The article “A Curious Combination: Momentum Investing, Tesla, and November 9th” first appeared on Alpha Architect Blog.

“The plural of anecdote is not data”

I’ve used this quote to discount the validity of a single observation to explain much of anything. That observation is true. Yet the real quote, attributed to Stanford researcher Ray Wolfinger, is the following:

“the plural of anecdote is data”.

Ray Wolfinger

Every data point has a story and sometimes that story can illuminate a larger truth.

I think the anecdote of Tesla’s recent stock surge this year gives us some insight into the Momentum Factor, namely that stocks like Tesla that have already surged in price are emotionally impossible to own for those of us not day trading on Robinhood. And for good reason: they can fall out of favor fast! The potential for these massive price corrections and the psychological toil of owning them helps explain the return premium associated with the Momentum Factor. Tesla’s recent stock volatility and the emotions it triggers not only makes it a worthy poster child for momentum stocks but also provides some insight into the differences across both momentum factors and momentum funds. And dare I add when looking at the price action of similar stocks on November 9th, it is a warning on what may yet still be on the horizon.

November 9th: A Unique Day for Momentum Investors

The traditional academic “momentum” moniker most simply applies to stocks that have performed the best over the past year. These stocks over various time periods and across markets, both in and out of sample, have exhibited excess risk-adjusted returns as well documented on this blog (here is an example) as well as many others 1. Equally well documented is the ability of momentum stocks to drop like a stone. In fact, on November 9th of this year, one of the sharpest price reversals for these stocks in the last couple of decades occurred. Yet the event passed largely unnoticed by the general public (outside of some by the #fintwit community and modest coverage in the Wall Street Journal).

