- The LERI shows corporate uncertainty increasing to its highest level since the pandemic, in line with what CEOs have been sharing on Q3 calls

- This week 1,695 companies are expected to report for Q3, 160 from the S&P 500

- Potential Surprises this week: Whirlpool Corp. (WHR)

- Peak weeks for Q3 season run from October 23 – November 10

Majority of S&P 500 Companies Beating Expectations this Quarter, but Commentary Remains Cautious

Tempered sentiment on Q3 earnings calls continued last week from some of the remaining big banks, Tesla and airlines, despite overall earnings coming in better than expected for many large cap companies. Thus far 73% of S&P 500 companies have beat earnings estimates.1

Bank of America (NYSE: BAC), for example, beat expectations on the top and bottom-line,2 but noted the softening economic environment. CEO Brian Moynihan commented in the earnings release, “We added clients and accounts across all lines of business.” “We did this in a healthy but slowing economy that saw U.S. consumer spending still ahead of last year but continuing to slow.”3

Investment banking behemoth, Goldman Sachs (NYSE:GS), was also able to eke out better-than-expected results on earnings and revenues, despite investment banking fees that fell slightly YoY ($1.554B in Q3 2023 vs. $1.576B in Q3 2022) due to stagnant dealmaking. CEO David Solomon commented on the call “I’m still of the belief that there’s been a lag with this tightening, and across a broad swath of the economy we will see more sluggishness.” “That doesn’t necessarily mean it has to be a recession,” he said.4

Continued concerns around the high interest rate environment impacting consumer spending resounded from other sectors as well, specifically within the discretionary space. Declining YoY profits from Tesla (NASDAQ:TSLA) and Winnebago (NYSE: WGO) pointed to a US consumer that is starting to hold back on large ticket purchases. Tesla CEO Elon Musk said: “I’m worried about the high interest rate environment we’re in,” and said people buying cars are focused on how much their monthly payments will be. “If interest rates remain high or if they go even higher, it’s that much harder for people to buy the car.”5 Similarly, Winnebago CEO Michael Happe said “the consumer market continues to be challenged, and our fourth quarter results reflect a stubborn retail environment.”6 He noted that even price increases weren’t enough to offset weak demand.

Investor’s will be looking for similar commentary from big tech this week as Q3 peak earnings season kicks into high gear. Currently S&P 500 earnings per share (EPS) growth stands at 0.4%, showing a slight improvement over the year ago period.7

Heading into Peak Earnings Season, US CEOs the Most Uncertain They’ve Been Since the COVID-19 Pandemic

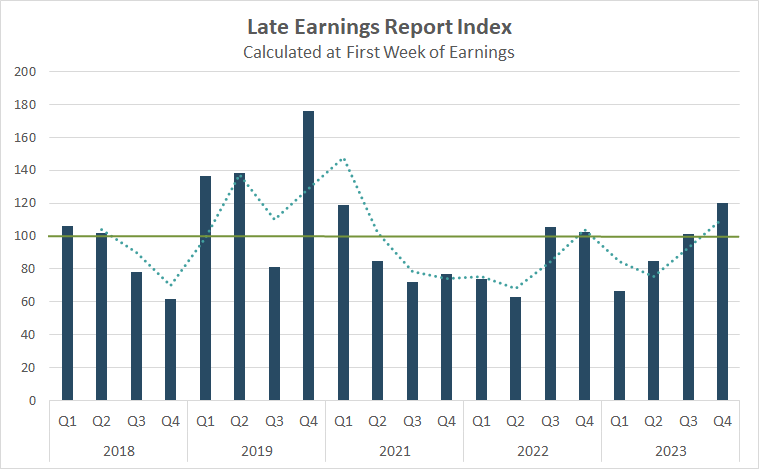

Just as we enter the busiest weeks for the Q3 earnings season, the most recent reading of the Late Earnings Report Index (LERI) shows that more companies are delaying earnings reports than advancing them.

