Silver-white, light, and highly reactive, lithium might not be the most famous element on the periodic table, but it is definitely one of the most influential at present in shaping our modern world. As the crucial ingredient of lithium-ion batteries, that power everything from your smartphone to electric vehicles (EVs), lithium has gained the status of the “white gold” of the 21st century.

In 2022, the global supply for lithium reached an 737,000 tons, marking a significant jump from the previous years. Yet, with projections suggesting the production could reach 964,000 tons in 2023 and a whopping 1.17 million tons by 2024, the lithium rush is far from over.

The Lithium Rush: It’s Electrifying!

What’s driving this lithium craze? In one word: electrification. As nations around the globe commit to a greener future, replacing gas-guzzling cars with electric ones, and powering grids with renewable energy, the demand for lithium batteries has gone through the roof.

Investors too can join the lithium rush by trading in the stock market. With nations like Australia, China and Chile already securing their front seats, there are plenty of investment opportunities to consider. One of the world’s largest Chilean lithium producers is Sociedad Química y Minera de Chile (SQM). When it’s not busy producing lithium, SQM also churns out plant nutrients, iodine, and other industrial chemicals.

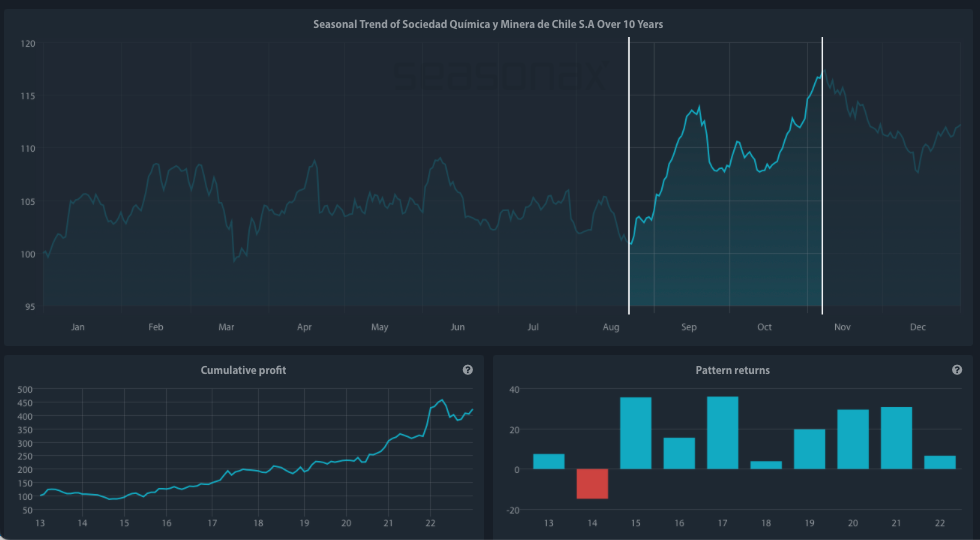

This “Lithium Giant” exhibits a strong seasonal period that has historically begun August 22 and has lasted until November 7. Over the past decade, during this time span, SQM has a marked notable average gain of 15.99%. Additionally, the pattern returns have recorded a 90% positive streak since 2013, piquing the interest of potential buyers.

Seasonal Chart of Sociedad Química y Minera de Chile over the past 10 years

Source: Seasonax – Click the link below to access an interactive chart.

Keep in mind that a seasonal chart depicts the average price pattern of a specific asset in the course of a calendar year, calculated over several years (unlike a standard price chart that simply shows prices over a specific time period). The horizontal axis depicts the time of the year, while the vertical axis shows the % change in the price (indexed to 100). The prices reflect end of day prices and do not include daily price fluctuations.

