Inflation report on Tuesday was good. Actually, it was pretty great: headline inflation fell to 7.1 per cent last month, lower than the 7.3 per cent forecast by economists and down from 7.7 per cent in October. It is now at the lowest level since December 2021. That gave the Fed cover to reduce the rate of hikes to a “mere” 50 bps. So why did stocks drop?

The post-meeting press conference on Wednesday is where things started to go wrong for the bullish crowd. If Fed chair Jay Powell was relieved by the previous day’s inflation report, it was not on display. Even as the US central bank slowed the pace of rate rises, the man donned his Grinch outfit.

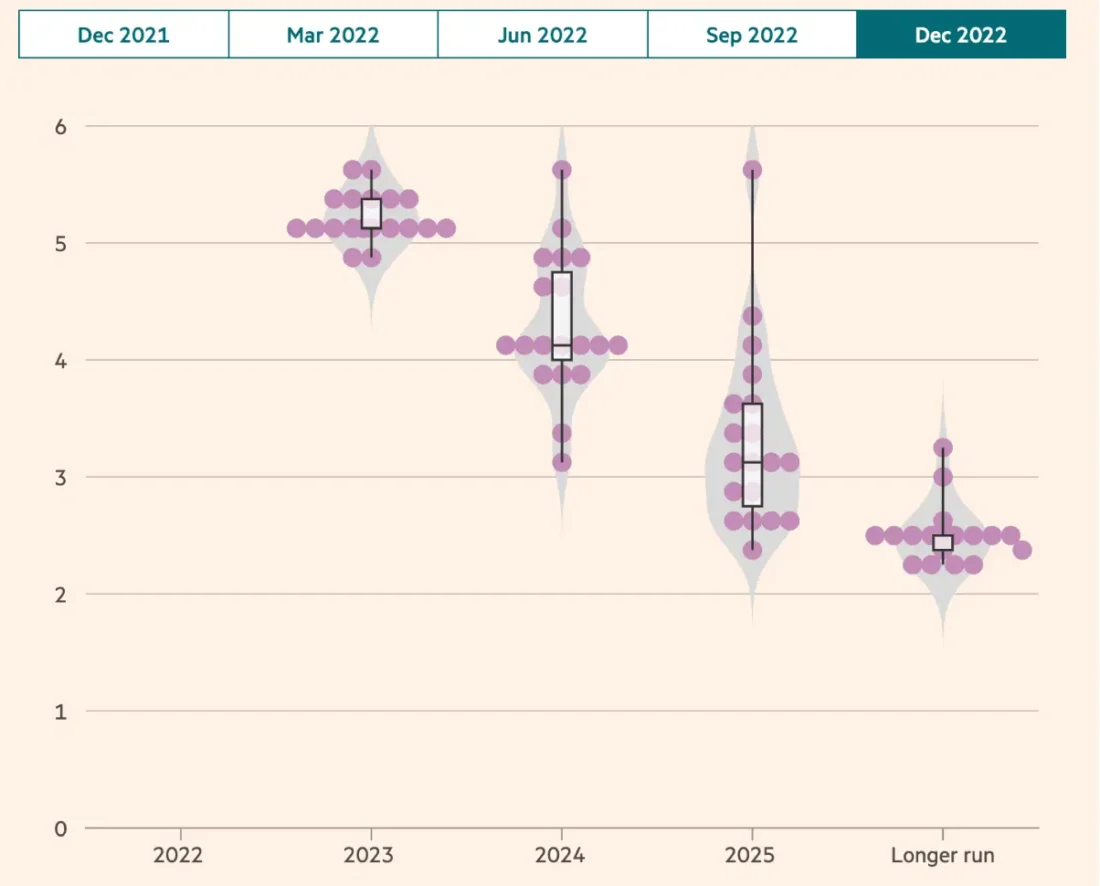

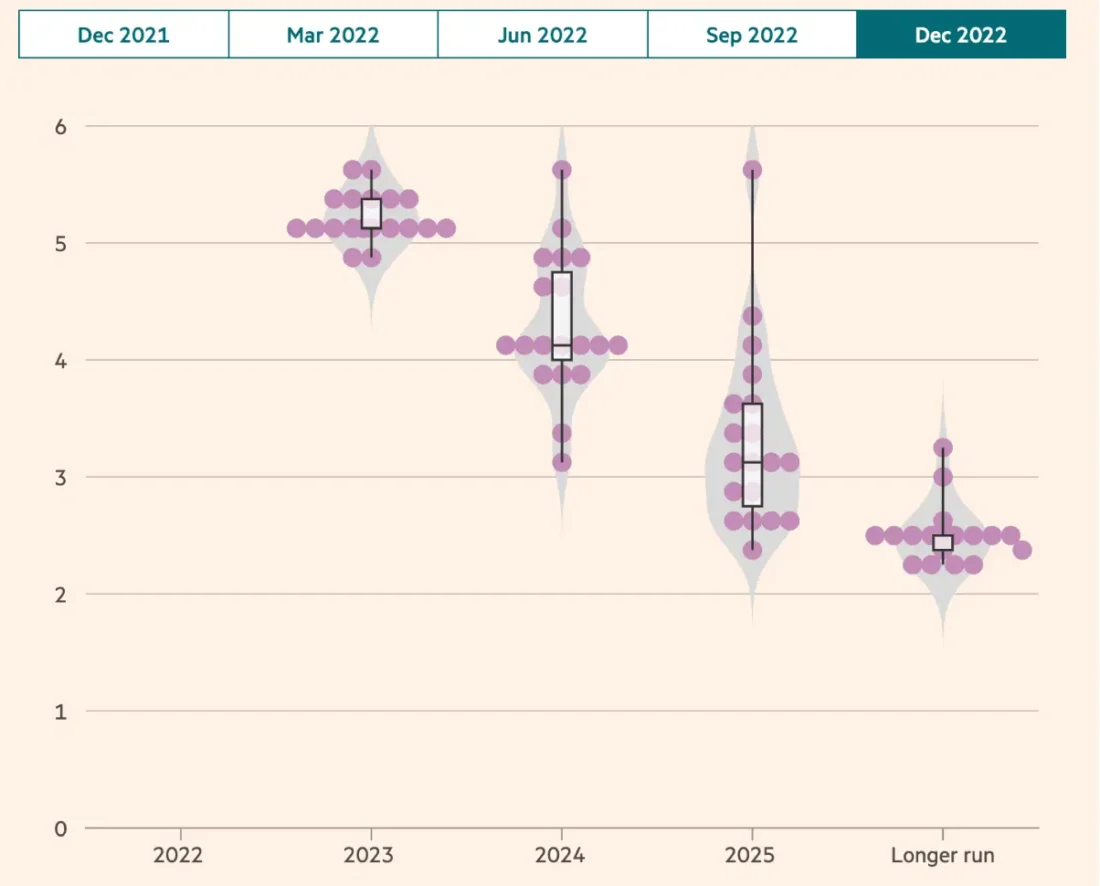

The key insight into Fed’s thinking was the quite literally named “dot plot.” The dot plot is a graphical representation of where Fed officials see interest rates going over the next several years. Each dot represents the interest rate prediction of one Fed official.

After the initial exuberance over the rate pace reduction, it took markets only a second to realize that officials expected the hiking cycle to go longer, and end higher.

Source: Financial Times

This was despite the fact that the Fed’s economic projections actually deteriorated since their last publication in September. Growth lower, and unemployment higher.

So why the hawkish rhetoric?

We discussed this a number of times but it’s worth saying it again: the Fed has to both act tough, and talk tough.

The “act tough” is impacting the short term rates. But that’s not the only channel that impacts the economy. Consumers’ sense of wealth – and therefore confidence to spend – derives from their houses and financial portfolios.

That makes long-dated mortgages, and stocks, pivotal to the overall financial conditions in the economy. The “talk tough” is a form of forward guidance where they try to prevent markets from loosening financial conditions by rallying stocks and bringing down mortgage rates.

Source: Federal Reserve bank of Cleveland

Ok, again – why?

They worry that inflation will become entrenched if they don’t. One look at the inflation picture above shows you that while headline inflation (CPI) has declined nicely, the Fed’s preferred measures (that excluding most volatile items + energy) is only just starting to decline.

The Fed is gearing up for a longer fight.

Idea Spotlight: Disney

TOGGLE analyzed 6 similar occasions in the past where analyst revision indicators for DIS:NYSE were deteriorating and historically, this led to a median increase in price.

Walt Disney’s Avatar: The Way of Water generated $134 million in US and Canadian theaters in its debut weekend – the 5th biggest opening weekends of the year domestically.

—

Originally Posted December 19, 2022 – Inflation drops. Then market drops.

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)