2022 continues to prove difficult for investors around the globe. The conjunction of heightened geopolitical risks, increasingly hawkish central bankers and runaway inflation forced many investors to change tack and modify their asset allocation significantly in the last 12 months. Duration has been lowered across asset classes, and a survey we commissioned recently revealed that 77% of European professional investors use equities to hedge against inflation1.

Fighting Inflation by Wielding Pricing Power

Not all equity investments are equal in the face of inflation. The key differentiator is their pricing power. Pricing power describes the ability of a company to increase its price without impacting demand or losing market share to competitors. In an inflationary environment, margins are under pressure because companies “import” inflation, whether they want it or not. Overall costs for the companies increase through labor, supply or energy. The only tool to mitigate the impact of inflation on margin is to increase prices. Companies with pricing power will be able to do so the most efficiently, creating tailwind versus competitors.

Certain types of companies tend to have higher pricing power:

- Companies that deliver essential services tend to wield a lot of pricing power as they have somewhat captive clients. This is the case for many companies in the Consumer Staples, Health Care, Utility or Energy sectors.

- Companies that deliver high-quality products or services and possess a distinct competitive advantage can also increase prices efficiently.

- Luxury goods companies benefit from their clientele’s relatively low price sensitivity.

- Some companies can benefit from favorable supply-demand dynamics at a particular point in time. This is, for example, the case of semiconductors in 2021 or energy companies this year.

History Is One of the Best Guides to the Future

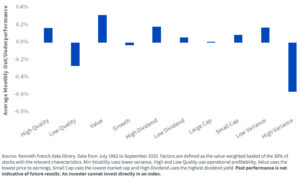

As is our habit when trying to assess the future, we turn to the past for guidance. The below graph focuses on U.S.-listed stocks since the 1960s. It assesses the average outperformance or underperformance of different groupings of stocks since the 1960s when inflation is higher than the last five-year average. We observe that on average:

- High-quality stocks weathered inflation better than low-quality stocks

- Value stocks beat growth stocks

- High-dividend stocks outperformed low-dividend stocks

- Small cap and low volatility did better than large-cap or high-vol companies

Overall, high-quality, high-dividend and cheap stocks appeared to fare better in high-inflation environments.

Historical Monthly Overperformance vs. S&P 500 When Inflation Is above Five-Year Average

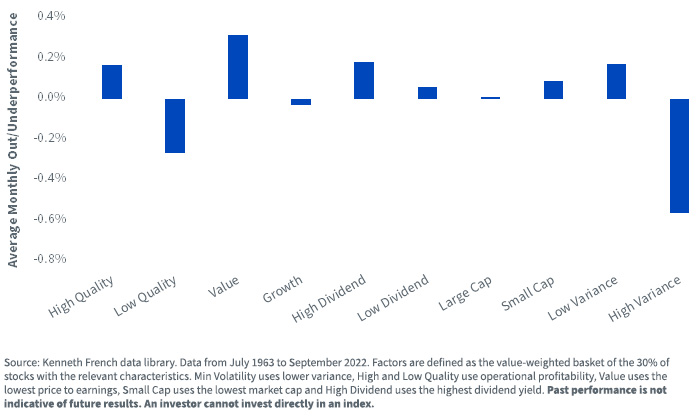

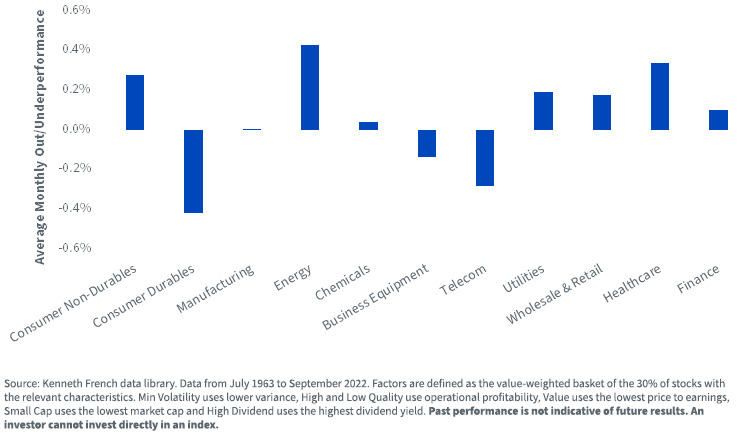

The same analysis on sectors shows that value-oriented, high-dividend sectors also tend to do better against inflation. Energy, Health Care, Consumer Non-Durables (Food, Tobacco, Textiles) and Utilities exhibit the strongest average outperformance during high inflation.

Historical Monthly Overperformance vs. S&P 500 When Inflation Is above Five-Year Average

It is clear here that the quantitative data aligns with our qualitative assessment. The factors and sectors that historically outperformed when inflation was high are those that have the most chance to harbor high-pricing-power companies. This should give investors clear indications on how they can tilt their portfolios to fight inflation.

Quality and Dividend Growth to Fight Inflation

In light of the unique challenges equity investors face, we believe that high-quality companies focusing on dividend growth could help strengthen portfolios. High-quality companies exhibit an “all-weather” behavior that tends to deliver a balance between building wealth over the long term and protecting the portfolio during economic downturns. Dividend-paying, highly profitable companies tend to:

- Exhibit higher pricing power, allowing them to defend their margins by passing the cost inflation to their customer

- Exhibit lower implied duration, protecting them in a rate-tightening environment, thanks to a focus on short-term cash flows

- Provide a defensive tilt and an enhanced capacity to weather uncertainty

Pierre Debru is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree Investments, Inc.

1 Source: CoreData Research, Pan-Europe Professional Investor Survey Research, July/August 2022

—

Originally Posted December 8, 2022 – When Inflation Is High, Investors Focus on High Pricing Power Equities

Disclosure: WisdomTree U.S.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473) or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

Interactive Advisors offers two portfolios powered by WisdomTree: the WisdomTree Aggressive and WisdomTree Moderately Aggressive with Alts portfolios.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree U.S. and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree U.S. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.