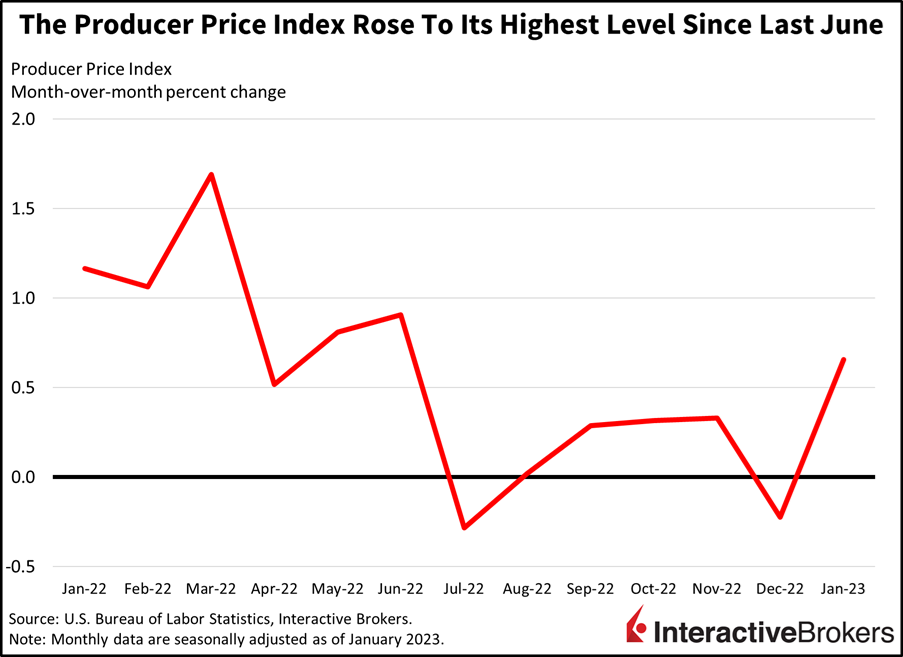

In another indication of accelerating inflation, today’s Producer Price Index release shows that just as inflation may have been transitory on the way up, it has also proven to be transitory on the way down. Today’s news has caused investors and spectators to raise their expectations of the magnitude of Fed tightening necessary to slay the inflation dragon. In fact, Cleveland Federal Reserve (Fed) Bank President Loretta Mester remarked “we are in it to win it” regarding the Fed’s efforts to lower inflation down to the 2% target. Other market players are speculating about the need to raise the terminal rate to a six handle, a phenomenon markets are not prepared to handle.

Another Morning, Another Market Decline

Markets are plunging this morning, a familiar event over the last few days as the ferocious bulls seem to never run out of ammunition to buy dips. Morning declines have been bid up and many pre-market-morning losses have been reversed by the afternoon as the S&P 500 Index has lingered around the same levels of 4100-4150 during most of February. Today, the battle is at 4100. While the bears pushed the index lower to 4091, bulls have handsomely bought the dips heavily yet again, lifting the index above 4125. Spectators have remarked that the emergence of zero day to expiry options (0dte) provides a powerful new tool to gather momentum throughout the trading day, leading to eye-boggling market reversals, some of which we’ve seen the last few days, propping up valuations towards sky-high, nose-bleed levels.

Spectators have remarked that the emergence of zero day to expiry options (0dte) provides a powerful new tool to gather momentum throughout the trading day, leading to eye-boggling market reversals, some of which we’ve seen the last few days, propping up valuations towards sky-high, nose-bleed levels.

The S&P 500 index is down 0.7% while the tech-heavy Nasdaq Index is down 0.8%, recovering roughly half of the losses since the open. Bond yields are rising notably, led by the long-end against the backdrop of rising inflation expectations, while the short-end pick up is driven by a Fed that is likely to maintain higher rates for longer than previously anticipated. The 2-year yield is up 4 basis points (bps) while the 10-year is up 6 bps. The dollar index is catching a bid with lower levels of momentum, however, up 15 bps to 104.08. WTI crude oil is down modestly, losing 46 bps to just over $78 a barrel as oil traders weigh strong demand from the Chinese reopening against the offsetting factor of rising inventories in the U.S., which have increased for eight consecutive weeks.

