Study Notes:

Today we’re going to take a look at how TWS displays currency balances and FX trades in the Account window, which we can open right here from the Mosaic Portfolio by clicking the Account button.

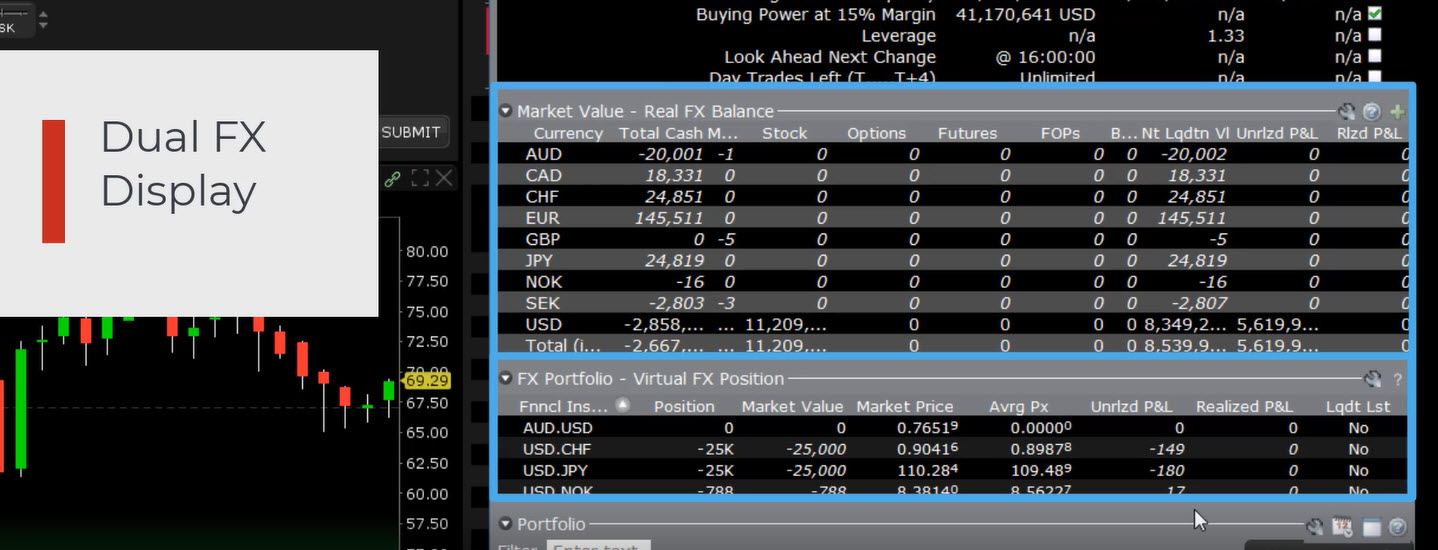

Here in the Market Value section we show you your real-time currency balances – and you can see I have several along with USD, which is my base currency. Some values are italicized; this is because I elected to display all balances in my base currency and those in italics are the converted values.

Below it, we have the FX Portfolio section, and if you’re an FX trader and trade currency pairs, you’ll appreciate this specialized view that treats an FX pair like an actual contract, so you can monitor some key metrics like your P&L and average price.

We call these two different currency sections our “Dual FX Display” and especially if you’re an FX trader, it’s important to understand the distinction between these values and how the routing destination you use for currency trades plays a crucial role in keeping the distinction clear.

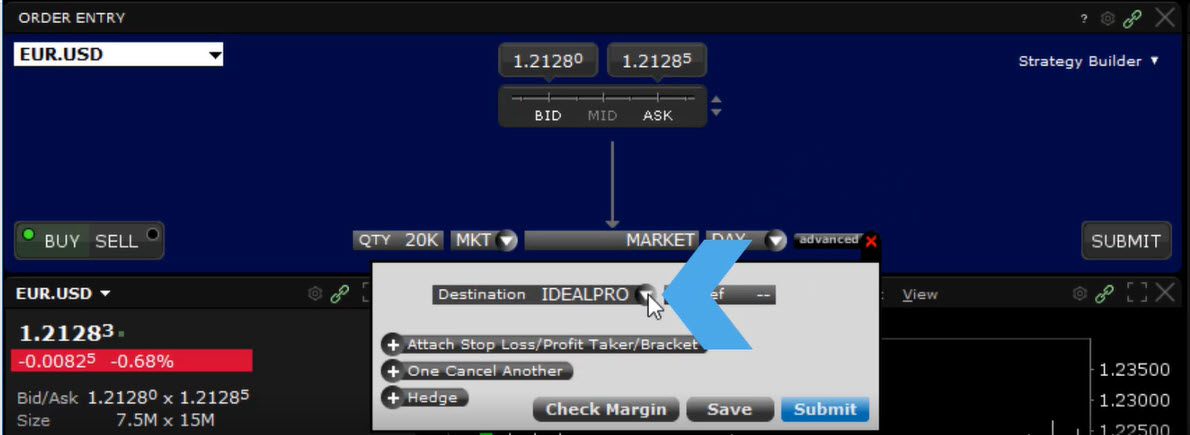

Let’s assume that I am an FX Trader and I’m going to buy the Aussie which means I’ll buy the Aussie Dollar pair. You’ll see when I create the order that the TWS default routing destination for currency orders is IDEALPRO.

