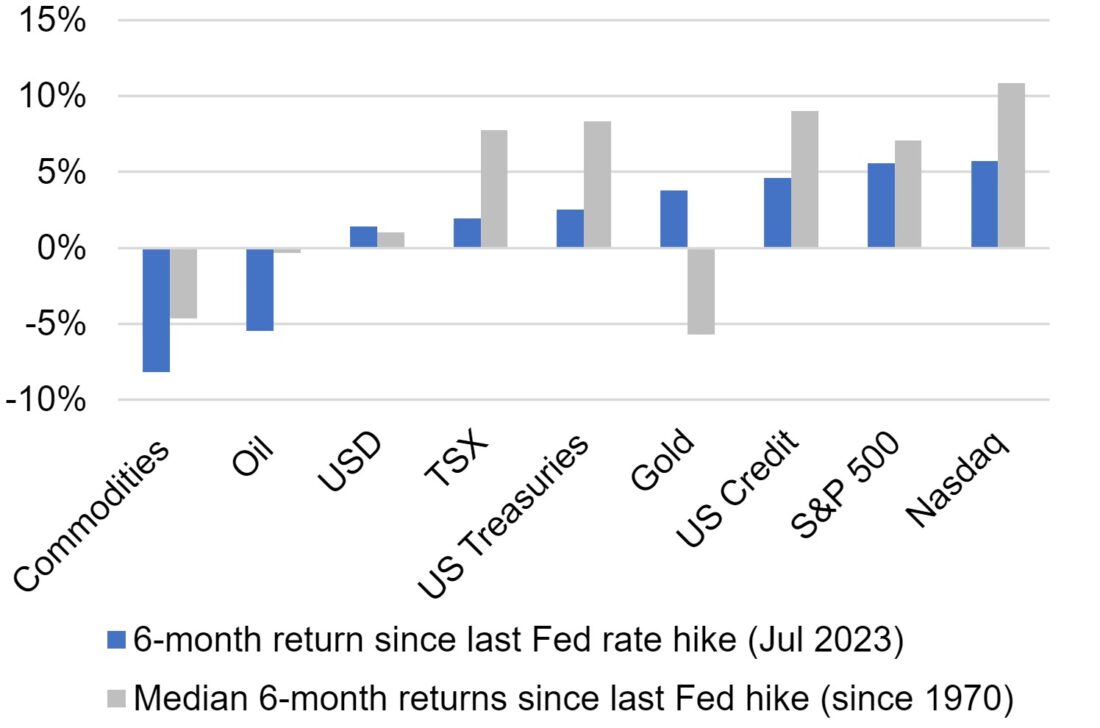

The end of Fed rate hike cycles generally sees a rally in equities (see Figure 3). Since 1970, the S&P 500 returned 7% in the first six months after the last rate hike. Since the Fed’s last hike in July, S&P 500 returned 6% through January, slightly below the median of past cycles. Cross asset performance has been similar as well, with fixed income returns also positive.

Figure 3: Equities usually rally after the end of Fed hikes

Source: Bloomberg, BMO GAM. January 31, 2024.