Producer Price Index Reinforces Inflation Fears

Today’s Producer Price Index report (PPI) came in strongly above expectations, catching market participants off guard after what was a hot, but near consensus, Consumer Price Index (CPI) report two short days ago. Many economists including myself use the PPI as a leading indicator for CPI because businesses generally pass on higher costs to consumers or take the hit to margins. Today’s report reminds investors that in 2023, they’ll either get hit on margins via earnings, or on valuations via the Fed. Since all-time equity highs in 2022, it’s certainly been a mix of both but more of the latter.

The PPI rose 0.7% month-over-month (m/m), its fastest pace since June, dwarfing expectations for a 0.4% increase and exceeding December’s -0.2% decline. Core PPI, which eliminates food and energy from the calculation, came in at 0.5% m/m, much higher than the 0.3% consensus expectation. Year-over-year (y/y) numbers came in 6% for headline and 5.4% for core, significantly above the Fed’s 2% target and accelerating in the shortterm. The ongoing real estate recession continues, with building permits rising a mere 0.1% m/m and housing starts falling 4.5% on an annualized pace basis. The labor market remains strong, with weekly jobless claims down 1,000 to 194,000 from the previous week’s 195,000, while the consensus forecast expected an increase to 200,000.

Businesses Tighten Their Belts

Economic fears are having an impact on corporate sentiment. Upwork, which operates a freelance worker portal, generated sluggish fourth quarter revenue growth and expressed caution for the coming months as businesses tighten their spending. Gross Services Volume (GSV), which is revenue from a variety of services, such as fees for services and spending on the company’s freelance marketplace, grew 4% y/y but its growth was flat quarter-to-quarter. Some clients reduced their spending after the firm changed its fee structure in the second quarter, but Upwork also experienced softness in client acquisitions. Nevertheless, the company’s total revenue grew 18% y/y. It believes many clients are slowing hiring due to the macroenvironment, but it expects its total revenue to grow 12% y/y in the current quarter.

Advertising is also contracting. Streaming video platform provider Roku’s fourth quarter is normally its strongest for the year, but 2022 was an exception. Its platform revenue, which includes advertising and subscriptions, grew 20% y/y compared to 80% in the final quarter of 2021. Paramount Global also experienced weakness with its $8.13 billion in revenues falling short of the $8.17 billion consensus expectation. It experienced a 5% fourth quarter decline in advertising revenue with its television media division advertising revenue dropping 7%. Its adjusted earnings per share of $0.08 fell substantially below the $0.24 expected by Wall Street.

Reality Calls

Market bulls may finally need to accept a painful reality—inflation is stronger than many investors have believed while corporate earnings are weakening. Despite a view that Fed Chairman Jerome Powell would likely throw underarm from the mound in March, Cleveland Fed President Loretta Mester isn’t alone in her hawkish stance. After CPI numbers were released yesterday, Richmond Fed President Thomas Barkin implied that the central bank may need to be more aggressive in fighting inflation and the Philadelphia Fed’s Patrick Harker said the terminal rate for the fed funds will need to be above 5%. Perhaps the tipping point that ends the panic in the morning and feast in the afternoon pattern for investors may occur today when St. Louis Fed President Jim Bullard speaks. His most recent hawkish comments may have fallen on deaf ears among investors, but the recent string of inflationary data, such as a sizzling jobs report, strong retail spending, this week’s CPI data and today’s PPI, may make it hard to dismiss his views. Bulls may be caught flat footed today or perhaps they will demonstrate that emotional urges, such as fear of missing out, are stronger than a balanced view of markets and the economy.

Visit Traders’ Academy to Learn More about the Consumer Price Index, Unemployment Claims, Building Permits and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.