In this post we will explore how to download fundamentals data with Python. We’ll be extracting fundamentals data from Yahoo Finance using the yahoo_fin package. For more on yahoo_fin, including installation instructions, check out its full documentation here.

Getting started

Now, let’s import the stock_info module from yahoo_fin. This will provide us with the functionality we need to scrape fundamentals data from Yahoo Finance. We’ll also import the pandas package as we’ll be using that later to work with data frames.

import yahoo_fin.stock_info as si

import pandas as pd

Next, we’ll dive into getting common company metrics, starting with P/E ratios.

How to get P/E (Price-to-Earnings) Ratios

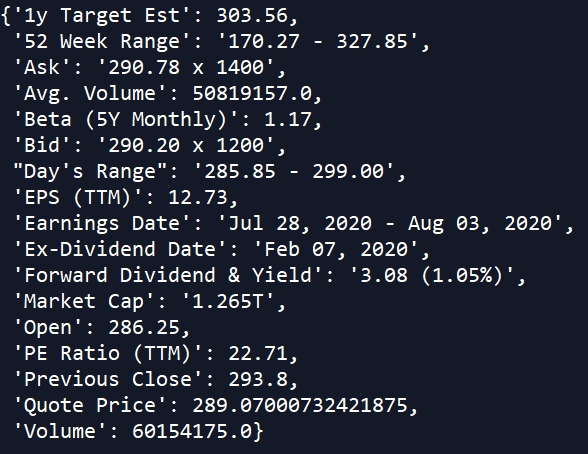

There’s a couple ways to get the current P/E ratio for a company. First, we can use the get_quote_table method, which will extract the data found on the summary page of a stock (see here).

quote = si.get_quote_table(“aapl”)

Next, let’s pull the P/E ratio from the dictionary that is returned.

quote[“PE Ratio (TTM)”] # 22.71

A company’s P/E ratio can also be extracted from the get_stats_valuation method. Running this method returns a data frame of the “Valuation Measures” on the statistics tab for a stock.

val = si.get_stats_valuation(“aapl”)

val = val.iloc[:,:2]

val.columns = [“Attribute”, “Recent”]

Next, let’s extract the P/E ratio.

float(val[val.Attribute.str.contains(“Trailing P/E”)].iloc[0,1])

How to get P/S (Price-to-Sales) Ratios

Another popular metric is the P/S ratio. We can get the P/S ratio, along with several other other metrics, using the same get_stats_valuation method. Let’s use the object we pulled above, currently stored as val.

Then, we can get the Price/Sales ratio like below.

Getting fundamentals stats for many stocks at once

Now, let’s get the Price-to-Earnings and Price-to-Sales ratios for each stock in the Dow. We could also do this for a custom list of tickers as well.

# get list of Dow tickers

dow_list = si.tickers_dow()

# Get data in the current column for each stock’s valuation table

dow_stats = {}

for ticker in dow_list:

temp = si.get_stats_valuation(ticker)

temp = temp.iloc[:,:2]

temp.columns = [“Attribute”, “Recent”]

dow_stats[ticker] = temp

# combine all the stats valuation tables into a single data frame

combined_stats = pd.concat(dow_stats)

combined_stats = combined_stats.reset_index()

del combined_stats[“level_1”]

# update column names

combined_stats.columns = [“Ticker”, “Attribute”, “Recent”]

Visit TheAutomatic.net to download ready-to-use code, and read the rest of the article: http://theautomatic.net/2020/05/05/how-to-download-fundamentals-data-with-python/

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from TheAutomatic.net and is being posted with its permission. The views expressed in this material are solely those of the author and/or TheAutomatic.net and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.