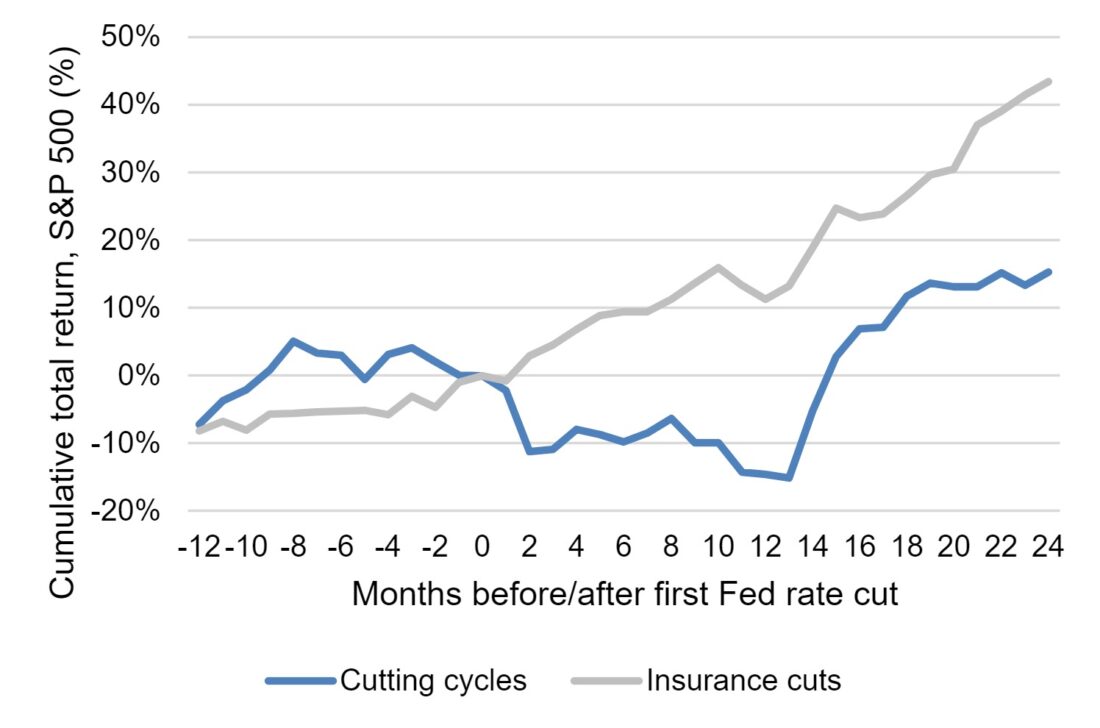

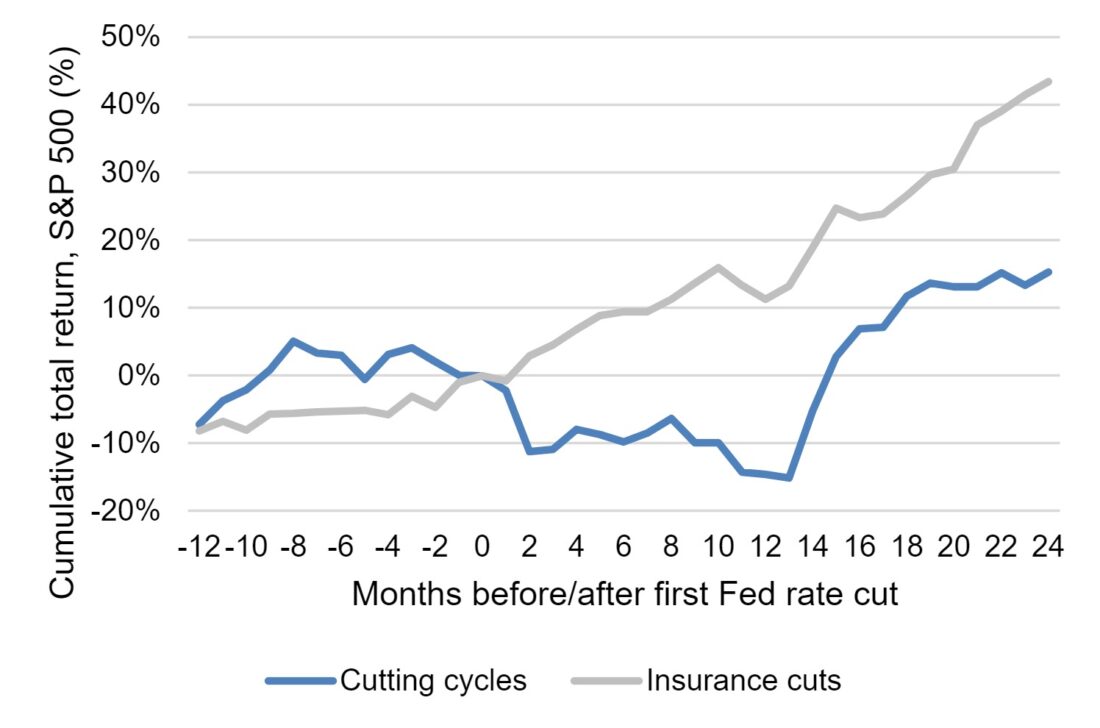

5. Fed insurance cuts are bullish for equity returns.

The Fed usually starts cutting rates within 12 months of the last hike. Insurance cuts (or a limited number of rate cuts motivated by normalization or a growth scare rather than a recession) see positive equity returns during the first two years after the first rate cut (see Figure 4). Unsurprisingly, cutting cycles (or significant cuts in response to a recession) generally don’t see positive returns but equities regain their footing meaningfully after a year. In general, the fewer the rate cuts, the stronger the returns for equities.

