Around a month ago, we launched a series of short videos called “Quantpedia Explains“, in which we plan to show and explain some of the themes out of quantitative finance that we think are worth mentioning. We have started with a quick intro to individual Quantpedia Pro reports, and now, we have expanded our content with a series of short case study articles. Each article uses one Quantpedia Pro report to generate a quick market/portfolio insight, and this blog post will give you a short recapitulation of the first five studies.

Insight nbr.1:

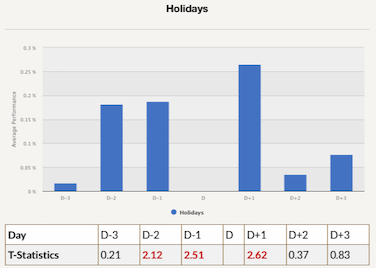

In our first, seasonal case study, we verified a few ideas out the academic research related to seasonality in the stock market (Turn of the Month effect described in “Xu, McConnell: Equity Returns at the Turn of the Month“, FED day effect described in “Tori: Federal Open Market Committee meetings and stock market performance“, etc.). We are often proponents of using academic research as an inspiration to translate a trading idea from one asset class to another. We used this opportunity to analyze the seasonal behaviour of Gold and shown that it displays a strong seasonal tendency in returns in days around US public holidays (which is not widely known).

Insight nbr. 2:

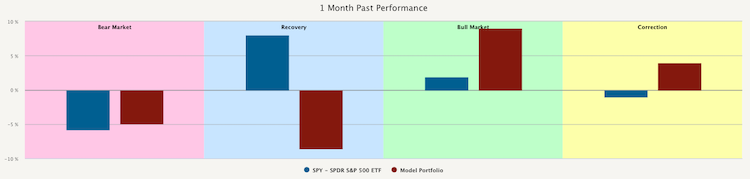

In the Market Phases Analysis case study, we devoted our time to studying how Bitcoin performs during various phases of the market cycle. Some cryptocurrency proponents advocate that Bitcoin can be used as a store of value, mainly during the economic and financial crisis. In the past, we have written a blog post where we argued that it is not necessarily the case as the performance of Bitcoin is usually the worst during the same time as stock market experiences the bear market. The following figure shows the 1 month past performance of SPY (blue bars) and Bitcoin (red bars).

Insight nbr. 3:

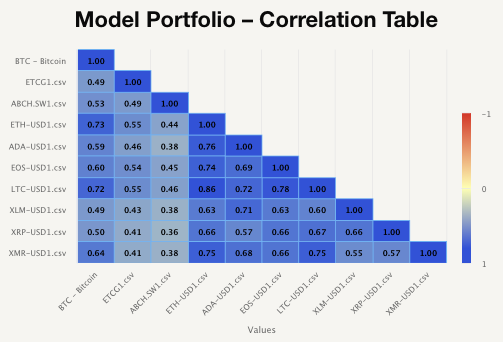

The third case study is related to the Correlation Analysis report, which can be used to analyze any model portfolio. We examined how are cryptocurrencies correlated to other assets and how the correlation evolved over time. The resulting outcome is that cryptocurrency market correlation slowly increases, and we can’t rule out the financialization of the crypto market (the same process that happened in commodities approximately ten years ago).

Insight nbr. 4:

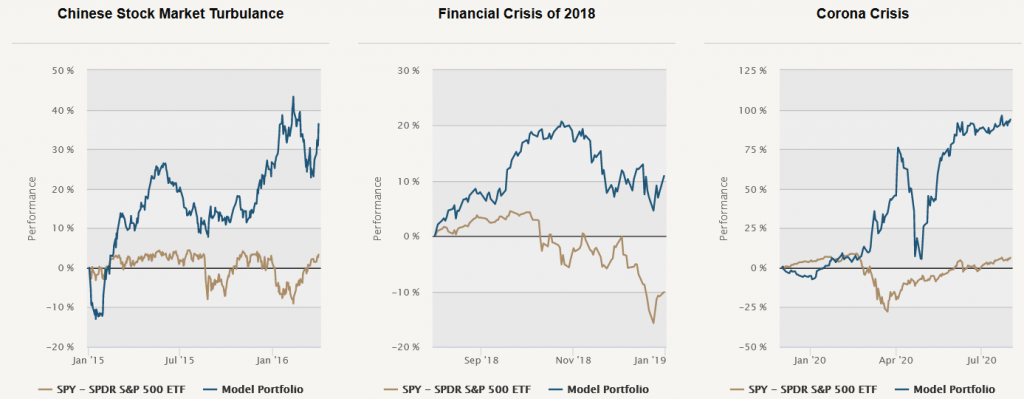

The fourth case study explores the Crisis Analysis report, which we used to analyze the behaviour of three different model portfolios during multiple short-term and long-term crisis periods. The case study confirmed that skewness-based trading strategies could serve as a practical hedge/diversification during stock market drawdowns (as we also described in our older article).

Insight nbr. 5:

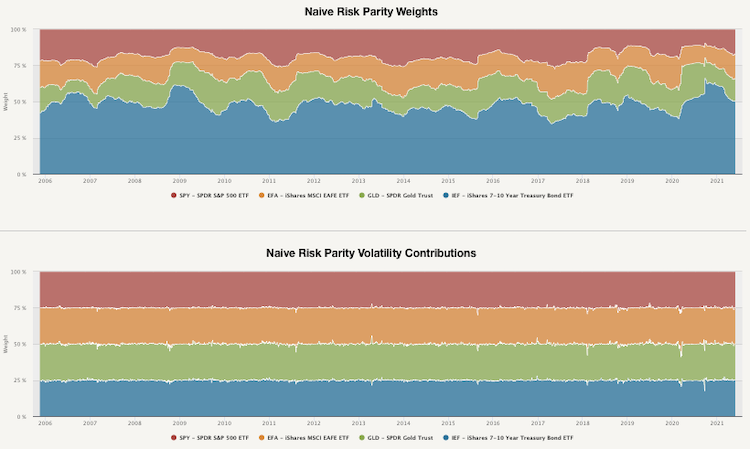

The fifth case study shows how to apply the Naive Risk Parity method to the model portfolio that consists of four ETFs. It shows the main attribute of most of the risk parity portfolios – lower total returns but significantly lower risk measures.

Visit Quantpedia for additional insight on this topic: https://quantpedia.com/five-small-shards-of-insight-hidden-in-data/.

Past performance is not indicative of future results.

Any stock, options or futures symbols displayed are for illustrative purposes only and are not intended to portray recommendations.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Quantpedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Quantpedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.