This post explains the logistic regression and implements R code for the estimation of its parameters.

Introduction

Logistic Regression is a benchmark machine learning model. This model have a binary response variable (Y) which takes on 0 or 1. We can find lots of this kind of variables, among them are success/failure, bankruptcy/solvency, exit/stay. To understand logistic regression model, we should know PMF(probability mass function) of the binomial distribution since its log likelihood function is constructed using this PMF. Given this log likelihood function, we can estimate its parameters by maximizing the log likelihood function by MLE (maximum likelihood estimation).

PMF for the binomial distribution

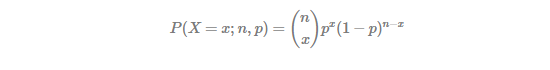

Given success probability p and the number of trials n, binomial distribution produces the probability of occurring x(≤n) success as follows.

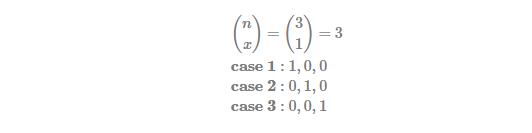

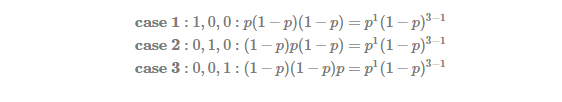

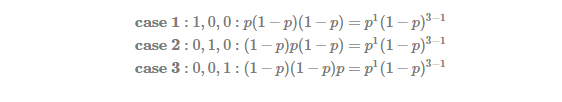

From the above equation for P(X=x;n,p),  denotes the case when the number of success is x from n Bernoulli trials. Let’s take an example: suppose n = 3, x = 1.

denotes the case when the number of success is x from n Bernoulli trials. Let’s take an example: suppose n = 3, x = 1.

It is worth noticing that since P(X=x;n,p) have one p, the symbol of combination is used. This logic is similar to that of calculating one weighted average.

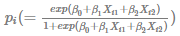

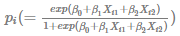

Standard linear regression is used for the calculation of the conditional mean, which is varying with the realization of covariates (X). This means that in addition to the unconditional mean, additional information from covariates are useful for the improvement of forecast performance. This story is also applied to logistic regression. Assuming p is neither a fixed nor an unconditional probability, we can estimate the conditional probability using explanatory variables (X).

Logit transformation

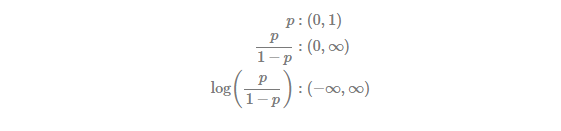

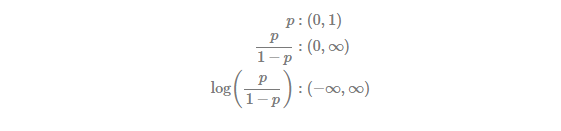

Since explanatory variables X have useful information for explaining variation of a binary variable Y, we can set up a linear regression model for this binary response variable. But output from a standard linear regression can be of less than zero or more than one. This is, therefore, not appropriate because Y is the binary variable which have a range from 0 and 1. From this reason, we need the following logit transformation which converts 0~1 binary variable to −∞~∞ real number.

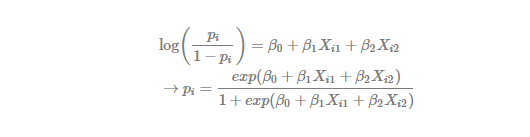

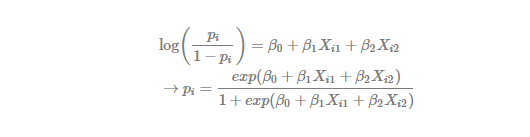

Using this transformation, we can obtain the logistic regression model in the following way.

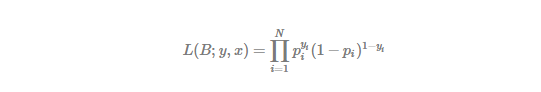

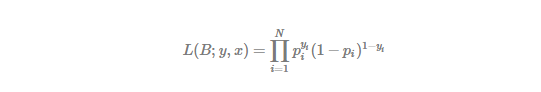

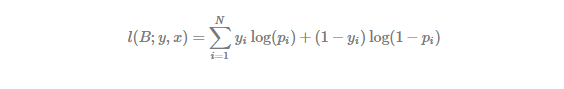

Log-likelihood function

Since each

We can find that there is no term like

It is typical to estimate parameters using MLE by calling numerical optimization. But for ready-made models like linear regression, logistic regression, etc, it is convenient to use glm() R package which performs optimization automatically.

