Key takeaways

The road to recovery

While the path to a sustained recovery and a new business cycle won’t be a straight one, I take solace in the belief that we are now finally on that path.

Financial resolutions

To start, assess each purchase not on its actual cost but on its opportunity cost. Every dollar spent is one that cannot work for you.

Brighter times ahead?

Our latest podcast guest explains why he’s becoming increasingly bullish after spending much of the year concerned about equities.

Goodbye and good riddance to 2022. I think we all need a break from what was a very challenging year. I’ll keep it short and run through a few of our usual categories with a level of brevity that is not typically my forte.

‘Tis the season

It’s beginning to look a lot like …

… a recovery? Stocks have been rallying1, bond yields have been falling2, the US dollar has been weakening3. The risk-on trade has been a nice reprieve from the “everything bear market”. What’s driving it?

Toys in every store …

… are a testament to how much supply chain challenges have eased and retail inventories have surged.4 The goods inflation story is now largely in the rearview mirror.

But the prettiest sight to see …

… is inflation expectation plunging. As I type this, the bond market’s expectation of inflation over the next year is now at 2.1%, well within the US Federal Reserve’s “comfort zone.”5

And the thing that’ll make (risk assets) ring is the …

… pause in monetary policy tightening that may be coming. The market expects the Fed to complete the most aggressive period of policy tightening on record by Q1 2023.6

Let’s not get too far ahead of ourselves. The rebound in market sentiment should be likely viewed as a positive repricing of recession risks. In other words, as inflation moderates, the likelihood that the Fed would be forced to drive the economy into a deep and long-lasting recession is receding. The lagged effects of interest rate hikes, however, are still left to be felt by the economy. While the path to a sustained recovery and a new business cycle won’t be a straight one, I take solace in the belief that we are now finally on that path.

Potential New Year’s resolutions for investors

- Save! It’s estimated that fully 18% of American household income is wasted on items such as unused gym memberships, lottery tickets, gambling, wasted food, wasted energy, interest expenses on credit cards, and more.7

- Assess each purchase not on its actual cost but on its opportunity cost. Every dollar spent is one that cannot work for you.

- Automate your investments. If you pay yourself first, you take emotion out of the equation.

- Stop trying to time the markets. Investors often tend to make bad decisions at inopportune times. Case in point: Stock and bond funds experienced significant outflows in September, only for the stock and bond markets to surge in October.8

- Steel your nerves. It was a tough year. But if history is a guide, then I expect US markets to recover and reach ever-higher highs over time.9

Since you asked

Have bonds lost their usefulness? No. Yields are as attractive today as they have been in years.10 Further, long-term rates tend to rally once the yield curve becomes deeply inverted.11 Currently, the yield curve is as inverted as it has been in decades. If anything, I would expect bonds, in 2023, to reaffirm their usefulness.

It may be confirmation bias, but …

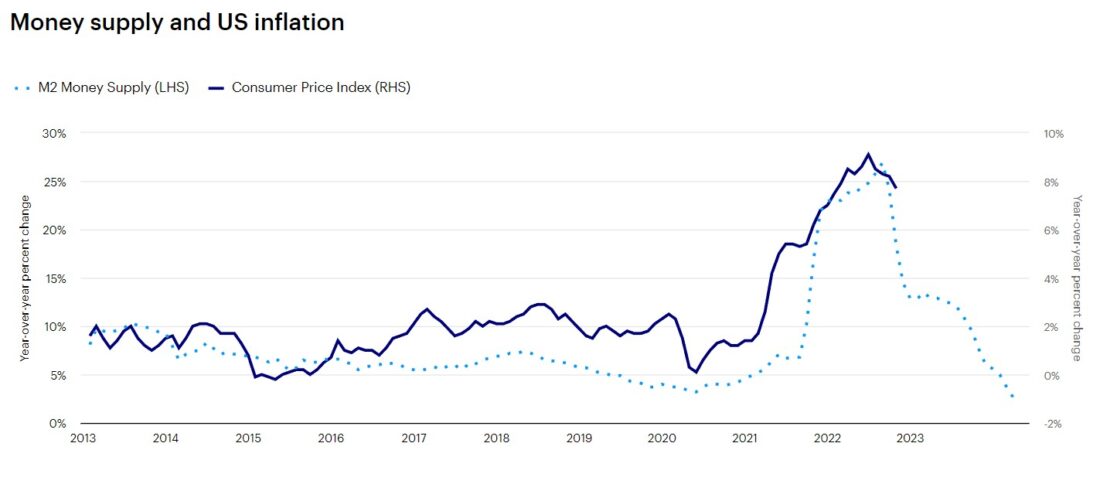

… inflation may come down more rapidly than many believe. Nobel Prize-winning economist Milton Friedman said that “inflation is always and everywhere a monetary phenomenon.” The growth in money supply is plunging.12 Inflation tends to follow.

Sources: Bloomberg, US Federal Reserve, 11/30/22. M2 is coins and notes in circulation plus short-term deposits in banks and certain money market funds. The Consumer Price Index (CPI) measures change in consumer prices as determined by the US Bureau of Labor Statistics. Core CPI excludes food and energy prices while headline CPI includes them. Past performance is no guarantee of future results.

