The CAPM model was a breakthrough for asset pricing, but the times where the market factor was most widely used are long gone. Nowadays, if we exaggerate a bit, we have as many factors as we want. Therefore, it might not be straightforward which factor model should be used.

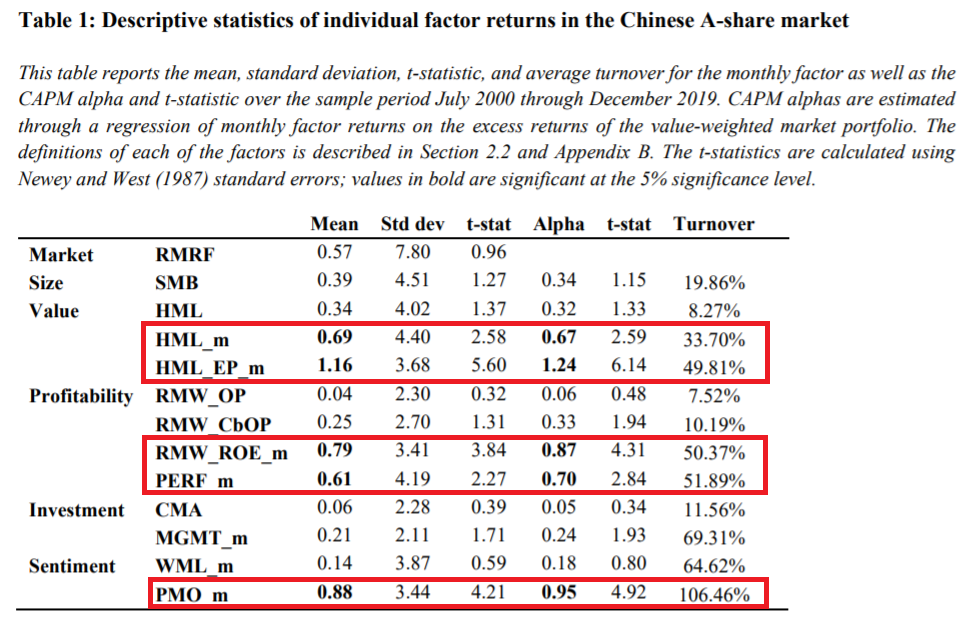

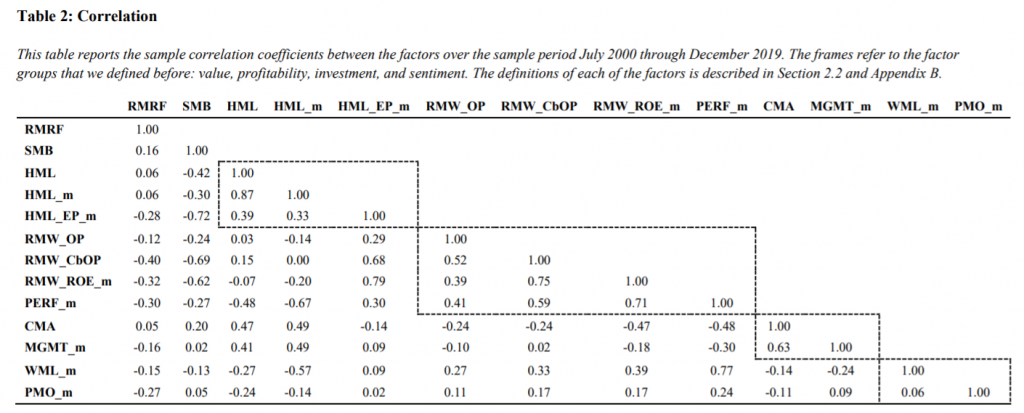

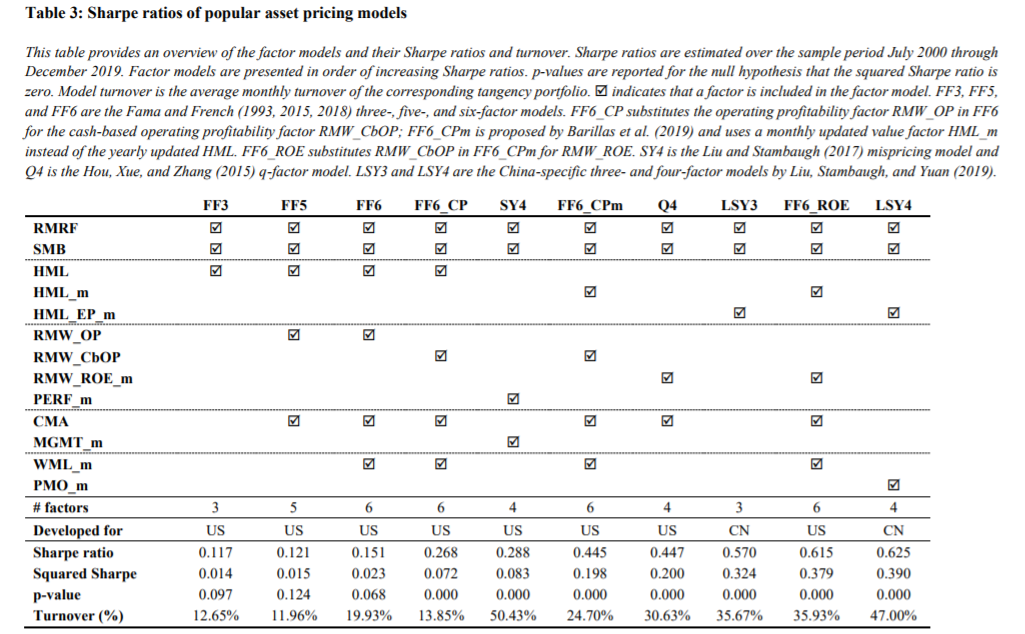

Hanauer et al. (2021) provide several insights into factor models. The authors postulate that the factor models should be examined in the international samples since this can be understood as a test for asset pricing models. The domestic Chinese A-shares stock market seems to be an excellent “playground” for the factors models, given the size of the Chinese stock market, but mainly because of its uniqueness. The paper compares the models (and factors) based on various methods (performance, data-driven asset pricing framework, test assets, turnovers and even transaction costs). Apart from valuable insights into the several less-known factors, the key takeaway message could be that the “US classic” Fama-French factor models perform poorly in China. The modified Fama-French six-factor model or q-factor is better, but overall, it seems that factor models designed for China, such as the model of Liu, Stambaugh and Yuan (2019), are the best.

Authors: Matthias X. Hanauer, Maarten Jansen, Laurens Swinkels and Weili Zhou

Title: Factor models for Chinese A-shares

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3918833

Abstract:

We compare the pricing ability of popular asset pricing models for the cross-section of U.S. equities on a large, liquid, but mostly segmented equity market of Chinese A-shares. The q-factor model performs well among factor models developed for the U.S. equity market, but is outperformed by a modified Fama-French six-factor model and by a four-factor asset pricing model adapted to the Chinese A-shares market. A data-driven method to detect the preferred asset pricing model results in the same four factors, plus three additional ones. However, these three additional factors do not reduce the pricing errors to a set of test assets. When taking transaction costs into account, the ranking of asset pricing models changes. The preferred model from both the direct and data-driven model comparison methods now consists of a three-factor model comprising the market, size, and an earnings-based value factor.

As always we present interesting tables:

Originally posted on Quantpedia: https://quantpedia.com/asset-pricing-models-in-china/.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Quantpedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Quantpedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.