The Jetsons, a beloved animated series from the 1960s, captured the imagination of audiences with its futuristic vision of a world filled with flying cars, robotic helpers, and space-age technology. One of the most iconic elements of the show was the flying car, which symbolised humanity’s enduring fascination with the idea of taking to the skies. The Jetsons’ flying car represented the ultimate realisation of the dream of living in a world where we could effortlessly soar above traffic and congestion, experiencing a new dimension of mobility and adventure.

While we may not yet have flying cars in the same way the show envisioned, Joby Aviation’s electric vertical take-off and landing (eVTOL) aircraft is quickly taking us to a place where we might be able to keep up with the Jetsons.

Joby’s eVTOL

The eVTOL is an aircraft that looks like a cross between a drone and a helicopter. According to Joby Aviation, it is a faster, cleaner, and smarter way to carry people through their lives. As an aerial ridesharing service, the aircraft will transport passengers from Downtown New York City to JFK Airport in just 7 minutes, in contrast to a car, which can take up to 49 minutes, assuming optimal conditions and no traffic1.

The eVTOL offers numerous additional benefits as well. Its vertical take-off and landing capability enables it to access urban locations more easily. Powered by electric motors running on lithium-ion batteries, like an electric vehicle, it produces zero operating emissions and flies quietly. It is also fast and can achieve a maximum speed of 200 miles per hour. And, as Joby Aviation states, it can accommodate one pilot and up to four passengers, making the experience of flying in it more akin to getting into an SUV than boarding a plane.

Your flying taxi has arrived

In June 2023, Joby Aviation received a Special Airworthiness Certificate by the US Federal Aviation Administration (FAA) for its first production prototype built at its Pilot Production Line in Marina, California, marking a significant milestone. This certificate allows the company to begin flight testing its first production prototype. This aircraft is expected to become the first-ever eVTOL delivered to a customer when it moves to Edwards Air Force Base in 2024 as part of a US Air Force contract. Joby, with substantial support from strategic partner Toyota, is progressing toward FAA certification and large-scale production. This achievement represents a major step in their journey towards sustainable aviation, with plans to begin commercial passenger operations in 2025 and a recent partnership with Delta Air Lines to offer emissions-free travel2.

For the average person, the cost of riding an eVTOL vs calling an Uber will also be an important factor when deciding whether taking to the skies is feasible. In 2021, Joby founder and CEO JoeBen Bevirt told The Washington Post that the company hopes to begin services at an average price of around $3 per mile – comparable to a taxi or Uber – and eventually move to below $1 per mile.

Decarbonising aviation

At WisdomTree, we believe that eVTOLs represent a crucial component in the exciting array of technologies contributing to aviation decarbonisation. Larger aircraft are increasingly turning to sustainable jet fuel to significantly reduce emissions while maintaining their reliance on internal combustion engines. Hydrogen is also emerging as a viable future aviation fuel, with Airbus planning to test a hydrogen engine on an A380 as early as 2026. Battery-powered flight is expected to make smaller planes airborne. The success of Joby Aviation and other companies involved in eVTOL development will likely inspire additional companies seeking to electrify their aircraft.

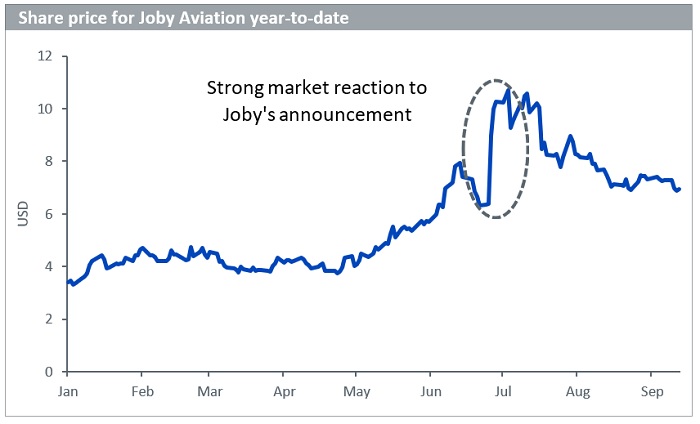

Source: WisdomTree, Bloomberg, data as of 14 September 2023. Historical performance is not an indication of future performance and any investments may go down in value.

At WisdomTree, we view the electrification of aviation as an exciting subsector within the battery value chain. Emerging technologies, especially those that capture the public’s imagination, can go through hype cycles. In June 2023, when Joby Aviation announced that it had received the FAA’s permit to fly its prototype, the share price immediately surged. Naturally, the share price has since stabilised but continues to show robust year-to-date growth. In a year dominated by headlines about Nvidia and artificial intelligence, Joby Aviation’s 107% year-to-date return (as of 14 September 2023) might have flown under the radar. Nevertheless, it underscores the potential of emerging players in the technology world.

Joby is yet to deliver its eVTOLs to customers and, understandably, has not yet achieved positive earnings. All that lies ahead. For now, it’s time to fasten your seatbelts.

Sources

1 Joby Aviation, September 2023.

2 Joby Aviation’s press release on 28 June 2023.

—

IMPORTANT INFORMATION

Marketing communications issued in the European Economic Area (“EEA”): This document has been issued and approved by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Marketing communications issued in jurisdictions outside of the EEA: This document has been issued and approved by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

WisdomTree Ireland Limited and WisdomTree UK Limited are each referred to as “WisdomTree” (as applicable). Our Conflicts of Interest Policy and Inventory are available on request.