My order fills and as do all currency trades, the real-time balance for both currencies is immediately updated here in the Market Value section – Total Cash field. Additionally, the result of the trade also displays here in the FX Portfolio in the form of an FX trade, and that’s because the order went to IDEALPRO and we tagged it as an FX pair trade.

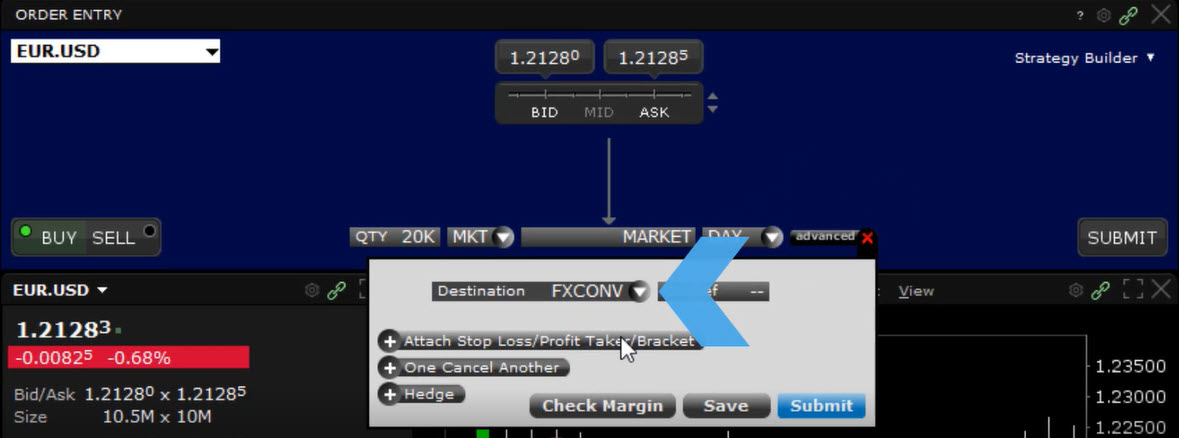

Now let’s do something a bit different. Instead of trading a currency pair like an FX trader would, I’m going to convert some of my Dollars to Euro. To do this we’ll buy the Euro Dollar pair.

Now let’s do something a bit different. Instead of trading a currency pair like an FX trader would, I’m going to convert some of my Dollars to Euro. To do this we’ll buy the Euro Dollar pair.

And this is done similarly to an FX trade, but before we submit, I’m going to change the routing destination – and this is key – to FXCONV. This tells TWS that I’m converting currency, not trading a currency pair, and that it shouldn’t put this transaction into my FX Portfolio.

Let’s look at the Account Information window now that the order has filled. You can see that my EUR balance has increased, but more importantly I don’t have any new FX transactions in my FX Portfolio. Just as I planned.

Now let’s do the same thing, buy the Euro Dollar pair, convert currency, but this time I’ll “accidently” leave the destination as IDEALPRO.

After the order fills, look at our account information again. Same expected updated values in the Total Cash field, but look – now we have a virtual FX Euro Dollar position that I didn’t want – because I left the destination as IDEALPRO.

There is a way to fix this display. Because FX Portfolio represents a ‘virtual’ position, we can simply adjust the size of the position back to what we had originally, or to zero. We’re not buying or selling anything we’re just adjusting the display that we inadvertently messed up by routing a conversion to IDEALPRO instead of to FXCONV.

Notice that up here in the Market Value section, the right-click menu only allows me to close, or change the balances by trading. I can’t make any adjustments here because these are actual currency balances.

Now if you don’t trade FX and have no need to monitor these positions, simply collapse the panel here in the Account Information window, and you’ll hide these pairs in TWS as well.

But if you trade FX and like to monitor these contract positions, the bottom line is to check your destination and if you are converting currency and don’t want it treated as an FX pair trade, be sure to select FXCONV as your destination.

Remember you can practice with this in your TWS paper account. Thanks for joining us, we’ll see you next time.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.