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

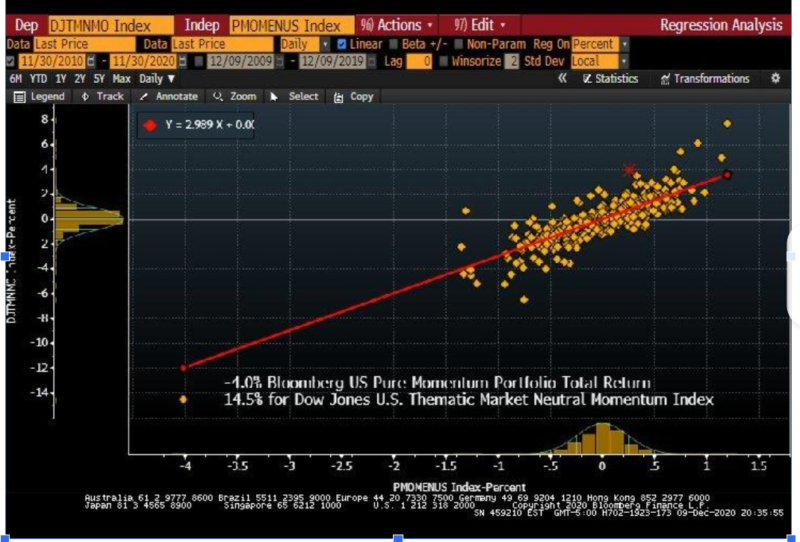

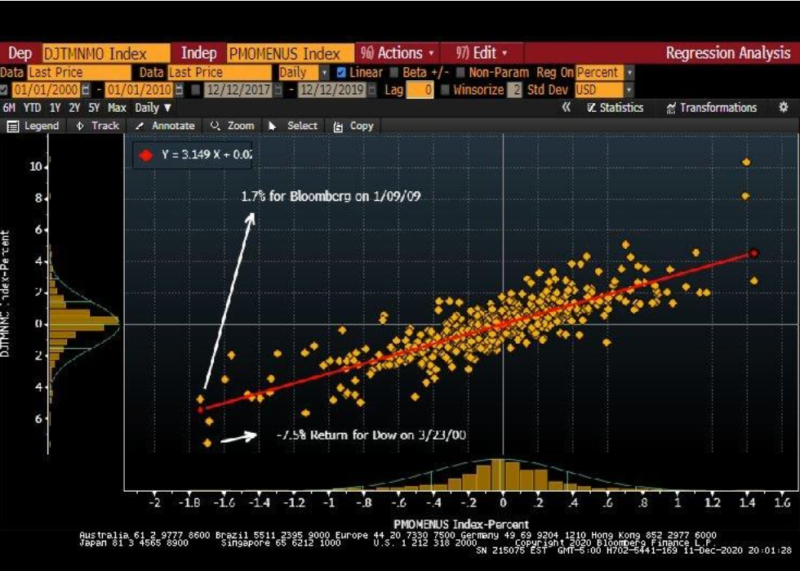

The scatter plot above captures this extreme relative move in the momentum factor on November 9th. The -14.5% return of the Dow Jones U.S. Thematic Market Neutral Momentum Index was almost 15 standard deviations from the norm 2. Bloomberg’s US Pure Momentum Portfolio factor was down a more modest 4% or 4 standard deviations from the norm. Since 1999, the most significant daily drop in price was a meager 7.5% for the Dow’s on March 23rd, 2000, and a 1.7% drop for Bloomberg’s factor on 1/09/09. Hmmm, coming out of the Internet Bubble and Great Financial Crisis the Momentum Factor experienced much more than just a daily reversal. This is a well-documented period of gut-wrenching drawdowns for the factor 3. French’s data goes back much further than the 01/01/2000 start of the other two factor indices and records 5 days exceeding a 10% drop, mostly in the 30s during the Great Depression 4. Again, the largest drawn down in the Momentum Factor’s history also occurred over this time period and the proximity of the large daily reversals should give us pause.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Differences Across Momentum Factors and Funds

And what about the large performance differences across the factors for this date? What first appears to be minor differences in both how and when to calculate the factor has major repercussions for returns. The Momentum Factor attempts to neutralize swings in the market by going long these momentum stocks and short out-of-favor stocks that have done poorly. But different quants calculate that factor differently. Ken French of Dartmouth sorts daily to calculate the Fama-French Daily Momentum Factor and combines both big company and small company portfolios to go long and short momentum. Bloomberg uses an implicit factor model using multivariate cross-sectional regression analysis designed to zero out exposure to other factors, including the market. Dow Jones sorts stocks based on 12 months returns within various sectors in attempt to minimize industry bets. French uses market value weights. To avoid idiosyncratic risk, Bloomberg uses the square root of market value when determining weights. Dow Jones uses equal weighting and rebalances quarterly.

Even momentum definitions can differ. Although momentum enjoys considerable consensus on what it means, namely 6 to 12 months of relative strong performance with an adjustment for well documented short term (up to a month) reversals, this also can lead to differences in returns. French-Fama’s factor uses returns starting 251 days back (roughly 12 months) and stopping 21 days back (roughly 1 month) to avoid short-term reversals. Bloomberg goes back 54 weeks and stops 2 weeks back. Dow Jones just goes back 52 weeks with no adjustment for short-term reversals.

Definitions aside, the differences in returns of the long-short measurements of the Momentum Factor also translates into differences in returns to long-only Exchange Traded Funds (i.e., ETFs) and mutual funds trying to capture the momentum strategy’s excess returns. As shown in the table below, on November 9th most, but not all, of the listed funds dropped with the factor indexes while the U.S. Market, as measured by Vanguard’s Total Stock Market ETF <VTI> was up 1.25%.

Visit Alpha Architect Blog to read the rest of the article:

https://alphaarchitect.com/2020/12/23/a-curious-combination-momentum-investing-tesla-and-november-9th/

Notes:

- see especially the blogs at Newfound Research and AQR ↩

- implying this distribution is anything but normal! ↩

- See Table 8.5 of the book Quantitative Momentum ↩

- As of publishing, French hasn’t updated his data for November ↩

Disclosure: Alpha Architect

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

This site provides NO information on our value ETFs or our momentum ETFs. Please refer to this site.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Alpha Architect and is being posted with its permission. The views expressed in this material are solely those of the author and/or Alpha Architect and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.