The Late Earnings Report Index tracks outlier earnings date changes among publicly traded companies with market capitalizations of $250M and higher. The LERI has a baseline reading of 100, anything above that indicates companies are feeling uncertain about their current and short-term prospects. A LERI reading under 100 suggests companies feel they have a pretty good crystal ball for the near-term.

The current pre-peak season LERI reading stands at 120, the highest reading since the COVID-19 pandemic. As of October 18, there were 65 late outliers and 49 early outliers. Typically, the number of late outliers trends upwards as earnings season continues, indicating that the LERI is poised to get even worse from here as corporations try to figure out what a barrage of economic headwinds mean for their bottom-line in Q4.

Academic research shows when a corporation reports earnings later in the quarter than they have historically, it typically signals bad news to come on the conference call, and the reverse is true, an early earnings date suggests good news will be shared.8

Source: Wall Street Horizon

Earnings on Deck – Week of Oct 23, 2023

Peak earnings season kicks off this week with expected earnings releases from 1,695 publicly traded companies (out of our universe of 10,000), with 160 of those coming from S&P 500 companies. Big tech will be in focus with results from Meta Platforms (NASDAQ:META) and International Business Machines (NASDAQ: IBM) on Wednesday, and Amazon (NASDAQ:AMZN) and Intel (NASDAQ:INTC) on Thursday.

Potential Surprises This Week

This week we get results from a number of large companies on major indexes that have pushed their Q3 2023 earnings dates outside of their historical norms. Six companies within the S&P 500 confirmed outlier earnings dates for this week, four of which are earlier than usual and therefore have positive DateBreaks Factors*. Those four names are Equinix Inc. (NASDAQ:EQIX), CenterPoint Energy Inc. (NYSE:CNP), Vulcan Materials Co. (NYSE:VMC) and American Tower Corp. (NYSE:AMT). According to academic research9, the earlier than usual earnings dates suggest these companies will report “good news” on their upcoming calls. Dover Corp (NYSE:DOV) and Whirlpool Corp (NYSE:WHR) confirmed later than usual dates, suggesting they will report “bad news” on their upcoming calls.

Whirlpool Corp (NYSE:WHR)

Company Confirmed Report Date: Monday, October 23, BMO

Projected Report Date (based on historical data): Wednesday, October 25, BMO

DateBreaks Factor: -2*

Whirlpool is set to report Q3 2023 results on Wednesday, October 25. While this is only two days later than expected, this would be the latest the company has reported Q3 results since 2016.

Academic research10 shows when a corporation reports earnings later than they have historically, it typically signals bad news to come on the conference call. Last quarter Whirlpool missed revenue expectations and reported their sixth YoY decline as demand for appliances softened.11 Cooling consumer sentiment due to inflation and increasing interest rates, with the addition of an unfavorable currency impact due to the stronger dollar, will likely remain a headwind for Whirlpool heading into the new year.

