In the recent bi-annual macroeconomic review published by the Monetary Authority of Singapore (MAS), outlook for Singapore’s 2022 full-year gross domestic product (GDP) growth was kept unchanged at 3 to 4 per cent with broad-based contributions from the trade-related, domestic-oriented, travel-related and modern services clusters.

However, MAS noted that Singapore’s economic growth is expected to slow to a pace that is below trend next year, weighed down by key external-facing sectors such as manufacturing and financial services.

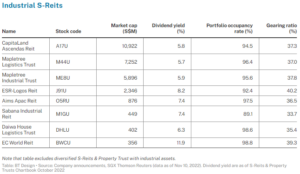

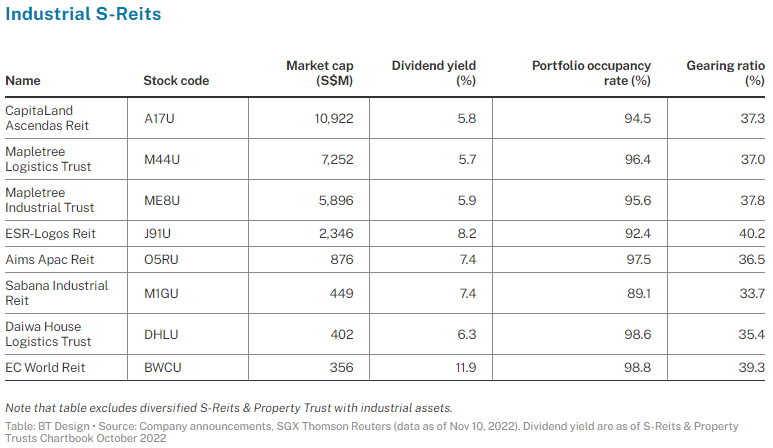

All eight of Singapore’s industrial S-Reits have reported their respective Q3 financial results or business updates. Average portfolio occupancy rate across the eight S-Reits was held steady at 95.4 per cent while average gearing ratio was at 37.2 per cent.

In their releases, many echoed the weakening global outlook provided by MAS, citing challenges such as inflation, geopolitical tension and rising energy costs. However, several also noted the resilience of the industrial segment in Singapore, underpinned by long-term demand for logistics, high-value manufacturing and biomedical sectors.

Four out of the eight industrial S-Reits published financial results for the latest quarter – Aims Apac Reit, EC World Reit, Mapletree Industrial Trust and Mapletree Logistics Trust – while the rest reported interim business updates.

Aims Apac Reit (AA Reit) reported that H1 FY2023 gross revenue and net property income (NPI) rose 27.5 per cent and 28.2 per cent year on year (yoy) respectively. This was supported by the acquisition of Australian supermarket and grocery chain Woolworths’ headquarters, as well as higher rental income and recoveries from the Singapore portfolio. However, distribution per unit (DPU) for the period dipped 1.1 per cent amid an enlarged unit base. AA Reit also noted strong leasing momentum with the execution of 47 leases representing 6.7 per cent of total portfolio net lettable area (NLA) at positive rental reversion of 8.1 per cent.

EC World Reit (ECWReit) noted that Q3 FY2022 results were consistent with improving stability in China during the quarter, albeit recording a 5.4 per cent yoy dip in NPI attributable to depreciation of the renminbi and higher property expenses. In October, ECWReit proposed the divestment of Beigang and Chongxian Port Logistics. The manager commented that this divestment is timely and will allow the Reit to realise value due to the premium on agreed property values, enable it to pare down debts and provide a special distribution to unitholders.

Mapletree Industrial Trust (MIT) reported that gross revenue and NPI for Q2 FY22/23 grew 12.8 per cent and 8.3 per cent yoy to S$175.5 million and S$130.3 million respectively. The improved performance is largely contributed by the acquisition of 29 data centres in the US, partially offset by higher property operating expenses and borrowing costs.

MIT will begin the release of S$6.6 million of income in Q3 FY22/23 over three quarters. This is related to distributions declared by joint ventures that had been withheld in Q4 FY19/20 to provide MIT greater flexibility in cash management during the pandemic.

Mapletree Logistics Trust (MLT) reported that Q2 FY22/23 gross revenue and NPI increased 11.4 per cent and 10.8 per cent yoy respectively. Amount distributable to unitholders grew 15.6 per cent as the impact of weakening currencies is mitigated through the use of foreign currency forward contracts to hedge income from overseas assets.

During the period, MLT achieved a positive average rental reversion of approximately 3.5 per cent, contributed by renewal or replacement leases from across almost all of MLT’s markets.

REIT Watch is a weekly column on The Business Times, read the original version

—

Originally Posted November 14, 2022 – REIT Watch – Industrial S-Reits see resilience despite macro challenges

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.