This matters because we see greater scope for insurance cuts this year amid resilient growth and falling inflation—a backdrop that is not only positive for earnings expectations, but cushions equity valuations, which are sensitive to inflation shocks.

Figure 4: Insurance cuts are bullish for equities

Source: Bloomberg, BMO GAM, February, 29, 2024.

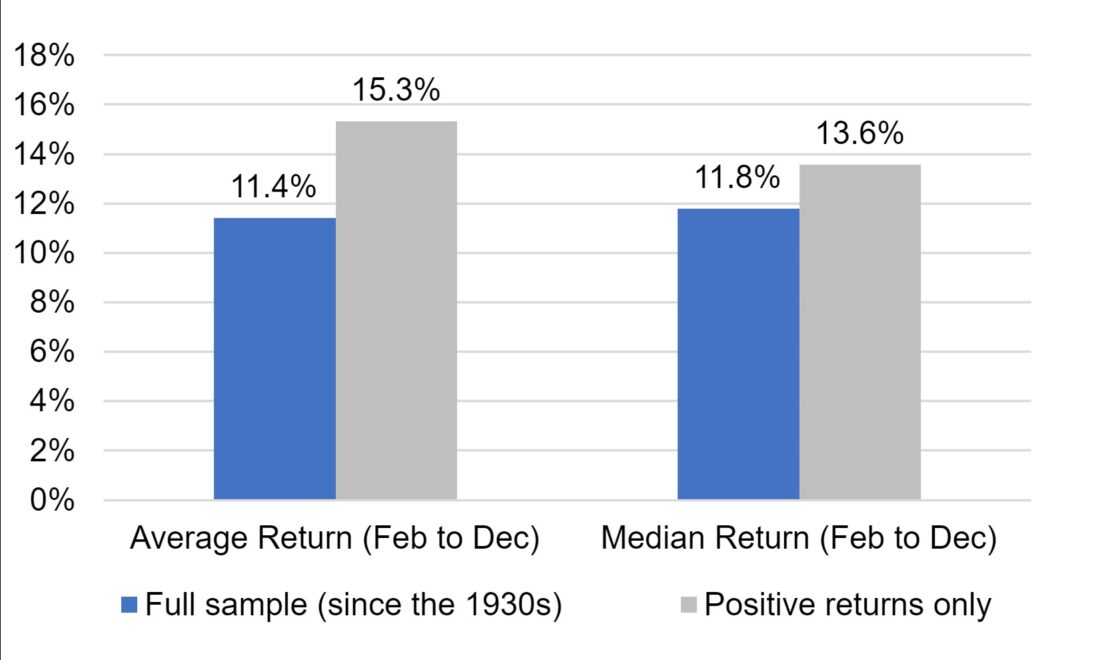

6. Seasonals and US elections support a positive year.

When S&P 500 returns are positive in January, returns are positive for the rest of the year more than 80% of the time since the 1930s, yielding 11% on average (see Figure 5).