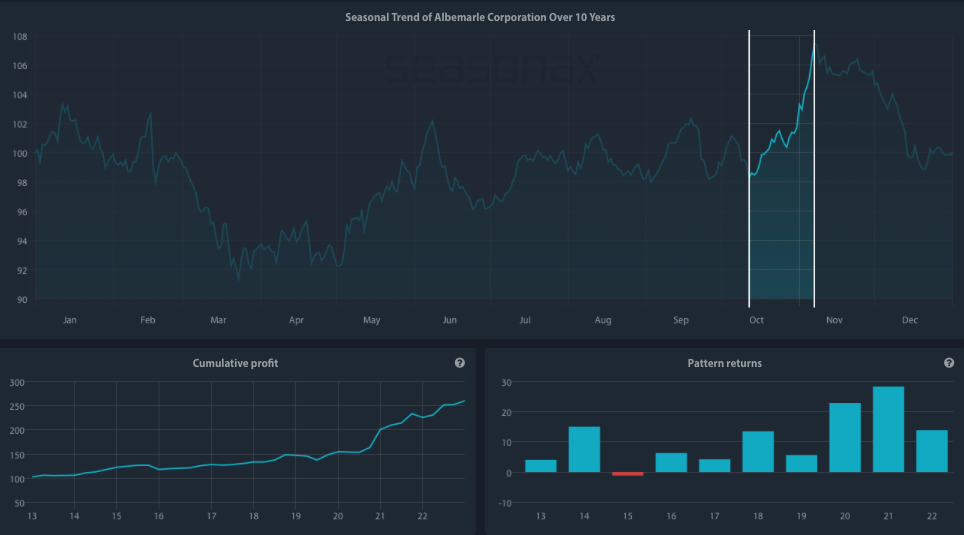

Another key player in the lithium industry is the Albemarle Corporation (ALB). Based in the United States, Albemarle proudly holds the title of the world’s largest lithium producer, making it an influential force in the lithium market. A substantial part of Albemarle’s lithium is used in the production of lithium-ion batteries for EVs. With the global push for electric mobility and renewable energy, the need for lithium has skyrocketed, and Albemarle has risen to the challenge.

Seasonal Chart of Albemarle Corporation over the past 10 years

Source: Seasonax – Click the link below to access an interactive chart.

http://tiny.cc/Seasonax-Albemarle

A quick look at the seasonal chart above is enough to see substantial peaks during May and October. What is even more astonishing is that this lithium producer has been delivering results like clockwork. For a decade, it has boasted an impressive 11% climb within a mere 19 trading days between October 12 and November 7. But it’s important to mention the cautionary note that one should never forget the primary rule of investment: past performance is not indicative of future results.

However, the significance of these recurring peaks cannot be discounted. They might be attributed to a variety of factors – seasonal buying trends, strategic business moves, or even simply the return of traders from their summer hiatus.

The Future of Lithium

As we move towards a more sustainable future, the importance of lithium will only increase. With electric vehicles and renewable energy storage poised to dominate in the coming years, it’s safe to say that the future will indeed be powered by lithium.

It is also crucial to spotlight those market participants who, despite not being directly engaged in lithium mining or production, still play a considerable role in the lithium market due to their extensive use of lithium-ion batteries. A notable example is that these batteries power a wide range of Apple’s devices, including iPhones, iPads, MacBooks, and Apple Watches.

Tesla, Inc. is another illustrative example of this phenomenon. As the numero uno in the EV industry, Tesla’s lithium needs are formidable, influencing lithium prices worldwide. Not just a consumer, Tesla has been dipping its toes in lithium supply, signing agreements with mining companies and exploring lithium extraction from its property in Nevada. One thing is clear – in the race towards a greener future, lithium is leading the charge.

Wherever you decide to invest into the lithium industry directly or indirectly, be sure to leverage Seasonax to identify the optimal entry and exit points based on recurring patterns. When you sign up for free at www.seasonax.com, you can access over 25,000 instruments, encompassing various sectors, stocks, (crypto)currencies, commodities, and indices.

Remember, don’t just trade it, Seasonax it!

—

Originally Posted July 18, 2023 – White Gold Fever: Riding the Lithium Wave in the Stock Market

Disclosure: Seasonax

Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. Seasonax GmbH neither recommends nor approves of any particular financial instrument, group of securities, segment of industry, analysis interval or any particular idea, approach, strategy or attitude nor provides consulting nor brokerage nor asset management services. Seasonax GmbH hereby excludes any explicit or implied trading recommendation, in particular, any promise, implication or guarantee that profits are earned and losses excluded, provided, however, that in case of doubt, these terms shall be interpreted in abroad sense. Any information provided by Seasonax GmbH or on this website or any other kind of data media shall not be construed as any kind of guarantee, warranty or representation, in particular as set forth in a prospectus. Any user is solely responsible for the results or the trading strategy that is created, developed or applied. Indicators, trading strategies and functions provided by seasonax GmbH or on this website or any other kind of data media may contain logical or other errors leading to unexpected results, faulty trading signals and/or substantial losses. Seasonax GmbH neither warrants nor guarantees the accuracy, completeness, quality, adequacy or content of the information provided by it or on this website or any other kind of data media. Any user is obligated to comply with any applicable capital market rules of the applicable jurisdiction. All published content and images on this website or any other kind of data media are protected by copyright. Any duplication, processing, distribution or any form of utilisation beyond the scope of copyright law shall require the prior written consent of the author or authors in question. Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Seasonax and is being posted with its permission. The views expressed in this material are solely those of the author and/or Seasonax and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.