I started this week wondering whether Microsoft’s (MSFT) management team had mis-read the calendar. It is typical for MSFT to report earnings alongside its mega-cap peers, making that week the peak of earnings season. This quarter, by reporting after today’s close, MSFT will be preceding Apple (AAPL), Alphabet (GOOG, GOOGL), Meta Platforms (META) and others of that ilk by about a week. I’m not sure why, but it gives this behemoth a chance to dominate the market conversation for a short while – at least until Tesla (TSLA) reports after tomorrow’s close.

Like some of its peers, MSFT has seen its share of post-earnings volatility. In October, after the company’s Q1 earnings beat EPS expectations by 5 cents, the stock fell 7.7%. In July, MSFT missed by about 7 cents and guided lower, but rose by 6.7%. When we consider that MSFT sports a market capitalization of about $1.8 trillion, those are swings of billions of dollars. It also means that the stakes are high for a stock that is up about 5% in the roughly three months since the aftermath of last quarter’s report.

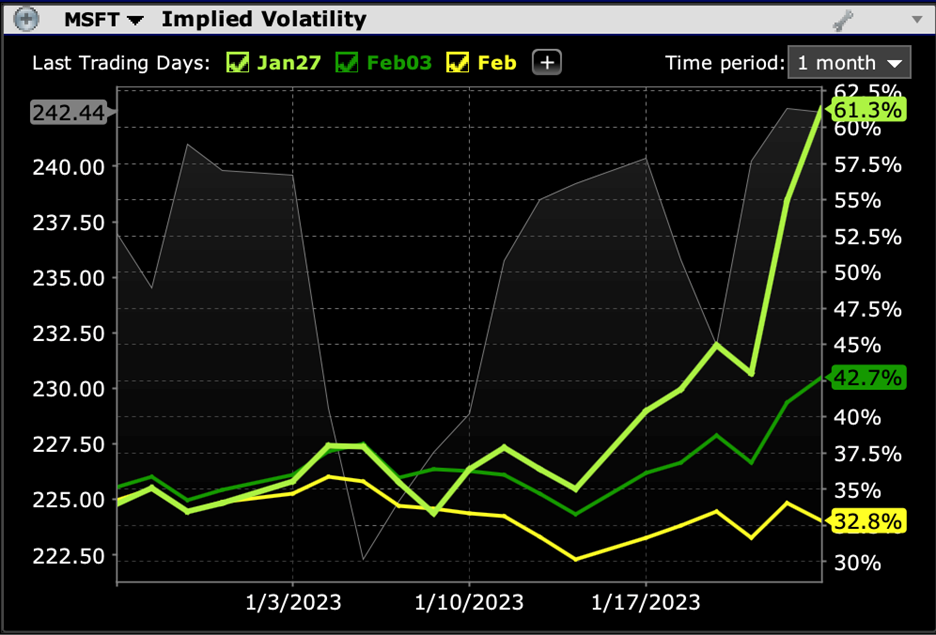

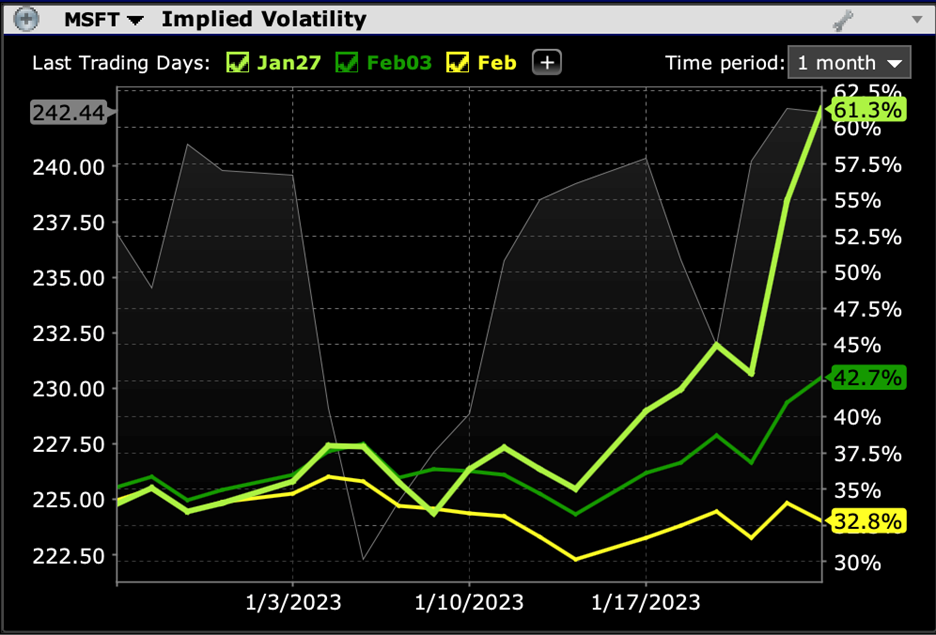

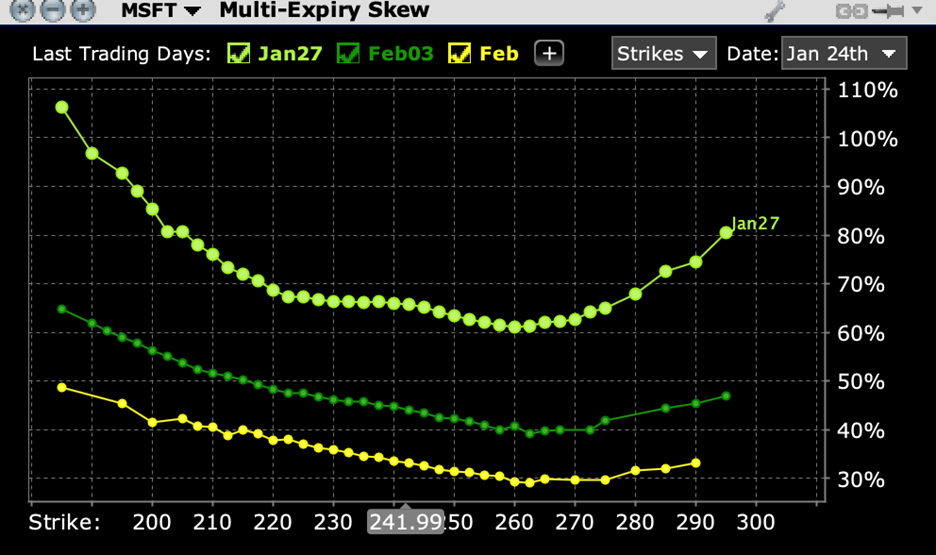

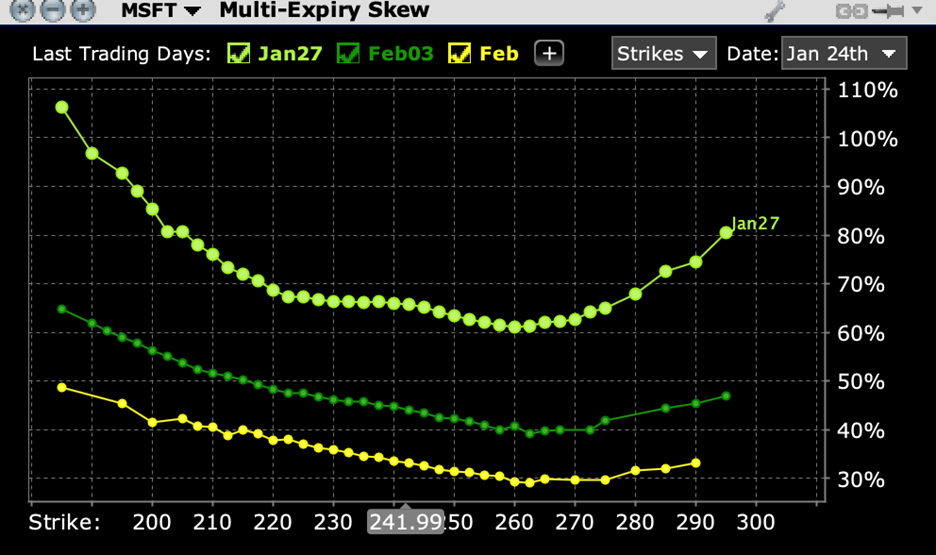

The turmoil of the past two quarters is clearly at the forefront of options traders’ minds. We see that the implied volatility of MSFT options expiring this Friday, January 27th is about 61% on an annualized basis. Using the “rule of 16”, that appears to imply a move that is consistent with MSFT’s longer-term average post-earnings move of 3.8%. But it actually implies a move closer to 6%. The historical volatility of MSFT over recent sessions is about 2% daily. So if we assume that there will be three days left to trade those options after the earnings are released, and that each of those days are typically 2% each, we would need one 6% move to create a roughly 4% average over the following three days.[i]

Implied Volatility for MSFT Options Expiring January 27th (chartreuse), February 3rd (green), February 17th (yellow)