For professional clients only. Past performance is not a reliable indicator of future performance. Any historical performance included in this document may be based on back testing. Back testing is the process of evaluating an investment strategy by applying it to historical data to simulate what the performance of such strategy would have been. Back tested performance is purely hypothetical and is provided in this document solely for informational purposes. Back tested data does not represent actual performance and should not be interpreted as an indication of actual or future performance. The value of any investment may be affected by exchange rate movements. Any decision to invest should be based on the information contained in the appropriate prospectus and after seeking independent investment, tax and legal advice. These products may not be available in your market or suitable for you. The content of this document does not constitute investment advice nor an offer for sale nor a solicitation of an offer to buy any product or make any investment.

An investment in exchange-traded products (“ETPs”) is dependent on the performance of the underlying index, less costs, but it is not expected to match that performance precisely. ETPs involve numerous risks including among others, general market risks relating to the relevant underlying index, credit risks on the provider of index swaps utilised in the ETP, exchange rate risks, interest rate risks, inflationary risks, liquidity risks and legal and regulatory risks.

The information contained in this document is not, and under no circumstances is to be construed as, an advertisement or any other step in furtherance of a public offering of shares in the United States or any province or territory thereof, where none of the issuers or their products are authorised or registered for distribution and where no prospectus of any of the issuers has been filed with any securities commission or regulatory authority. No document or information in this document should be taken, transmitted or distributed (directly or indirectly) into the United States. None of the issuers, nor any securities issued by them, have been or will be registered under the United States Securities Act of 1933 or the Investment Company Act of 1940 or qualified under any applicable state securities statutes.

This document may contain independent market commentary prepared by WisdomTree based on publicly available information. Although WisdomTree endeavours to ensure the accuracy of the content in this document, WisdomTree does not warrant or guarantee its accuracy or correctness. Any third party data providers used to source the information in this document make no warranties or representation of any kind relating to such data. Where WisdomTree has expressed its own opinions related to product or market activity, these views may change. Neither WisdomTree, nor any affiliate, nor any of their respective officers, directors, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this document or its contents.

This document may contain forward looking statements including statements regarding our belief or current expectations with regards to the performance of certain assets classes and/or sectors. Forward looking statements are subject to certain risks, uncertainties and assumptions. There can be no assurance that such statements will be accurate and actual results could differ materially from those anticipated in such statements. WisdomTree strongly recommends that you do not place undue reliance on these forward-looking statements.

WisdomTree Issuer ICAV

The products discussed in this document are issued by WisdomTree Issuer ICAV (“WT Issuer”). WT Issuer is an umbrella investment company with variable capital having segregated liability between its funds organised under the laws of Ireland as an Irish Collective Asset-management Vehicle and authorised by the Central Bank of Ireland (“CBI”). WT Issuer is organised as an Undertaking for Collective Investment in Transferable Securities (“UCITS”) under the laws of Ireland and shall issue a separate class of shares (“Shares”) representing each fund. Investors should read the prospectus of WT Issuer (“WT Prospectus”) before investing and should refer to the section of the WT Prospectus entitled ‘Risk Factors’ for further details of risks associated with an investment in the Shares.

Notice to Investors in Switzerland – Qualified Investors

This document constitutes an advertisement of the financial product(s) mentioned herein.

The prospectus and the key investor information documents (KIID) are available from WisdomTree’s website: https://www.wisdomtree.eu/en-ch/resource-library/prospectus-and-regulatory-reports

Some of the sub-funds referred to in this document may not have not been registered with the Swiss Financial Market Supervisory Authority (“FINMA”). In Switzerland, such sub-funds that have not been registered with FINMA shall be distributed exclusively to qualified investors, as defined in the Swiss Federal Act on Collective Investment Schemes or its implementing ordinance (each, as amended from time to time). The representative and paying agent of the sub-funds in Switzerland is Société Générale Paris, Zurich Branch, Talacker 50, PO Box 5070, 8021 Zurich, Switzerland. The prospectus, the key investor information documents (KIID), the articles of association and the annual and semi-annual reports of the sub-funds are available free of charge from the representative and paying agent. As regards distribution in Switzerland, the place of jurisdiction and performance is at the registered seat of the representative and paying agent.

For Investors in France:

The information in this document is intended exclusively for professional investors (as defined under the MiFID) investing for their own account and this material may not in any way be distributed to the public. The distribution of the Prospectus and the offering, sale and delivery of Shares in other jurisdictions may be restricted by law. WT Issuer is a UCITS governed by Irish legislation, and approved by the Financial Regulatory as UCITS compliant with European regulations although may not have to comply with the same rules as those applicable to a similar product approved in France. The Fund has been registered for marketing in France by the Financial Markets Authority (Autorité des Marchés Financiers) and may be distributed to investors in France. Copies of all documents (i.e. the Prospectus, the Key Investor Information Document, any supplements or addenda thereto, the latest annual reports and the memorandum of incorporation and articles of association) are available in France, free of charge at the French centralizing agent, Societe Generale at 29, Boulevard Haussmann, 75009, Paris, France. Any subscription for Shares of the Fund will be made on the basis of the terms of the prospectus and any supplements or addenda thereto.

For Investors in Malta: This document does not constitute or form part of any offer or invitation to the public to subscribe for or purchase shares in the Fund and shall not be construed as such and no person other than the person to whom this document has been addressed or delivered shall be eligible to subscribe for or purchase shares in the Fund. Shares in the Fund will not in any event be marketed to the public in Malta without the prior authorisation of the Maltese Financial Services Authority.

For Investors in Monaco: This communication is only intended for duly registered banks and/or licensed portfolio management companies in Monaco. This communication must not be sent to the public in Monaco.

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.