Imagine if investing worked like this: you fire up your Bloomberg in the first week of January. You trade some stocks, pull up a few charts, read the news but mostly, you wait for a market indicator that is only published on the fifth trading day. If it’s good, you go max long. The rest of the year, you pull up a few charts, read the news but you don’t trade anymore. By year end, much more often than not, you make money. Read on.

It turns out, there is widespread belief such an indicator does in fact exist: The First 5 Trading Days of January. It’s alarmingly simple. If the market is up after the first five trading days of the year, it’ll end the year up. If it’s down, it won’t be a good year.

Investors are famously superstitious. It’s not unusual to see hedge fund managers wear their “lucky socks” for days on end when the monthly P&L is down. This has left a plethora of mediocre – or downright incorrect – indicators still in use because, well: can you be sure it’s NOT going to work this time?

You can’t, of course but that’s the wrong premise. The working assumption with any indicator should be that it’s garbage unless you have compelling evidence to the contrary.

To be fair, its most recent record has been stellar. It worked in the pandemic 2020 – correctly predicting the upturn – and again in 2021. It then also worked in 2022, this time anticipating the downturn.

Does it stand up to more comprehensive statistical scrutiny?

Source: Barron’s

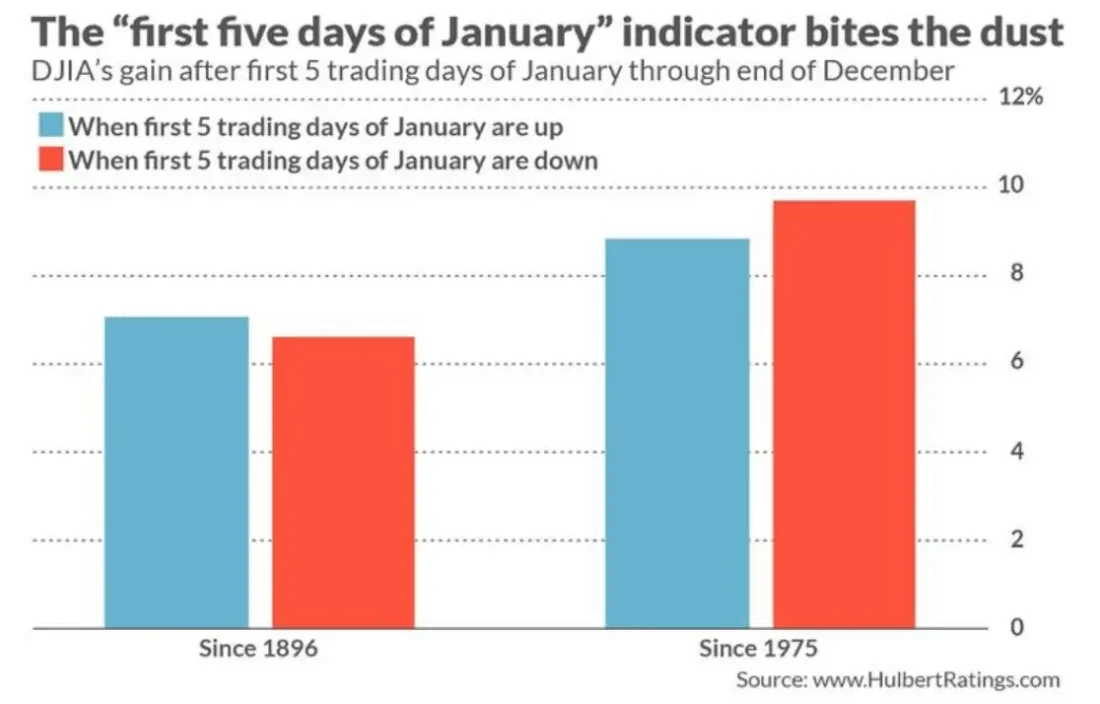

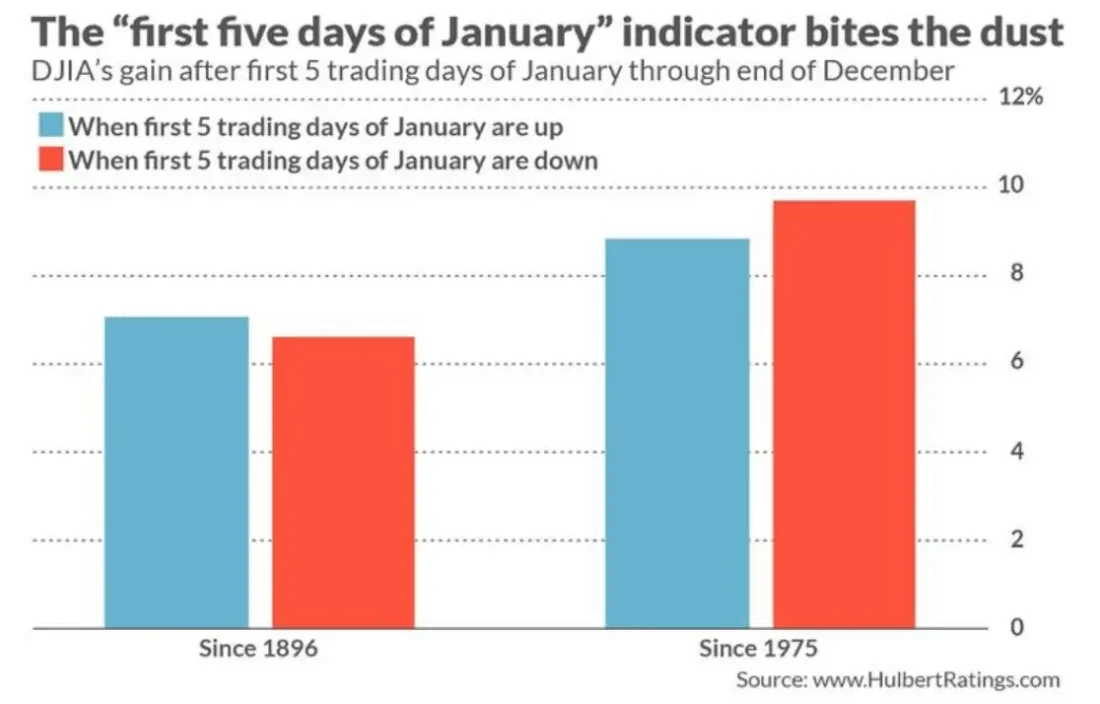

A good article in Barron’s a couple of years ago argued that it does not. The gist? The indicator isn’t any better than guessing. In fact, during the pre-1975 period when – directionally – it was marginally correct, there were other months that had stronger correlation with the full-year market performance. So, even if you liked the concept you’d have to pick a month other than January.

For those very open-minded to esoteric indicators: the planet Mercury entered one of its roughly three-week retrograde periods on December 28. TL; DR the planet appears to be moving backward. Astrologists associate that period with confusion and frustration. This paper argues that doesn’t bode well for stocks, either.

Idea Spotlight – KO:NYSE

TOGGLE observed that equity yield indicators for Danone BN:ENXP reached a recent low and historically, this led to a median increase in Coca Cola price.

Interestingly, a large portion of the insight’s episodes were observed during the Great Recession and given the beverage giant’s defensive characteristics, it could make a reliable investment for potential economic downturns.

—

Originally Posted January 4, 2023 – Does January predict market performance?

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)