STOCKS – MSFT, ABNB, UPS

MACRO – SPY, RATES, VIX, MOVE

MICHAEL KRAMER AND THE CLIENTS OF MOTT CAPITAL OWN MSFT

Tomorrow is the big CPI report, and I have nothing more to add here. Most of the data indicate consensus estimates are too low. But again, all we can try to do is look at the data and make the best-educated guess we can. The PPI report was mainly in-line, too hotter; core PPI was the only metric that came in lower at 7.2% less than the 7.3% estimate.

The market didn’t care much about the PPI report and finished lower by around 33 bps to close at 3,577. The pattern on the SPX looks pretty bearish at this point; with a descending triangle pattern and a gap lower tomorrow, I would think things get into motion for a test of 3,520 and potentially a drop to around 3,220.

To be honest, I’m unsure how I got to this point of looking for such a significant drop in the index. But this is what I am seeing and where the data have led me.

Volatility

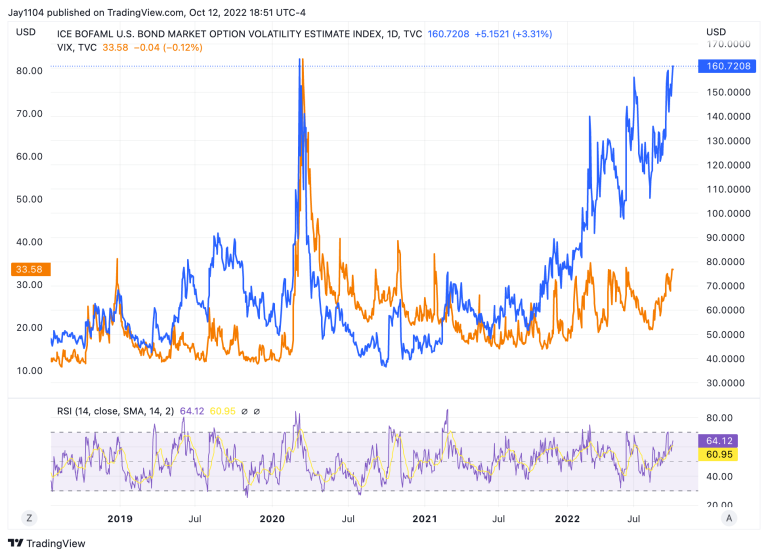

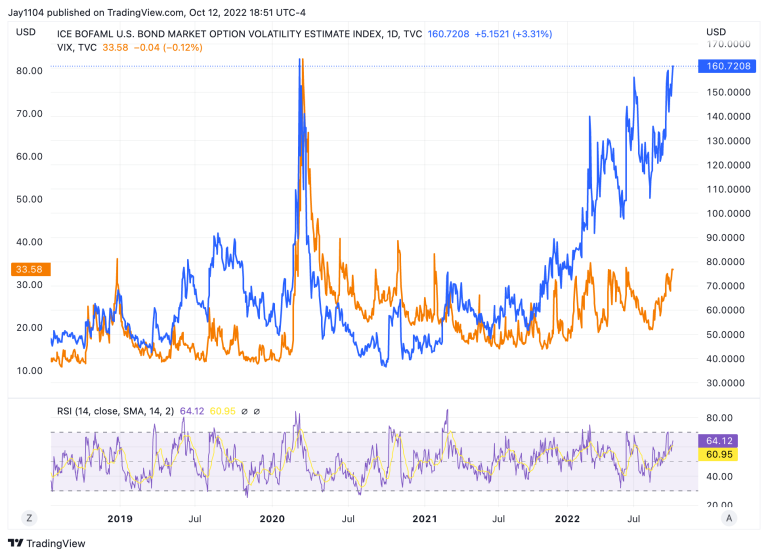

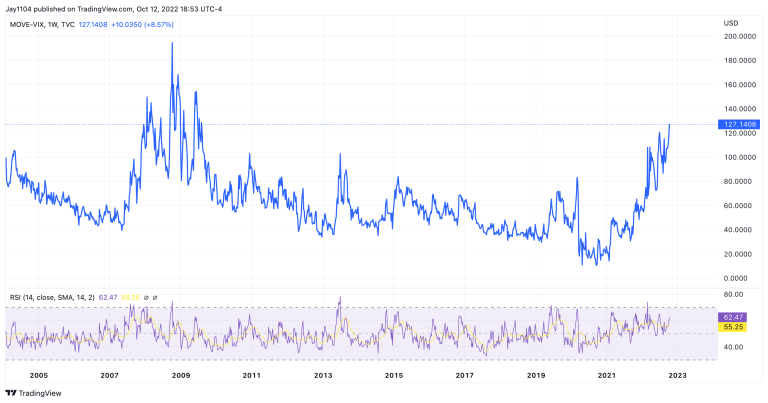

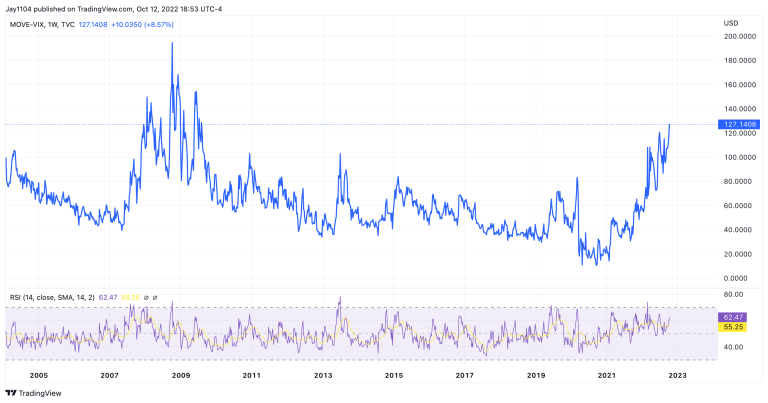

The ICE BofA Move index, which measures bond market volatility today, reached a new high, while the VIX finished the day lower. The gap between the MOVE index and the VIX is quite large at this point, which is not usual.

What is interesting is that when you take the spread between the Move and the VIX indexes, you can see just how wide the spread is, and the last time this happened was in the 2008 and 2009 time frame.

2-Yr

The 2-year looks as if it’s ready to race higher, too, with a bull flag within a bull flag.

Microsoft (MSFT)

Microsoft today fell to support, closing around $225. This has been a significant area of support. If support breaks, it probably speaks poorly not only for Microsoft but the market as well because there would be no technical support until around $212, about 7% from here.

UPS (UPS)

UPS appears to have a head and shoulder pattern and a broadening wedge. Both of those patterns seem bearish to me, and for now, the UPS is finding support at $155. Should the $155 support break, the next significant support level comes at $134.

Airbnb (ABNB)

Airbnb appears to have formed a double top and, to this point, has found support around $105. But there is a clear downtrend in the RSI, suggesting the decline isn’t over. If the stock breaks support at $105, there is further downside to around $92.

–

Originally Posted on 12th October – Stocks Drop On October 12, 2022, Ahead Of The CPI Main Event

Disclosure: Mott Capital Management