Everyone gets a podcast

Talley Léger, Equity Strategist at Invesco, joined the Greater Possibilities podcast to declare that he is becoming increasingly bullish after spending much of the year concerned about equities. Talley’s reasoning:

- Stocks have already priced in a mild recession.13

- Inflation appears to have peaked in June.14

- The US dollar and US Treasury yields may have peaked in October.15

- The Fed is poised to slow its rate of interest rate hikes.16

Talley added, “I’m more concerned about missing the long-term recovery and the best few days in the market than I am about an additional 10% downside if I’m wrong.”

Talley is a man after my own heart.

On the road again

My travels in December took me to Cleveland, Ohio, to a conference where I was on an agenda with Eddie George, the former Tennessee Titans running back and Heisman Trophy winner at Ohio State University. (I resisted mentioning that my Michigan Wolverines bested his Buckeyes for the second consecutive year.)

George talked about the power of goal setting. As an underclassman, he visited the Downtown Athletic Club where the Heisman Trophy is awarded. He stayed in the room and mapped out his plan to one day receive the award. If the team worked out once a day, he worked out twice. It wasn’t easy. George was even benched for over a year and considered transferring. Instead, he treated every practice as a game and every play as if the championship were on the line. On Dec. 9, 1995, Eddie George returned to the Downtown Athletic Club to receive his Heisman Trophy.

Goal setting. Perseverance. Consistency. It was a great message after a very difficult year.

Happy holidays to everyone. I’ll see you in 2023.

Footnotes

- 1Source: Bloomberg, 12/9/22, as represented by the S&P 500 Index

- 2Source: Bloomberg, 12/9/22, as represented by the 10-year US Treasury rate

- 3Source: Bloomberg, 12/9/22, as represented by the US Dollar Index, which measures the value of the US dollar relative to majority of its most significant trading partners.

- 4Source: US Census Bureau, 11/30/22

- 5Source: Bloomberg, 12/9/22. The 1-year inflation breakeven is calculated by the difference between the 1-year US Treasury rate and the 1-year US Treasury Inflation Protected Security rate.

- 6Source: Bloomberg, 12/9/22, as represented by the Fed funds implied futures, which are financial contracts that represent the market’s opinion of where the federal funds rate will be at a specified point in the future. The federal funds rate is the rate at which banks lend balances to each other overnight.

- 7Source: US Census Bureau, 2021

- 8Source: Investment Company Institute and Bloomberg. Stocks are represented by the S&P 500 Index. Bonds are represented by the Bloomberg US Aggregate Bond Index, which is an unmanaged index considered representative of the US investment-grade, fixed-rate bond market.

- 9Source: Bloomberg, 12/9/22, based on the long-term advance of the S&P 500 Index from 1957 to 12/9/2022

- 10Source: Bloomberg, 12/9/22, based on the yield to worst of the Bloomberg US Aggregate Bond Index. Yield to worst is the lowest potential yield an investor can receive on a bond without the issuer actually defaulting.

- 11Source: Bloomberg, 12/9/22

- 12Source: Bloomberg, US Federal Reserve, 11/30/22. M2 is coins and notes in circulation plus short-term deposits in banks and certain money market funds.

- 13Source: Bloomberg, 10/31/22. Based on recession dates defined by the National Bureau of Economic Research: Aug. 1957 – Apr. 1958, Apr. 1960 – Feb. 1961, Dec. 1969 – Nov. 1970, Nov. 1973 – Mar. 1975, Jan. 1980 – Jul. 1980, Jul. 1981 – Nov. 1982, Jul. 1990 – Mar. 1991, Mar. 2001 – Nov. 2001, Dec. 2007 – Jun. 2009 and Feb. 2020 – Apr. 2020.

- 14Source: US Bureau of Labor Statistics, 10/31/22

- 15Source: Bloomberg, 11/18/22. Based on the 10-year US Treasury rate and the strength of the US dollar versus a trade-weighted basket of currencies.

- 16Source: Bloomberg, 12/9/22, based on Fed funds implied futures.

—

Originally Posted December 20, 2022

Above the Noise: Signs of a brighter year ahead? by Invesco US

Important information

NA2639983

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions. This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

All investing involves risk, including the risk of loss.

Past performance does not guarantee future results.

Investments cannot be made directly in an index.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

In general, stock values fluctuate, sometimes widely, in response to activities specific to the company as well as general market, economic and political conditions.

The yield curve plots interest rates, at a set point in time, of bonds having equal credit quality but differing maturity dates to project future interest rate changes and economic activity. An inverted yield curve is one in which shorter-term bonds have a higher yield than longer-term bonds of the same credit quality. In a normal yield curve, longer-term bonds have a higher yield.

Tightening is a monetary policy used by central banks to normalize balance sheets.

The S&P 500 Index is a market-capitalization-weighted index of the 500 largest domestic US stocks.

The opinions referenced above are those of the author as of Dec. 14, 2022. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

Disclosure: Invesco US

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial advisor/financial consultant before making any investment decisions. Invesco does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. Federal and state tax laws are complex and constantly changing. Investors should always consult their own legal or tax professional for information concerning their individual situation. The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

All data provided by Invesco unless otherwise noted.

Invesco Distributors, Inc. is the US distributor for Invesco Ltd.’s Retail Products and Collective Trust Funds. Institutional Separate Accounts and Separately Managed Accounts are offered by affiliated investment advisers, which provide investment advisory services and do not sell securities. These firms, like Invesco Distributors, Inc., are indirect, wholly owned subsidiaries of Invesco Ltd.

©2024 Invesco Ltd. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Invesco US and is being posted with its permission. The views expressed in this material are solely those of the author and/or Invesco US and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)