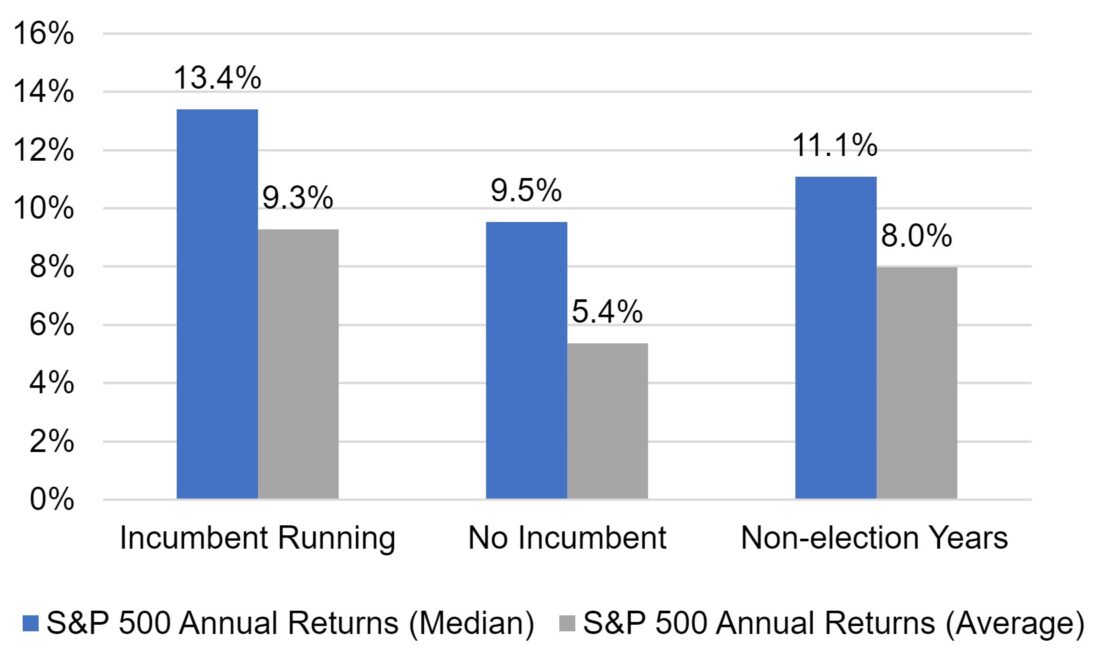

Returns during presidential election years are like those in non-election years, but returns are larger when an incumbent is running (see Figure 6). In 2024, the US election is likely to be a race between two incumbents (Trump and Biden). We note that the track record of both candidates proved to be positive for equity markets in the near term after they were elected.

Figure 5: S&P 500 annual performance when January returns are positive

Source: Bloomberg, BMO GAM, February, 29, 2024.

Figure 6: Stronger returns during years of incumbent elections

Source: Bloomberg, BMO GAM, February, 29, 2024.

Summary: Overcoming the tall wall of worry

The six points above are supportive of risk assets, and we think these forces could continue despite an abundance of fear. The resilient US economic outlook could support further outperformance of equities over fixed income and cash and continue to favor US equities. We see tactical opportunities in long duration1 and a potential rotation to dividend payers, banks, and small caps, i.e., equities most sensitive to recession fear and rates risk. Gold and USD are ideal hedges. Both outperform in recession and reflation scenarios but can also perform in our more optimistic scenario.

—

Originally Posted March 18, 2024 – The Underappreciated Bullish Case for 2024

1 Duration: A measure of the sensitivity of the price of a fixed income investment to a change in interest rates. Duration is expressed as number of years. The price of a bond with a longer duration would be expected to rise (fall) more than the price of a bond with lower duration when interest rates fall (rise).↩

Disclosure: BMO Exchange Traded Funds

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

®/™Registered trade-marks/trade-mark of Bank of Montreal, used under licence.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from BMO Exchange Traded Funds and is being posted with its permission. The views expressed in this material are solely those of the author and/or BMO Exchange Traded Funds and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.