The article “Macro Risks and the Term Structure of Interest Rates” first appeared on Alpha Architect Blog.

Macro risks and the term structure of interest rates

- Bekaert, Engstrom, Ermolov

- Journal of Financial Economics, 2021

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The authors of this paper identify aggregate supply and aggregate demand shocks for the US economy utilizing macroeconomic data on inflation, real GDP growth, core inflation, and the unemployment gap. They then go on to extract how these shocks to supply and demand impact the term structure of interest rates. This paper investigates two main research questions:

- Is it possible to use non-Gaussian features in US macroeconomic data to identify aggregate supply and demand shocks while imposing minimal economic assumptions?

- Do macro risks contribute to the variation in yields, bond risk premiums and the term premium?

What are the Academic Insights?

The authors explore the following bias:

- YES- The authors extract aggregate supply and demand shocks for the US economy from data on inflation, real GDP growth, core inflation and the unemployment gap. They use a novel approach exploiting unconditional higher-order moments in the data, which we show to be highly statistically significant. They find aggregate demand shocks to be distinctly negatively skewed and leptokurtic, whereas supply shocks unconditionally show little skewness but are also leptokurtic. Additionally, they find that the prevalence of supply shocks was high during the 1970s and again during the Great Recession. In contrast macroeconomic variation in the 1980s and 1990s, particularly during recessions were more strongly dominated by demand shocks. They also find that negative demand and supply shocks contributed approximately equally to the Great Recession.

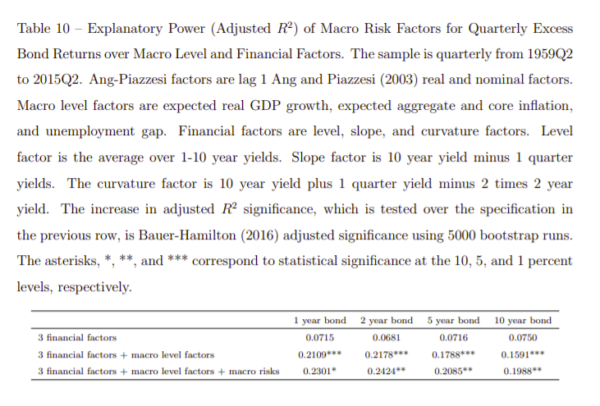

- YES- While most of the literature focuses on explaining expected bond returns with the expectations of the level of macroeconomic variables or with actual realized macroeconomic data, the authors show the importance of decomposing macroeconomic variation into components due to the variance of supply and demand shocks, and into the good and bad types of variance. They find that the time-variation in the macro risk factors for supply and demand implies that the covariance between inflation and real activity changes through time and switches sign. The analysis links the time-variation to bond risk premiums by showing that demand (supply) variance negatively (positively) estimates bond excess returns. In fact, it shows that while overall the expected excess bond returns are counter-cyclical, an increase in demand (supply) variance is associated with lower (higher) expected returns.

Why does it matter?

This paper is important because it makes several contributions to the literature. It develops a new identification methodology to decompose macroeconomic shocks into “demand” and “supply” shocks. It also develops a new dynamic model for real economic activity and inflation, where the shocks are drawn from a Bad Environment – Good Environment model, which accommodates time-varying non-Gaussian features with “good” and “bad” volatility. Finally, it links the macro factors to the term structure.

The Most Important Chart from the Paper:

Abstract

We extract aggregate supply and aggregate demand shocks for the US economy from macroeconomic data on inflation, real GDP growth, core inflation and the unemployment gap. We first use unconditional non-Gaussian features in the data to achieve identification of these structural shocks while imposing minimal economic assumptions. We find that recessions in the 1970s and 1980s are better characterized as driven by supply shocks while later recessions were driven primarily by demand shocks. The Great Recession exhibited large negative shocks to both demand and supply. We then use conditional (time-varying) non-Gaussian features of the structural shocks to estimate “macro risk factors” for supply and demand shocks that drive “bad” (negatively skewed) and “good” (positively skewed) variation for supply and demand shocks. The Great Moderation, a general decline in the volatility of many macroeconomic time series since the 1980s, is mostly accounted for by a reduction in the good demand variance risk factor. In contrast, the risk factors driving bad variance for both supply and demand shocks, which account for most recessions, show no secular decline. Finally, we find that macro risks significantly contribute to the variation in yields, bond risk premiums and the term premium. While overall bond risk premiums are counter-cyclical, an increase in bad demand variance is associated with lower risk premiums on bonds.

Past performance is not indicative of future results.

Any stock, options or futures symbols displayed are for illustrative purposes only and are not intended to portray recommendations.

Disclosure: Alpha Architect

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

This site provides NO information on our value ETFs or our momentum ETFs. Please refer to this site.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Alpha Architect and is being posted with its permission. The views expressed in this material are solely those of the author and/or Alpha Architect and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.