Excerpt:

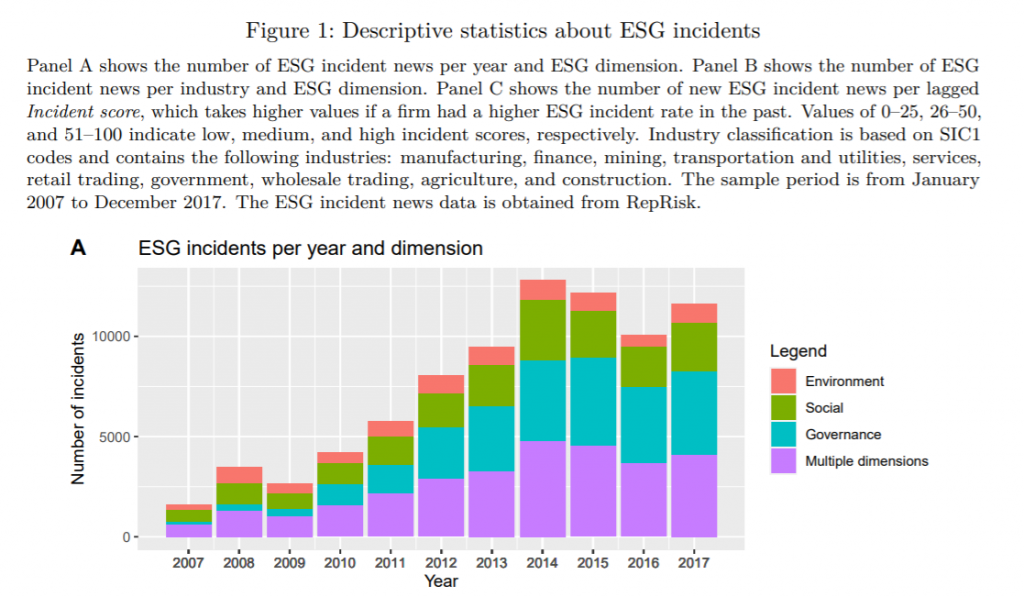

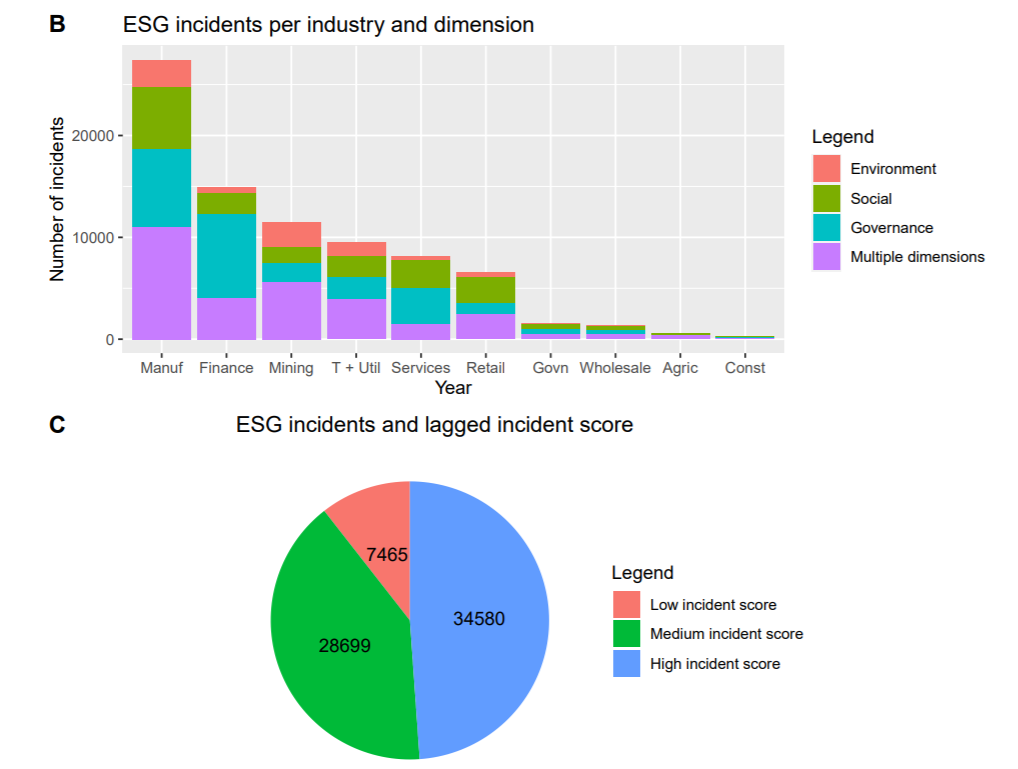

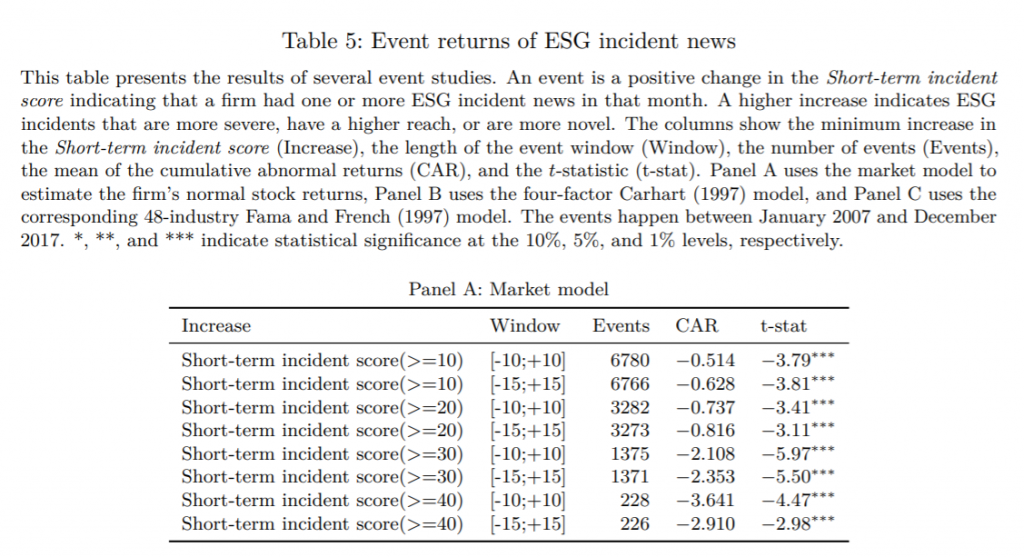

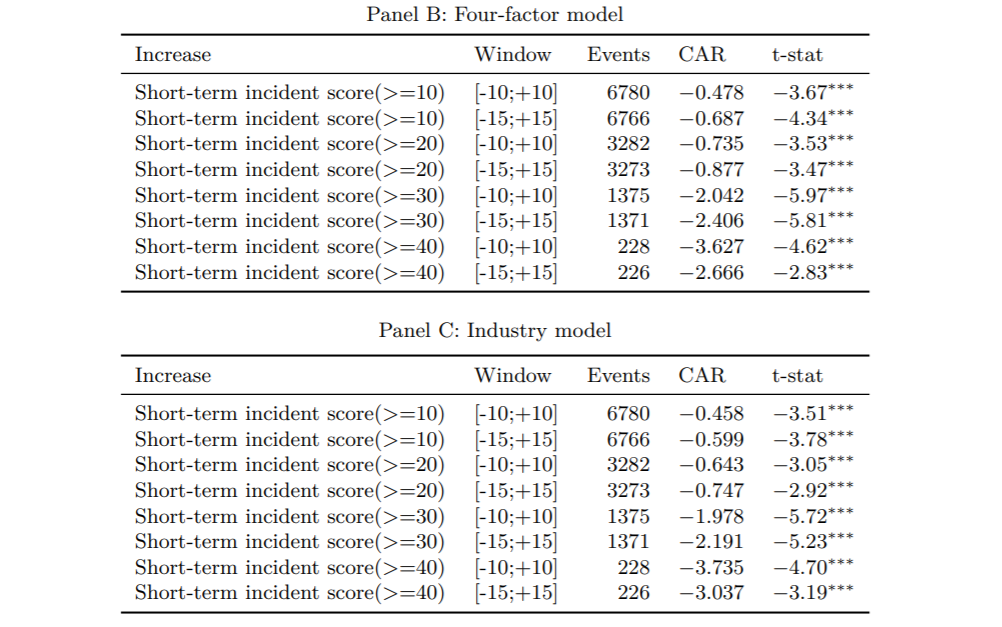

ESG scores are the modern trend in the financial markets, and while sustainable investing has its critics, it seems to become a regular part of the markets. Frequently, and probably rightfully, ESG is criticized for the lack of commonality across various “scorers”, and as a result, there might be a large dispersion among the score of one firm. The reason is that the score usually consists of different metrics and aggregation methodology. Apart from this “long-term” score, investors can easily recognize the “short-term” score, which can be proxied by negative incidents such as pollution, poor social aspects, social or governance scandals and so on. Moreover, these incidents could be more informative about (un)sustainable practice compared to ESG scores. These ESG incidents are studied by the novel research of Simon Glossner (2021). Using incidents news, the author provides interesting results that mainly support proponents of sustainable investing. Poor ESG performance proxied by incidents predicts more incidents in the future, lower profitability which should subsequently spill to negative performance in future. For example, portfolios consisting of negative incidents stocks significantly underperform the market for both US and European stocks. Therefore, this research paper is a compelling addition to the literature that, apart from social aspects, connects ESG also with performance.

Authors: Simon Glossner

Title: ESG Incidents and Shareholder Value

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3004689

Abstract:

This paper uses novel environmental, social, and governance (ESG) incident news data to study poor ESG practices. I find that firms’ past ESG incident rates predict more incidents, weaker profits, and lower risk-adjusted stock returns. When examining the cause of these abnormal returns, I find analyst forecast errors as well as lower returns around earnings announcements and subsequent incidents. Moreover, incident rates predict stronger abnormal returns in firms with higher short-term ownership, higher valuation uncertainty, and lower investor attention. Overall, these findings suggest that poor ESG practices negatively impact long-term value, which is not fully reflected in stock prices.

As always we present several interesting figures and tables:

Visit Quantpedia to read the Notable quotations from the academic research paper: https://quantpedia.com/esg-incidents-and-shareholder-value/

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Quantpedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Quantpedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.