Tech stocks for your stock market watchlist today.

The tech industry is like the heartbeat of our modern world, powering everything from our phones to our cars. Think of big names like Apple (NASDAQ: AAPL), Google (NASDAQ: GOOGL), and Microsoft (NASDAQ: MSFT); they’re all giants in this sector. This industry is about creating new technology or improving existing ones to make our lives easier and more connected.

Now, when we talk about tech stocks, we’re referring to shares you can buy in tech companies. When you buy a stock, you’re buying a small piece of that company. If the company does well, the value of your piece might go up. Tech stocks have been especially popular because many of these companies grow super fast, which can lead to big profits for investors.

However, buying tech stocks isn’t a surefire way to make money. Just like any other investment, there are risks. Not every tech company becomes the next Apple or Google. Some might face challenges or even fail. That’s why it’s always important to do your homework. Given this, here are two tech stocks to watch in the stock market right now.

Tech Stocks To Watch In August 2023

- Palantir Technologies Inc. (NYSE: PLTR)

- Snowflake Inc. (NYSE: SNOW)

Palantir Technologies (PLTR Stock)

First up, Palantir Technologies (PLTR) is a software company that specializes in big data analytics. The company has developed platforms like Palantir Gotham and Palantir Foundry that help organizations analyze vast amounts of data. Used by government agencies, financial institutions, and many other sectors, Palantir’s tools aid in making sense of complex datasets.

Just this week, Palantir Technologies announced its second quarter of 2023 financial results. Specifically, for Q2 2023, Palantir reported earnings of $0.05 per share, with revenue of $533.32 million. This is in comparison to Wall Street’s consensus estimates which were earnings of $0.05 per share, and revenue estimates of $530.63 million. Additionally, revenue increased by 12.75% versus the same period, the previous year. What’s more, Palantir said it estimates Q3 2023 revenue to come in between $533.0 million to $557.0 million.

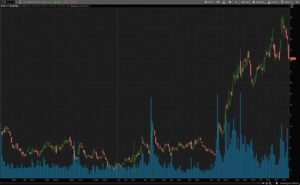

Year-to-date, shares of PLTR stock have risen by 154.62% so far. Though, following this most recent earnings release during Tuesday morning’s trading action, Palantir stock has fallen by 9.56% trading at $16.27 a share.

Source: TD Ameritrade TOS

Snowflake (SNOW Stock)

Snowflake (SNOW) is a cloud-based data warehousing company. Its platform allows businesses to manage and analyze large volumes of data effortlessly. With its unique architecture, Snowflake separates the storage, processing, and consumption layers, enabling scalability and performance.

At the end of last month, Snowflake announced when it will be releasing its Q2 2024 financial results. Diving in, the company reported that its set to release its financial and operating results for the second quarter of fiscal year 2024 after the close of the U.S. markets on Wednesday, August 23, 2023.

In 2023 so far, shares of SNOW stock are up by 18.30% year-to-date. Meanwhile, during Tuesday morning’s trading action, Snowflake stock is trading lower off the open by 3.82% at $160.30 a share.

Source: TD Ameritrade TOS

—

Originally Posted August 8, 2023 – What Stocks To Consider Today? 2 Tech Stocks For Your Watchlist

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from StockMarket.com and is being posted with its permission. The views expressed in this material are solely those of the author and/or StockMarket.com and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.