Excerpt

Mathematical Concepts

Starting with the mathematical concepts of trading, it is a must to mention that mathematical concepts play an important role in algorithmic trading. Let us take a look at the broad categories of different concepts here:

- Descriptive Statistics

- Probability Theory

- Linear Algebra

- Linear Regression

- Calculus

Measure of Central Tendency

Here, Mean, Median and Mode are the basic measures of central tendency. These are quite useful when it comes to taking out average value from a data set consisting of various values. Let us understand each measure one by one:

Mean

This one is the most used concept in the various fields concerning mathematics and in simple words, it is the average of the given dataset. Thus, if we take five numbers in a data set, say, 12, 13, 6, 7, 19, 21, the formula of the mean is

which makes it :

(12 + 13 + 6 + 7 + 19 + 21)/6 = 13

Furthermore, the trader tries to initiate the trade on the basis of the mean (moving average) or moving average crossover.

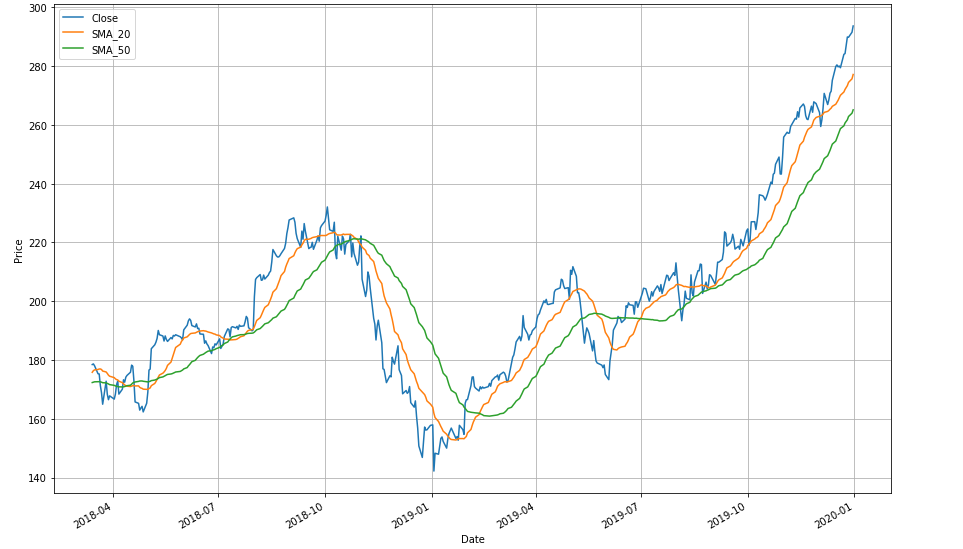

Here, let us understand two types of moving averages based on the ranges (number of days) of the time period they are calculated in and the moving average crossover:

- Faster moving average (Shorter time period) –

A faster moving average is the mean of a data set (stock prices) calculated over a short period of time, say past 20 days.

2. Slower moving average (Longer time period) –

A slower moving average is the one that is the mean of a data set (stock prices) calculated from a longer time period say 50 days.

Now, a faster-moving average and a slower moving average also come to a position together where a “crossover” occurs.

According to Wikipedia, “A crossover occurs when a faster-moving average (i.e., a shorter period moving average) crosses a slower moving average (i.e. a longer period moving average). In other words, this is when the shorter period moving average line crosses a longer period moving average line.”

Visit QuantInsti website to download the mathematical formulas and read the rest of the article.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from QuantInsti and is being posted with its permission. The views expressed in this material are solely those of the author and/or QuantInsti and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.