Our recent survey revealed that 31% of European professional investors say they don’t allocate to thematic ETFs as there is too much overlap with existing portfolio allocations1. In this blog, we explore why this isn’t always the case and the importance of always checking ‘under the bonnet’.

The best thing about exchange-traded funds (ETFs) is that they represent a wider array of tools that investors can use to manage the risks they want to take within their portfolios. Thematic ETFs are simply a subset of the broader ETF universe.

It is our belief that the ultimate value of ETFs, thematic or otherwise, comes from the ease with which they can be used to satisfy portfolio objectives.

Building a thematic strategy: WisdomTree’s case study of artificial intelligence

In the latter part of 2018, WisdomTree was contemplating its initial foray into thematic strategies. Artificial intelligence (AI) was going to be the first offering.

In constructing the exposure, we noticed what we believe is one of the classic conundrums when building an investment like this.

One doesn’t need to look too deeply at companies like Amazon, Alphabet, Microsoft and Apple to see that artificial intelligence is important. These companies contribute a lot to research and development in the space, and they tend to also have massive platforms of users. When companies have such large user bases (billions in some cases) any action taken or offering made is globally significant within an instant. Not many companies have ever had this in the history of the world.

However, these companies tend to be some of the largest weights in the most established benchmarks, whether one is tech-focused looking at the Nasdaq 100 Index or more globally focused looking at the MSCI ACWI Index. Even if we had an amazing AI story behind Amazon, Alphabet, Microsoft and Apple, and even if everyone chose to agree with our story, many wouldn’t even need our ‘new fund’ to take advantage. Without ever hearing the story, they already have the exposure!

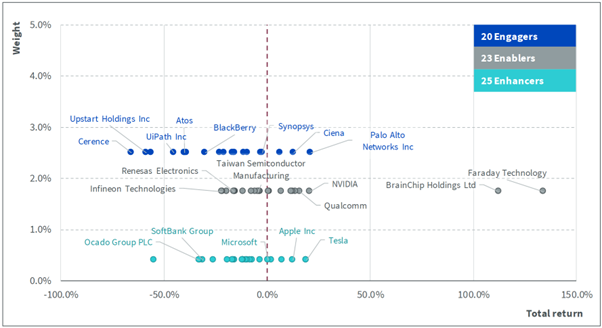

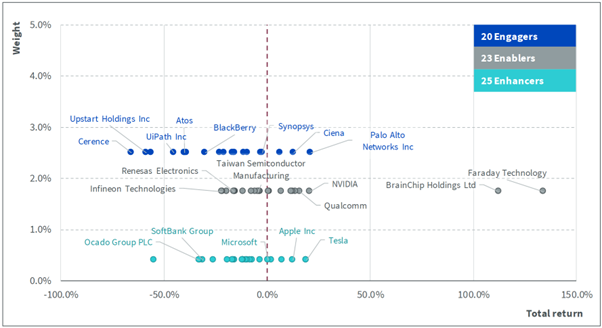

Figure 1 showcases how WisdomTree addressed this challenge within the context of the Nasdaq CTA Artificial Intelligence Index. Whilst not the only solution, it is a notable example.

Statement of the problem: Some of the world’s largest companies (Amazon, Apple, Microsoft and Alphabet) do a lot within the artificial intelligence space and could make sense within such a megatrend exposure. However, if investors have exposure to equities, it is highly likely that they already have exposure to these firms whether or not they care about AI.

WisdomTree’s approach to mitigation: Within the context of the Nasdaq CTA Artificial Intelligence Index, companies are split into 3 distinct groups: Engagers, Enablers and Enhancers. Engagers are those companies for which AI is the clear dominant focus and, when they sell a product or service to customers, they are spreading AI. These companies will comprise 50% of the total exposure. Enablers are companies that represent the hardware upon which AI runs, largely semiconductors, and these are 40% of the total exposure. Enhancers are those companies which may be very large, very important, but that do many things that could very well include AI. Enhancers will only be 10% weight in total.