Source: Interactive Brokers

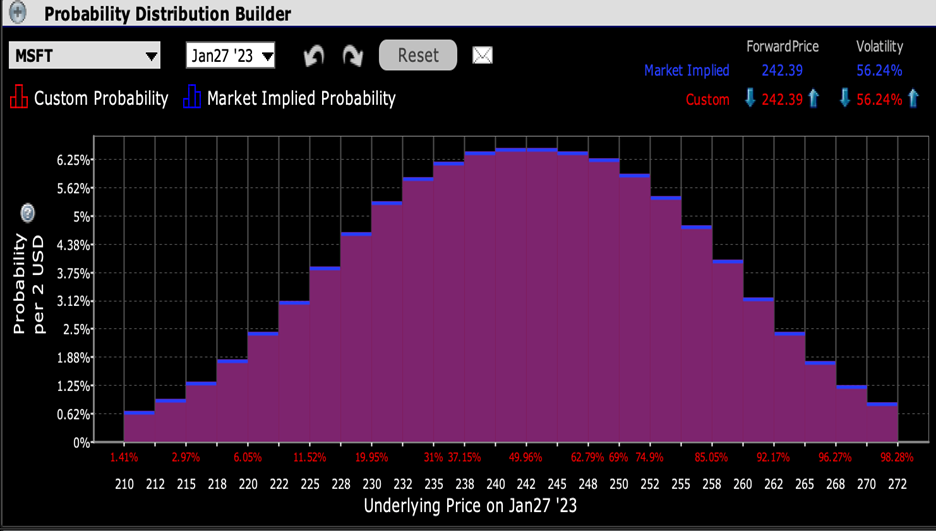

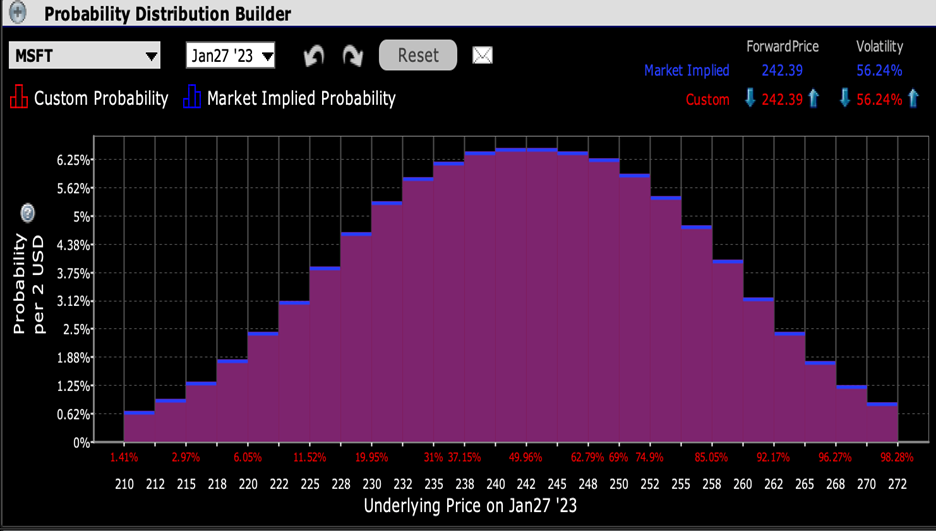

Perhaps because the past two earnings moves were divergent but with similarly large magnitudes, the IBKR Probability Lab shows a somewhat agnostic view about the direction of MSFT’s post-earnings move. With the stock trading around $242.5, we see a peak probability range of $240-245, with only slightly lower probabilities placed on the surrounding strikes. The options market might be wary of a large move, but it doesn’t appear to know which way it might go. Thus, the risks balance out around the at-money options.

IBKR Probability Lab for MSFT Options Expiring January 27th, 2023

Source: Interactive Brokers

Skews on near-term options show something along those lines. We know that the weekly options expiring Friday are carrying significantly higher implied volatilities than those of subsequent weeks, and we also know that implied volatility curves tend to skew to the downside. What we see in MSFT, however, is a set of multi-expiry skew curves that are roughly parallel until extreme levels. That once again shows that options traders are not particularly more biased in one direction or another for options expiring this week.

Multi-expiry Skew for MSFT Options Expiring January 27th (chartreuse), February 3rd (green), February 17th (yellow)

Source: Interactive Brokers

To sum up, options markets are pricing in another potentially large post-earnings move for MSFT but are not sure which direction is substantially more likely. Those traders who have a strong view about direction could find an opportunity to exploit the market’s uncertainty, while those who are expecting a more historically typical post-earnings move than we have seen over the past two quarters could seek out trades that favor their views. In any case, investors of all types will be watching MSFT’s results for clues about how next week’s rush of megacap tech earnings might fare.

—

[i] Some simplified equations. 61/16=3.81%, a rough estimate of the market’s anticipation for MSFT’s daily moves through Friday’s expiration. Let’s call that 4% for simplicity. 3 days at 4% = 12%. If we assume typical non-earnings move of 2%, based upon historical volatility, and including today, then 12% – 3 x 2% =6%. The exact math is more complicated, but this method puts us close enough.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