R code for Logistic Regression

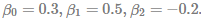

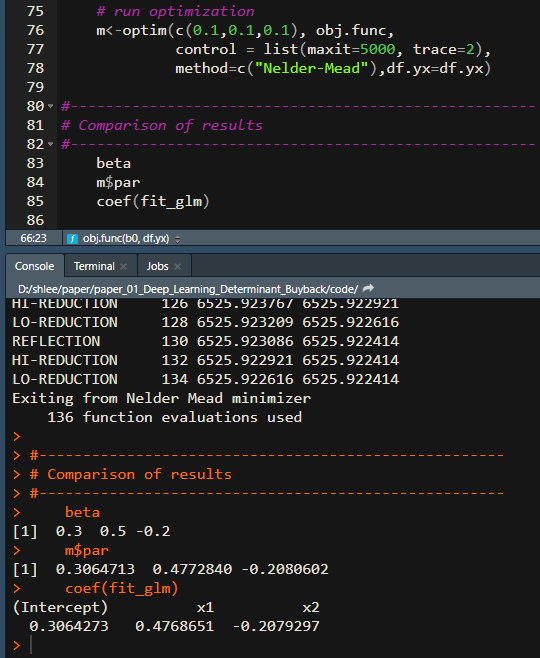

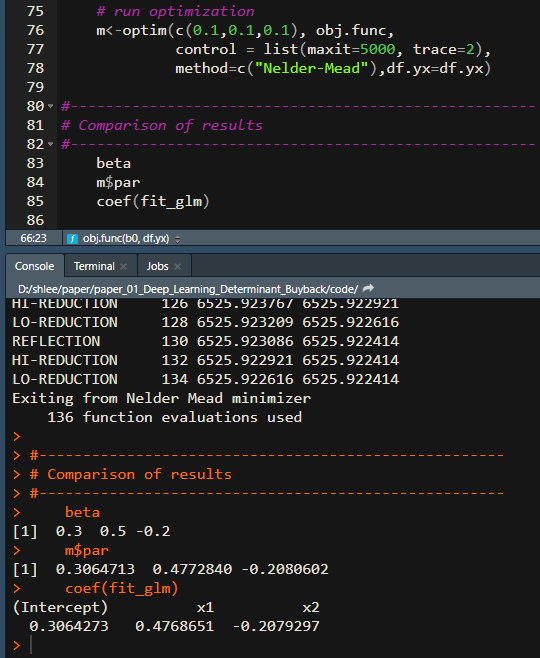

The following R code shows how to implement logistic regression using R. We provide two-method: the one uses glm() conveniently and the other maximize log likelihood function by numerical MLE directly. To check for the accuracy of estimation, we assume population parameters as

#=========================================================================#

# Financial Econometrics & Derivatives, ML/DL using R, Python, Tensorflow

# by Sang-Heon Lee

#-------------------------------------------------------------------------#

# Logistic Regression

#=========================================================================#

graphics.off() # clear all graphs

rm(list = ls()) # remove all files from your workspace

#-----------------------------------------------------

# Simulated data

#-----------------------------------------------------

# number of observation

nobs <- 10000

# parameters assumed

beta <- c(0.3, 0.5, -0.2)

# simulated x

x1 <- rnorm(n = nobs)

x2 <- rnorm(n = nobs)

bx = beta[1] + beta[2]*x1 + beta[3]*x2

p = 1 / (1 + exp(-bx))

# simulated y

y <- rbinom(n = nobs, size = 1, prob = p)

# simulated y and x

df.yx <- data.frame(y, x1, x2)

#-----------------------------------------------------

# Estimation by glm

#-----------------------------------------------------

fit_glm = glm(y ~ ., data = df.yx, family = binomial)

summary(fit_glm)

#-----------------------------------------------------

# Estimation by optimization

#-----------------------------------------------------

# objective function = negative log-likelihood

obj.func <- function(b0, df.yx) {

beta <- b0

y <- df.yx[,1]

x <- as.matrix(cbind(1,df.yx[,-1]))

bx = x%*%beta

p = 1 / (1 + exp(-bx))

# we can calculate log-likelihood

# using one of the two below

# 1. vector operation

#

loglike <- sum(y*log(p) + (1-y)*log(1-p))

# 2. loop operation

#

# loglike <- 0

# for(i in 1:nrow(df.yx)) {

# loglike <- loglike + y[i]*log(p[i]) +

# (1-y[i])*log(1-p[i])

# }

return(-1*loglike)

}

# run optimization

m<-optim(c(0.1,0.1,0.1), obj.func,

control = list(maxit=5000, trace=2),

method=c("Nelder-Mead"),df.yx=df.yx)

#-----------------------------------------------------

# Comparison of results

#-----------------------------------------------------

beta

m$par

coef(fit_glm)The above R program delivers the parameter estimates from two approaches.

From the estimation output, we can find that two approaches show the same results. Numerical optimziation for MLE is used only for educational purpose. It is, therefore, recommended to use glm() function.

For additional insight on this topic and to download the R script, visit https://kiandlee.blogspot.com/2021/05/understanding-logistic-regression.html.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from SHLee AI Financial Model and is being posted with its permission. The views expressed in this material are solely those of the author and/or SHLee AI Financial Model and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.