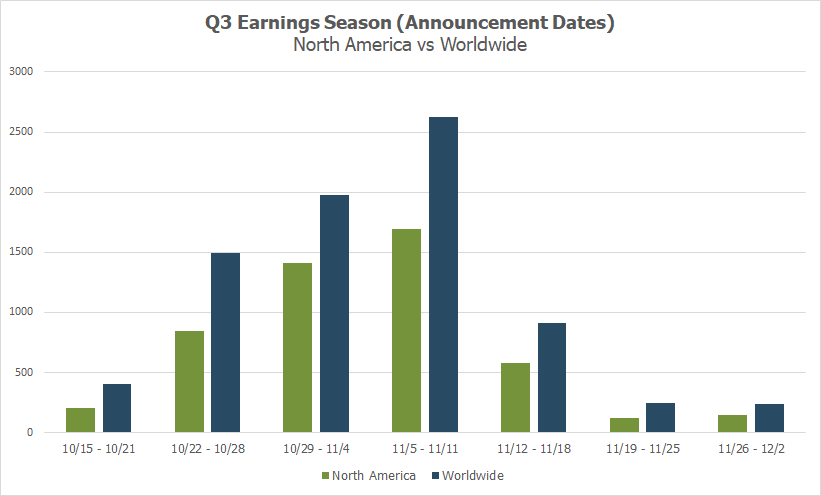

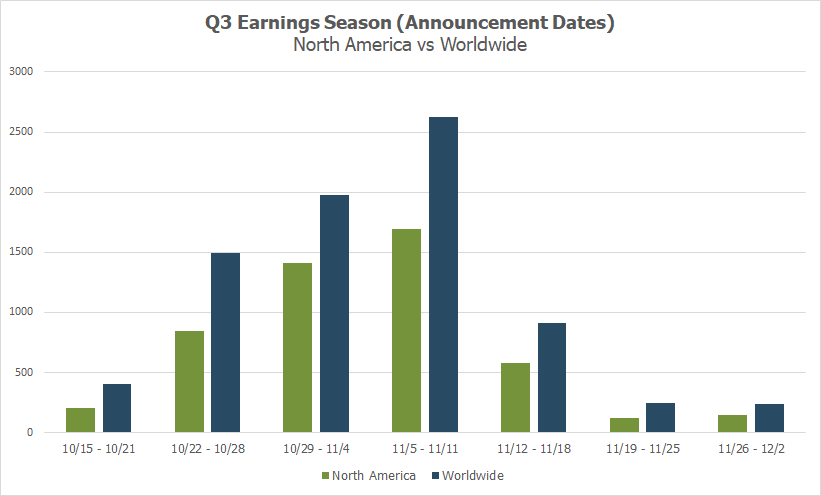

Q3 Earnings Wave

This season peak weeks will fall between October 23 – November 10, with each week expected to see nearly 2,000 reports or more. Currently November 9 is predicted to be the most active day with 1,121 companies anticipated to report. Thus far 63% of companies have confirmed their earnings date (out of our universe of 9,500+ global names), with 6% reporting. The remaining dates are estimated based on historical reporting data.

Source: Wall Street Horizon

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company’s 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

1 Earnings Insight, FactSet, John Butters, October 20, 2023,https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_102023A.pdf

2 Bank of America tops profit estimates on better-than-expected interest income, CNBC, Hugh Son, October 19, 2023,https://www.cnbc.com/2023/10/17/bank-of-america-bac-earnings-3q-2023.html

3 Bank of America Q3 Report, Bank of America, October 19, 2023,https://d1io3yog0oux5.cloudfront.net/_50da6093ff0ec0586ab9fdb5d4eee952/bankofamerica/db/806/9961/earnings_release/The+Press+Release_3Q23.pdf

4Goldman Sachs Conference Call on 2023 Third Quarter Results, Goldman Sachs, October 17, 2023,https://www.goldmansachs.com/investor-relations/presentations/2023/broadcast-third-quarter-2023.html

5 Tesla, Inc. Q3 2023 Financial Results and Q&A Webcast, Tesla, Inc., October 18, 2023,https://ir.tesla.com/webcast-2023-10-18

6 Winnebago Industries Reports Fourth Quarter and Full Year Fiscal 2023 Results, Winnebago Industries, October 18, 2023,https://winnebago.gcs-web.com/news-releases/news-release-details/winnebago-industries-reports-fourth-quarter-and-full-year-fiscal

7 Earnings Insight, FactSet, John Butters, October 20, 2023,https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_102023A.pdf

8 Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec, 2018,https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2480662

9 Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec, 2018,https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2480662

10 Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec, 2018,https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2480662

11 Whirlpool Corp. Q2 2023 Earnings Call, Whirlpool Corp., July 25, 2023,https://s202.q4cdn.com/229739679/files/doc_financials/2023/q2/Q2-2023-Earnings-Call-Transcript.pdf

—

Originally Posted October 23, 2023 – Will Q3 Be a Trick or Treat for Investors As Peak Season Begins?

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.