The article was first posted on Quantpedia. The below is an excerpt.

The pandemic of COVID-19 brought many changes for the whole humanity. The financial markets were no exception, but the trading has continued. Nowadays, the order can be placed from anywhere around the world and almost all stock exchanges are electronic and algorithmic. However, there still is one exchange where the floor trading exists – NYSE. During these tough times, NYSE was also purely electronic, the floor trading was closed, and human interaction was not possible. A novel study by Brogaard, Ringgenberg and Roesch examines the role of floor traders in the recent era driven by computers. The conclusion is clear: in the current digital age, floor traders still matter.

Authors: Jonathan Brogaard, Matthew C. Ringgenberg, Dominik Roesch

Title: Does Floor Trading Matter?

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3609007

Abstract:

While algorithmic trading now dominates financial markets, some exchanges continue to use human floor traders. On March 23, 2020 the NYSE suspended floor trading because of COVID-19. Using a difference-in-differences analysis, we find that floor traders are important contributors to market quality, even in the age of algorithmic trading. The suspension of floor trading leads to higher effective spreads, volatility, and pricing errors. Moreover, consistent with theoretical predictions about automation, the effects are strongest during the opening and closing auctions when complexity is highest. Our findings suggest that human floor traders improve market quality.

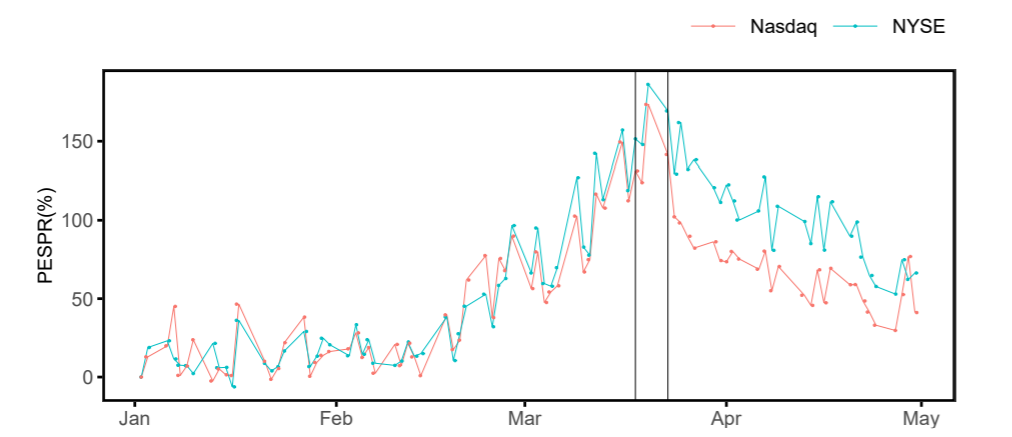

If floor traders are not present, spreads between stocks listed on NYSE and another exchange are widening. As always, the information is the best absorbed visually (for proportional effective spreads):

“This figure shows proportional effective spreads (PESPR) in per cent for all matched NYSE and Nasdaq listed stocks in our sample. We calculate changes in PESPR since January, 1st 2020 per stock-day and plot the daily marketcap-weighted average PESPR across all stocks in our sample. The first vertical line (2020-03-18) indicates the announcement of the event, the closing of the NYSE floor. The second vertical line (2020-03-23) indicates the event day. Data is from CRSP and TAQ.”

Visit Quantpedia to read the full article: https://quantpedia.com/do-floor-traders-matter/.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Quantpedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Quantpedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.