By classifying Amazon, Apple, Alphabet and Microsoft as ‘Enhancers’, the weight is therefore reduced and investors will not see a top 10 holdings that looks similar to the world’s benchmark indices.

Figure 1: Tiering exposures to control putting too much weight in the world’s largest companies

Source: WisdomTree, CTA, Nasdaq. Total returns of stocks are in USD terms and for the period between two rebalances, from 17 September 2021 to 18 March 2022. If companies went public after 17 September 2021, their return is computed starting from the day of their IPO or direct listing. Companies are constituents of the NASDAQ CTA Artificial Intelligence Index. Weights represent hypothetical equal weights computed from the number of stocks within each index category and the portfolio weight allocated to that category, assuming 50% for engagers, 40% for enablers and 10% for enhancers.

You cannot invest directly in an index.

Historical performance is not an indication of future performance and any investments may go down in value.

Conclusion: always check the overlap

If investors were to walk away from reading this piece remembering one statement, it should be this: always check the overlap.

What we mean specifically is to recognise that every portfolio has existing, main benchmark exposures. Investors must recognise what these are and then test any new investment, thematic or otherwise, against them.

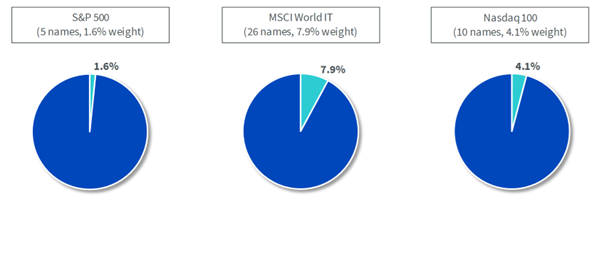

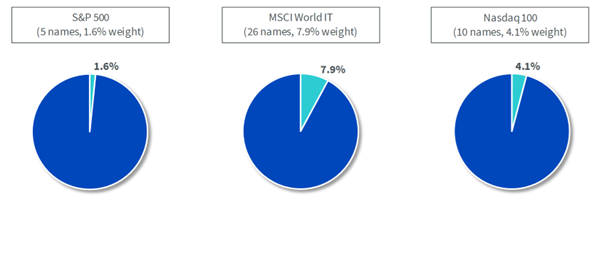

In Figure 2, we can consider a hypothetical example where an investor has a lot of large market capitalisation tech exposure, mostly through the United States. Is it appropriate to include a strategy focused on cloud computing?

One metric that could help in assessing this decision could be overlap. We know that the largest public cloud providers (Amazon Web Services, Microsoft Azure and Google Cloud) are parts of some of the largest companies in the world and are already represented in the S&P 500, Nasdaq 100 and other major benchmarks.

But does a cloud computing exposure need exposure to these parts of the market?

Our real answer is that it depends. In Figure 2, we show the overlap between the BVP Nasdaq Emerging Cloud Index which, due to its focus on the ‘emerging cloud’, does not include exposure to any of the world’s largest companies that house the big public cloud providers. Other cloud strategies may include these companies. Our point is not to say ‘one is right’ and ‘one is wrong’, but rather to simply say that many investors already have exposure to the world’s largest public cloud providers without needing to focus on a cloud investment.

Figure 2: Emerging cloud is different from the largest public cloud player

Source: WisdomTree, Nasdaq, FactSet, MSCI, S&P Global. As of 31 May 2022. EMCLOUD is the BVP Nasdaq Emerging Cloud Index. Overlap of common securities is the sum of all overlapping weights with EMCLOUD within a given index. Overlapping weight is computed as the lower weight of a security that is held both in EMCLOUD and a given index.

You cannot invest directly in an index.

Historical performance is not an indication of future performance and any investments may go down in value.

Our bottom line: with more tools to manage portfolios, the greater the burden of needing to understand how they all interact. Hopefully, this short piece gives some food for thought in this practice.

Sources

1 Pan European Professional Investor Survey, September 2022, 600 respondents, conducted by Core Data Research

—

Originally Posted November 7, 2022 – Do thematic ETFs have too much overlap with established indices?

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)