Mott Capital Management is the portfolio manager for one portfolio offered by Interactive Advisors. Interactive Advisors clients do not invest directly with the Portfolio Managers like Mott Capital Management, and the Managers do not have discretionary trading authority over Interactive Advisors client accounts. The Portfolio Managers on the Interactive Advisors platform simply license their trade data to Interactive Advisors, which then allows its clients to have the same strategy and trading decisions mirrored in their accounts if the Portfolio is in line with their risk score. Portfolio Managers like Mott Capital Management implement their trading philosophy and strategy without knowing the identity of Interactive Advisors’ clients or taking into account these clients’ individualized circumstances.

Mott Capital Management has entered into a Portfolio Manager License Agreement with Interactive Advisors pursuant to which it provides trading data IA uses to offer a portfolio to its investment advisory clients. Mott Capital Management is not affiliated with any entities in the Interactive Brokers Group.

Interactive Advisors is an affiliate of Interactive Brokers LLC.

Pursuant to the Investment Management Agreement between Interactive Advisors and its clients, all brokerage transactions occur through Interactive Brokers LLC, an affiliate of Interactive Advisors. The use of an affiliate for brokerage services represents a potential conflict of interest as Interactive Brokers LLC is paid a commission on trades executed on behalf of Interactive Advisors. Interactive Brokers LLC does not consider this conflict material as it does not sell, solicit, recommend, trade against or otherwise attempt to induce Interactive Advisors to place any orders in any products. Interactive Advisors does not offer services through any other broker-dealer. All trading by Interactive Advisors is self-directed. Interactive Advisors clients acknowledge this potential conflict of interest and authorize Interactive Advisors to execute transactions through Interactive Brokers LLC when they open an Interactive Advisors account. Clients should consider the commissions and other expenses, execution, clearance, and settlement capabilities of Interactive Brokers LLC as a factor in their decision to invest in an Interactive Advisors Portfolio. Interactive Advisors believes it satisfies its best execution obligation by trading its clients’ trades through Interactive Brokers LLC. While there can be no assurance that it will in fact achieve best execution, Interactive Advisors does periodically monitor the execution quality of transactions to ensure that clients receive the best overall trade execution pursuant to regulatory requirements.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Mott Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Mott Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)