Corporate earnings face a growing challenge with today’s Producer Price Index (PPI) showing persistent inflation, especially within services, at a time when consumer spending is slowing. Investors responded to a worsening outlook for earnings and inflation by selling equities, with most broad indexes declining and yields rising, albeit modestly.

Today’s November Producer Price Index (PPI) report continued to weigh on the equity market’s (S&P 500) recent downtrend from its 200-day moving average. The PPI came in hotter than expected, 7.4% year-over-year (y/y) and 0.3% month-over-month (m/m), versus the consensus expectation of 7.2% and 0.2%. When excluding food and energy, the Core PPI came in even hotter than headline relative to consensus expectations. Core PPI came in at 6.2% y/y and 0.4% m/m, hotter than the expected 5.9% and 0.2%. While non-core PPI rose at the same pace as October, core PPI accelerated significantly, from 0.1% to 0.4%.

In a reversal from last month, the strongest inflation occurred within final demand services, which increased 0.4% compared to the 0.1% for final demand goods. In October, goods led, climbing 0.6% compared to the 0.1% increase for services. Within services, prices for various financial services, such as securities brokerage and investment advice, climbed 11.3%. Other considerable price increases occurred with wholesaling services for machinery and vehicles, retailing services for fuels and lubricants, portfolio management and long-distance motor carrying. Among goods, food was the most significant increase, climbing 30 basis points while energy decreased 3.3%.

Services continue to drive the bulk of the inflationary pressures, and unfortunately, they comprise most of the American economy. In addition, the services category is the most challenging segment of inflation to cool partially because its price changes are less volatile than goods and commodities. Services are also labor intensive. Rising wages can potentially become embedded in firm and individual psychology, raising the risks of a wage-price spiral driving further sticky inflation. This problem is especially risky today, with an incredibly tight labor market that has job openings outnumbering unemployed folks 1.7 to 1.

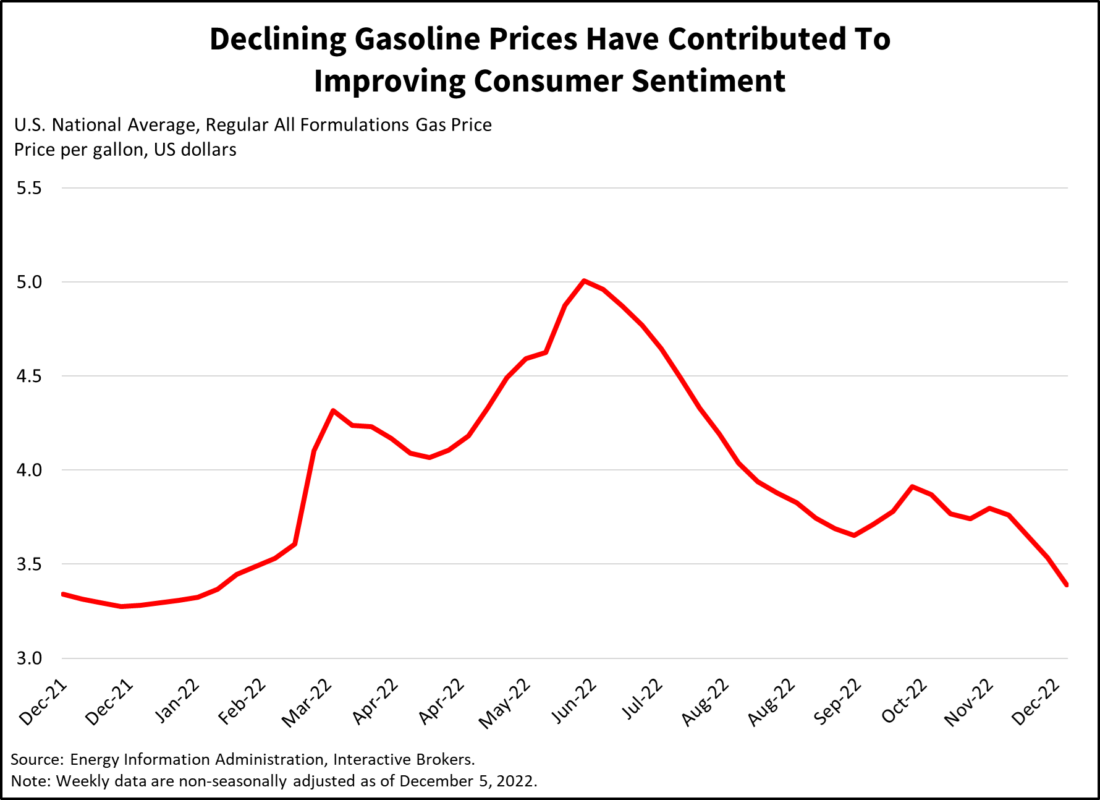

Weaker consumer spending is expected going forward as well, with consumer sentiment bouncing along low levels and providing little, if any, reason to expect Americans to loosen their purse strings. Today’s preliminary University of Michigan Consumer Sentiment release for December was 59.1, better-than-consensus expectations of 56.9 and an improvement from November’s 56.8 level. Sentiment for current economic conditions rose from 58.8 to 60.2 while the index of consumer expectations rose from 55.6 to 58.4. The increase was broad based with gains across all segments of the data. Short-term inflation expectations improved significantly against the backdrop of falling gasoline prices which is providing some relief from pain at the pump. Consumers are expecting inflation next year to be 4.6%, down from the 4.9% expectation recorded last month. Consumers are expecting longer term inflation over the next five years to settle closer to the Fed’s 2% target at 3%, unchanged from last month. Short and long-term business conditions improved while the recent stock market recovery from the October low also boosted sentiment.

Investors started the morning on edge in response to many financial institutions having recently downgraded their earnings estimates for 2023. At the same time, Black Friday online shopping, at least for goods, flopped this year, with Adobe Analytics and RetailDive reporting that sales increased only 2.3% y/y, significantly trailing the 7.7% y/y inflation rate as measured by the Consumer Price Index. As discussed yesterday in my commentary “Demand Weakens Globally While Inflation Persists,” Bank of America credit and debit card transactions increased only 5% m/m in November and Wells Fargo has also experienced weak credit and debit card usage.

This morning’s PPI and Consumer Sentiment data add growing concerns for investors, who are already focused on persistent inflation and an uncertain outlook for the extent of monetary policy tightening during the coming months. In recent comments, Federal Reserve Chairman Jerome Powell hinted that the central bank may moderate its aggressive pace of fed funds rate increases, which shored up optimism that monetary tightening may have a less dramatic impact on corporate earnings and may be less likely to spark a recession. As investors fret over threats to margins resulting from accelerating services inflation, wage pressures and weakening consumer spending, many will be sitting on the edge of their chairs during the Federal Reserve’s (the Fed) meeting scheduled for this coming Wednesday. The big question will be if the Fed believes it’s made enough progress in battling inflation to ease off its monetary policy tightening or if persistent price increases as illustrated by the PPI illustrate that the Fed clearly isn’t out of the woods yet and must continue with aggressive rate hikes that when combined with weakening consumer spending and wage pressures could be a painful hit to corporate earnings.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.